CoreLogic confirmed it is in discussions with unnamed suitors for a transaction that values the company at $14 per share more than the hostile bid from Senator Investment and Cannae Holdings.

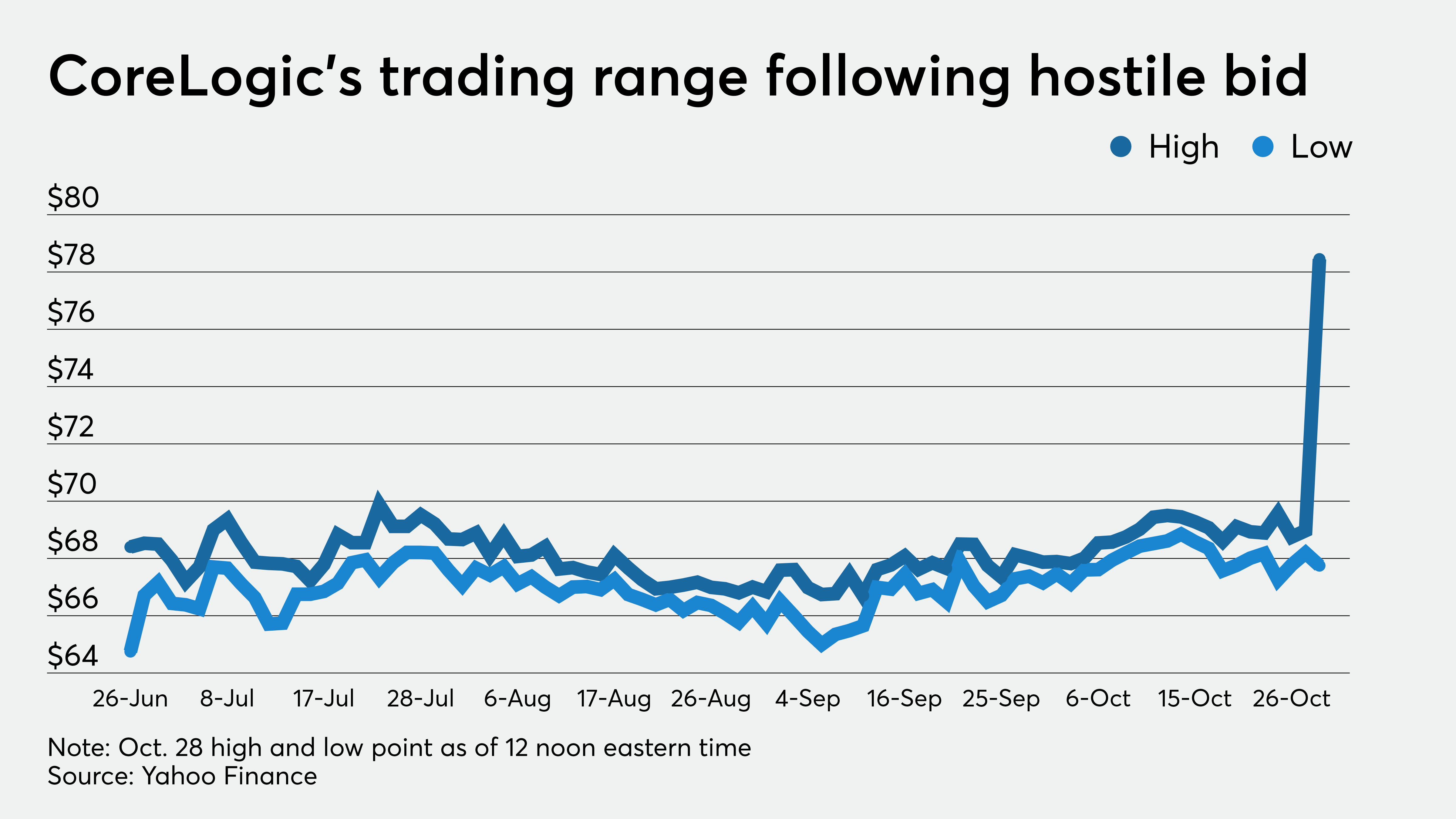

Within 15 minutes after the market opened Wednesday morning CoreLogic’s stock zoomed to $76.98 per share from $67.67, according to Yahoo Finance. Trading was halted for approximately 20 minutes around 10:15 a.m. during which the company issued a press release disclosing the talks.

“In light of recent market speculation, CoreLogic today confirmed it is engaging with third parties indicating preliminary interest based on public information in the potential acquisition of the company at a value at or above $80 per share,” it said in a press release.

“No decision has been made to enter into a transaction at this time, and the company can offer no assurance that it will enter into any transaction in the future or, if entered into, what the terms of any such transaction would be. The company does not intend to comment further on market speculation or further developments unless and until it deems further disclosure to be appropriate or required.”

Shortly after it resumed trading, CoreLogic’s stock reached $78.45 per share, an all-time high, topping the $69.87 per share reached on July 23, the day CoreLogic released its second quarter earnings. The original bid from Senator/Cannae of $65 per share became public on June 26.

During CoreLogic’s third quarter earnings call, while arguing against the hostile bid, CEO Frank Martell said the company was “open to all pathways to create value” for its shareholders.

Senator and Cannae are looking to elect nine new membersto CoreLogic’s board during a special meeting on Nov. 17.

In raising its bid to $66 per share, Senator and Cannae offered a “go shop” period if CoreLogic accepted the new offer. But that bid was also rejected.

Furthermore, Senator and Cannae have argued that newer shareholders in CoreLogic are expecting it to do a merger transaction.

Cannae’s chairman Bill Foley has the same title at both Fidelity National Financial and Black Knight.