While the interest rate for the typical home loan went unchanged during the latest week tracked by Freddie Mac, recent benchmark bond yield fluctuations indicate that it could become more volatile soon.

The 10-year Treasury yield rose 2.7 basis points to 1.158% initially Thursday morning, after jobless claims fell by 33,000 at the end of January. But other indicators present reasons for economic pessimism, which could put downward pressure on yields. For example, U.S. productivity dropped at 4.8% annual rate in the fourth quarter.

“The longer-term trajectory for yields and rates is almost certainly upward, the near-term outlook is currently at a bit of an impasse,” Zillow Economist Matthew Speakman said in a separate press release.

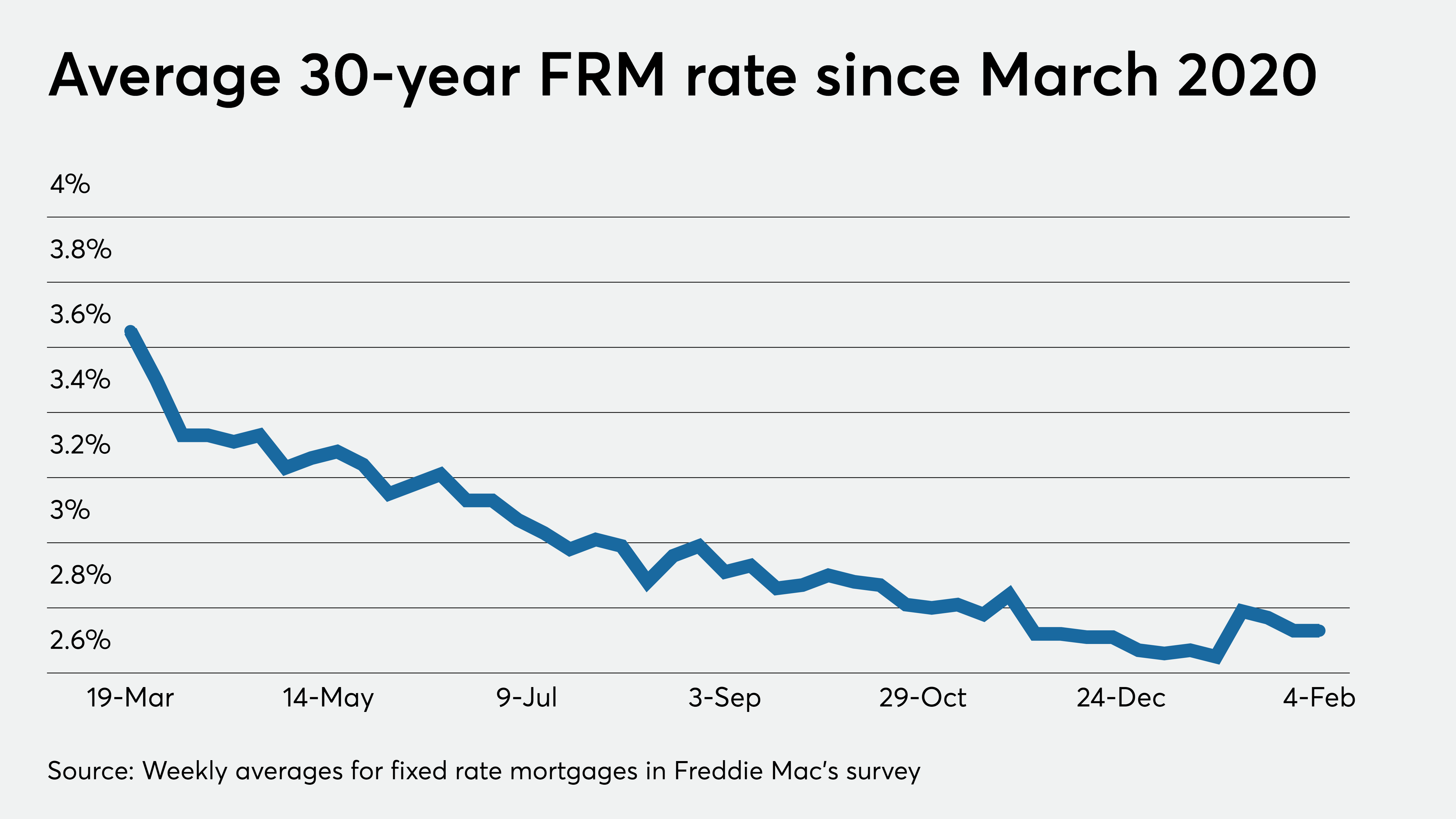

At 2.73%, that 30-year rate matched the previous week’s but was markedly lower than the 3.45% seen a year ago, according to the government-sponsored enterprise.

“Mortgage rates remained flat this week and near record lows, signifying an economy that continues to struggle,” said Sam Khater, Freddie Mac’s chief economist, in a press release.

Resiliency in the service sector activity and a relative drop in coronavirus case volumes point to economic improvement but on the other hand, the labor market remains troubled, Speakman said.

“If [the jobs] report reflects renewed improvements in the labor market, and especially if it coincides with meaningful progress regarding more fiscal relief, then mortgage rates could move upward quickly. If not, the pattern of modest weekly oscillations in mortgage rates is likely to continue in the coming weeks,” Speakman said.

Lower-income households are being left behind in the refinancing boom, Khater noted.

“While many have already refinanced, the evidence suggests that upper income homeowners have taken advantage of the opportunity more so than lower income homeowners who could stand to benefit the most by lowering their monthly mortgage payment,” he said.