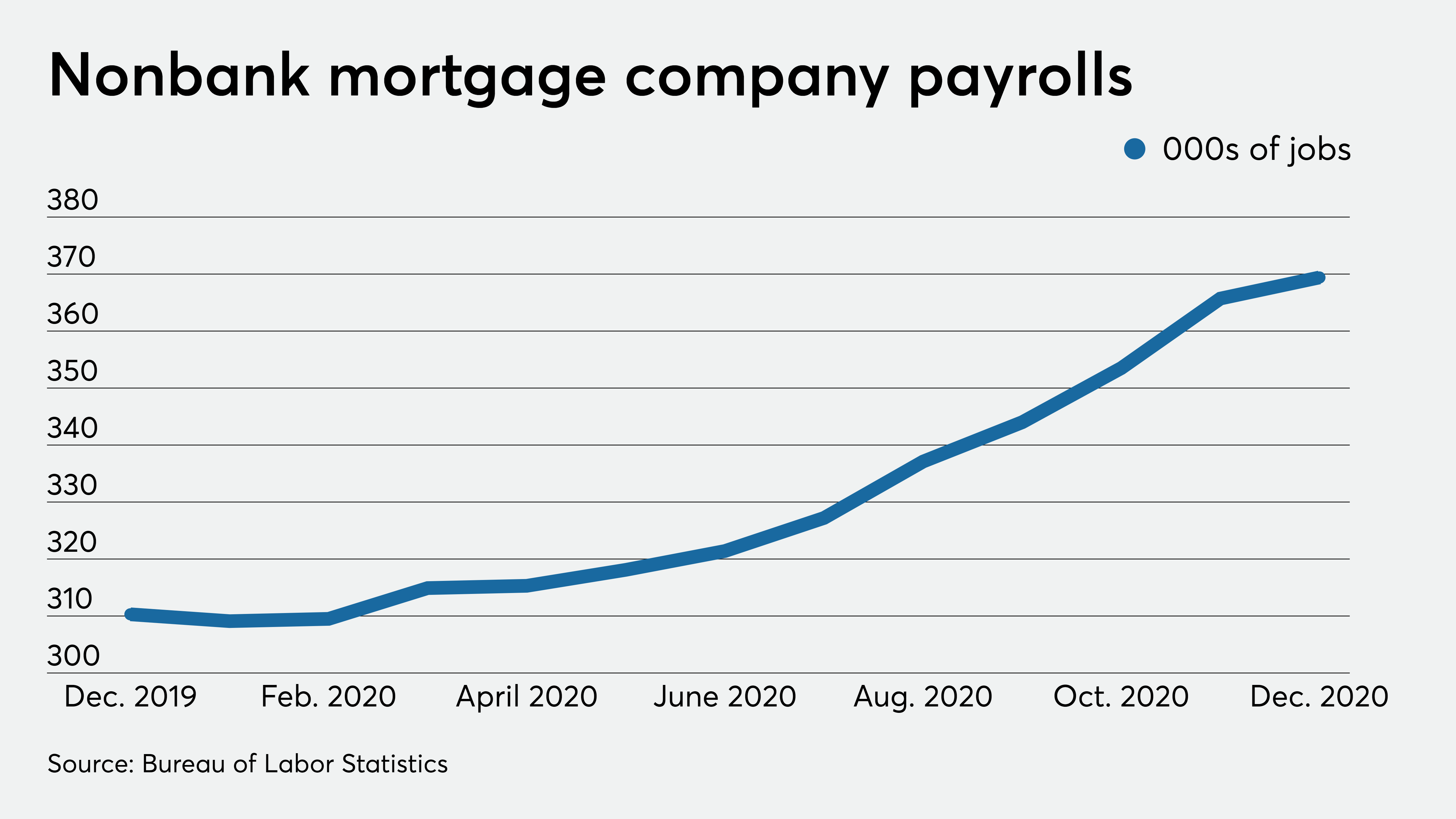

Record-breaking employment in the home lending business was even stronger than early indicators suggested last year, but it is starting to level off as hints of tightening in mortgage credit begin to emerge.

Payroll size for nonbank mortgage bankers and brokers climbed to 369,400 in December from 365,700 in November and from 310,300 in December 2019, according to the Bureau of Labor Statistics. The bureau’s numbers in these categories were all slightly higher than previously estimated for the past year when reconciled with the BLS’s annual business census. October payrolls totaled 353,500 after revisions.

While some lenders may’ve engaged in “excessive staffing” when rates first dropped precipitously last year, mortgage companies should have more predictable hiring needs now, Mat Ishbia, CEO of United Wholesale Mortgage, said in an earnings call this week.

“If that [excessive hiring] happens in the first month or maybe the second month after that, I understand it; but it shouldn’t be the case nine months later,” he said.

UWM reported that it set a new record for volume in the fourth quarter, but its consecutive-quarter gain was smaller than the previous one because it tightened underwriting in response to credit concerns heighted by the pandemic.

Industrywide, credit availability tightened slightly in December, according to the Mortgage Bankers Association’s latest index report. The index was down by 0.1% that month.

Credit availability generally contracts when the employment is weaker.

There was a slight improvement in unemployment in January, which inched down to 6.3% in January from 6.9% the previous month. However, unemployment remains well above the record low of 3.5% seen in January 2020, according to the BLS. The BLS reports broader numbers more quickly than some industry data.

As in the previous month, unemployment may have been as much as 0.6% higher due to an ongoing categorization error that affects the bureau’s data.

While the percentage of those unemployed improved a little in January, there were signs that previous job losses are becoming entrenched.

“Although the headline unemployment rate declined, there are still 4 million people who have been actively looking for work for 27 weeks or longer,” Mortgage Bankers Association Chief Economist Mike Fratantoni noted in an emailed press statement.

Just 49,000 jobs were added to the economy in January. While that marked an improvement from the downwardly revised loss of 227,000 jobs in December, it was down from pre-pandemic numbers seen last January. That month, U.S. employers added a revised 214,000 jobs.

While a relatively weak jobs report could add to upward pressure on benchmark 10-year Treasury yields and mortgage rates, the weak overall employment gains left it largely unchanged. At 1.15%, the 10-year was only 0.6% higher shortly after noon on the East Coast.

Mortgage lenders have been so profitable they may be able hold their rates low for a while even if there is upward pressure on their margins from the bond market.

That’s likely to occur because the recent wave of initial public offerings from nonbank mortgage lenders will likely put more pressure on large and influential players to generate continual growth for their shareholders, said Walt Schmidt, a senior vice president and mortgage researcher at FHN Financial.

“I don’t see them allowing the rates to get higher. They want to keep the volume going,” he said.

These players will be hoping to stay in a sweet spot where the economy is weak enough that rates remain low and they can generate volume, but not so weak it hurts the stock market, Schimdt added.

Because the relative weak gains in the jobs report were seen as potentially making the case for additional government stimulus, stocks were broadly higher at deadline Friday.

At midday, the Dow was up nearly 200 points or 0.3%. Digital mortgage giant Rocket Co.s,, which spurred the current wave of nonbank IPOs by going public, was trading just slightly lower at $21.47, down 0.5%.