Managing costs and creating operational efficiencies are foremost on the minds of the mortgage lenders, with the ongoing pandemic creating pressure on their profit margins.

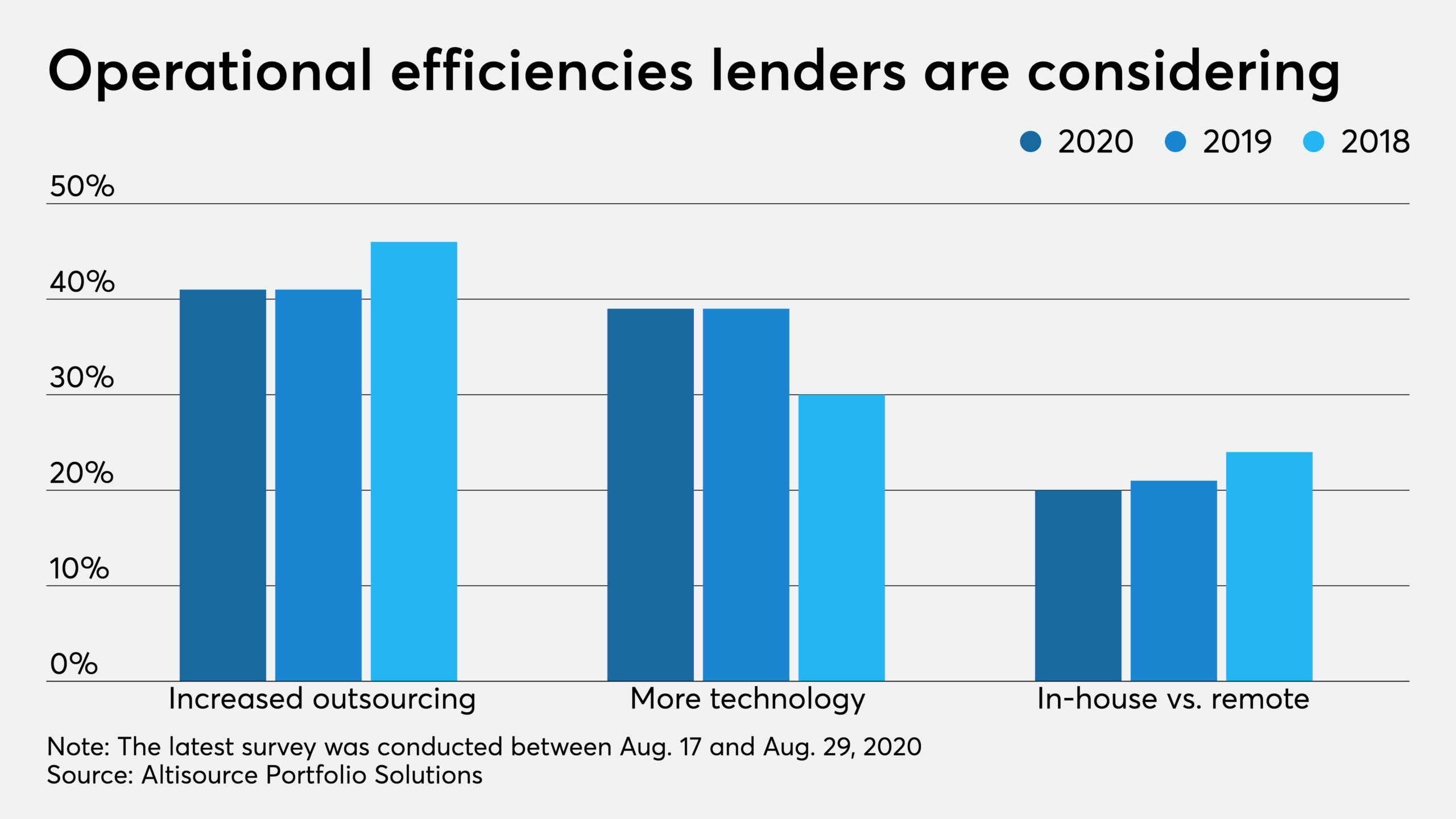

Outsourcing was the leading choice for producing those efficiencies, by 41% of those surveyed for Altisource Portfolio Solution’s latest the State of the Originations Industry report.

That edged out using more technology and digital services to reduce the need for staff, cited by 39% of the respondents to the survey of 200 people conducted between Aug. 17 and Aug. 29, 2020. Those shares were unchanged compared with the previous year’s survey.

“With costs rising and revenues down in many cases due to the pandemic, it makes sense. Rather than spending time and money hiring and training full-time staff, service providers can support and strengthen an originator’s workforce by handling a portion of the lender’s volume,” the report said. “In this way, an originator can avoid the typical hiring/firing cycles that significantly distract an organization from closing more loans.”

When asked what they predict for the mortgage business over the next two-to-three years, 80% of the respondents — up from 79% the previous year — said originators will outsource more to third-party vendors to better deal with market fluctuation, especially as total volume is expected to shrink due to lower refinance activity.

That was the third most-cited prediction, with the No. 1 being that growing costs will drive smaller lenders out of the business or into merging with other lenders. That was cited by 84% of respondents, up four percentage points from the previous year’s survey.

Sandwiched between those two choices was the return of private money into the mortgage securitization market, predicted by 82% of the respondents. That share was unchanged from the previous year, but it was the most cited answer for that period.

Ranked fourth among the predictions cited by the respondents was the likelihood of a market crash in the next 24 months, at 68%, while fifth, at 64%, was a new option for the latest survey, nonbanks will dominate the originations business over the next two-to-three years.

Prior surveys gave respondents the option that big banks will come back in and dominate the mortgage business; in the previous year’s survey, that was the second most cited response at 81%.

Regulatory constraints was the most-cited challenge in today’s mortgage market, by 27% of respondents. This was followed by technology at 24%; staff retention, 21%; margin compression — which is why many lenders are worried about costs — 19%; capacity, 10%; and other, 1%

When asked to rank the initiatives that are most important in differentiating their individual business compared with their competition, technology enhancements edged out customer service, 21% to 20%. Pricing was third at 19%, followed by marketing at 11%, quickest timeline at 10% and artificial intelligence at 9%.

In terms of what makes mortgage products more attractive to consumers, 38% said improved customer experience was key. Lower loan costs was cited by 23%, followed by fully digital closings at 22% and fasting closings at 18%.

“While the road ahead is still unclear, as always, mortgage companies that are ready for whatever comes will have the best chance of thriving in the market,” Brian Simon, president of three Altisource subsidiaries including the Lenders One cooperative, said in a press release.