In order to educate pandemic-impacted borrowers on payment assistance and forbearance plans, a group of government entities and trade associations came together to launch the COVID Help for Home campaign.

This coalition — led by the CFPB, Mortgage Bankers Association, American Bankers Association, Housing Policy Council and NeighborWorks America — aims to curb coronavirus-related delinquencies and foreclosures by doing effective, coordinated outreach to borrowers who have missed one or more payments and who may be eligible for mortgage payment relief via CARES Act forbearance assistances.

“The CARES Act provides important relief to homeowners seeking assistance on their federally backed mortgages, and I’m happy to support this campaign in getting the word out about financial relief options that can help eligible borrowers stay in their homes,” CFPB Director Kathy Kraninger said in a press release.

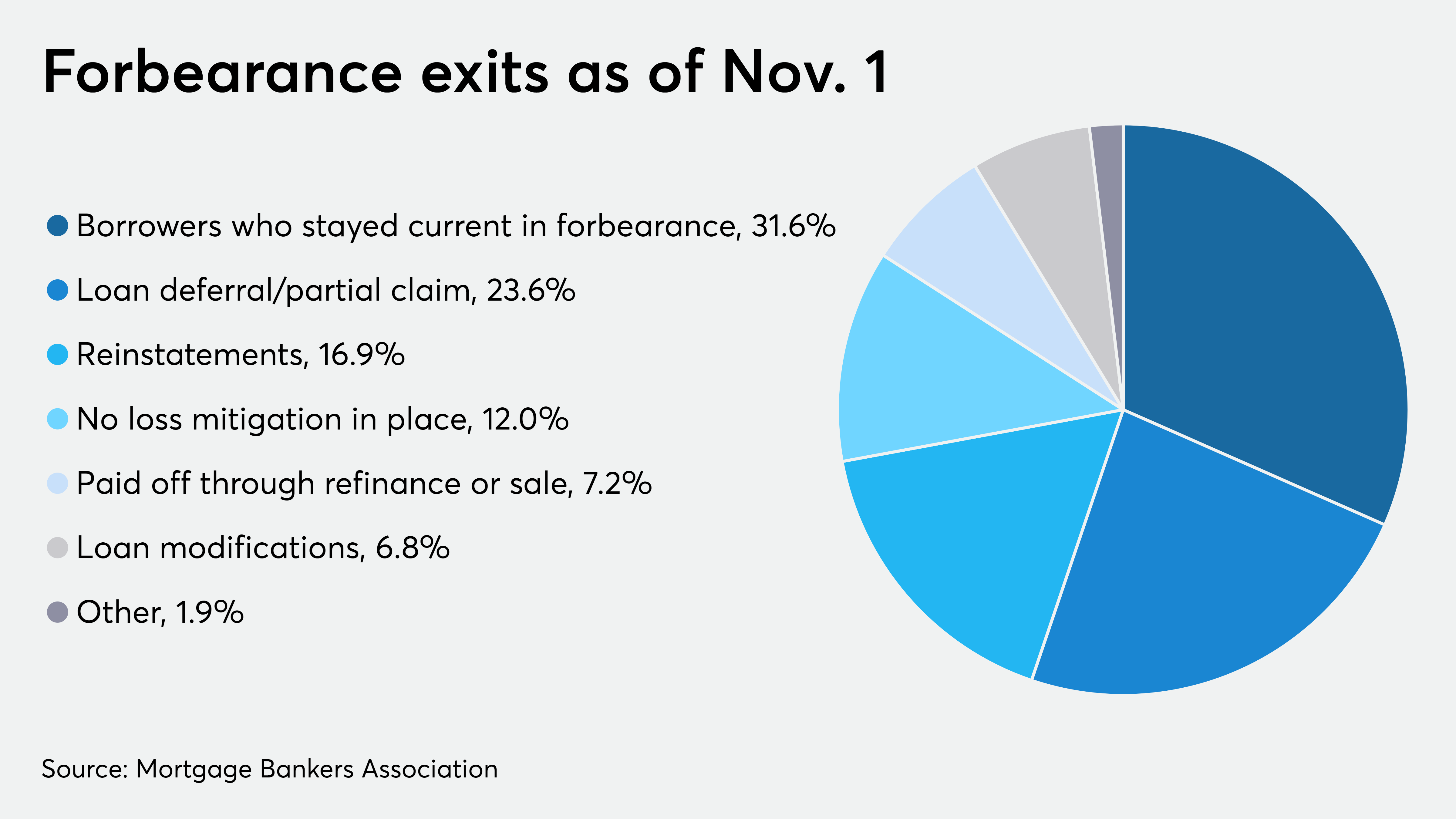

The rate of forborne mortgages continues to decline with the overall economic recovery. The latest numbers from the MBA show about 2.8 million borrowers sit in forbearance plans as of Nov. 1 but some of that is attributed directly to the CARES Act expirations.

Servicers are required to make quality right-party contact as CARES Act forbearance protections expired after the initial six months. However, many servicers cannot reach their customers so the coalition aimed its message toward the borrowers themselves with the slogan, “Not Ok? That’s Ok.”

The unrest of the pandemic created new opportunities for fraudsters to take advantage of struggling consumers. Members of the COVID Help for Home coalition hope that borrower education furnished by the group will help them avoid scams.

“If you’re still struggling, pick up the phone and call your servicer, pick up the phone and call a counselor, but pick up the phone and call somebody,” Pete Mills, SVP of residential policy and member engagement at the MBA, said in an interview.

“You need to make that contact to get the additional forbearance or other assistance,” he added. “We’re just trying to get folks focused on that part of it to know it’s not an advance fee scam. Some of the scammers out there are saying give us a fee, we’ll get you additional forbearance. You don’t have to pay a fee.”