A greater portion of borrowers built their equity levels in the fourth quarter, while the share of underwater properties shrunk, according to Attom Data Solutions.

Of the country’s 59 million mortgaged properties, 17.8 million — or 30.2% — qualified as equity-rich, with combined loan-to-value ratios of 50% or less. The steady improvement continued from 16.7 million and 28.3% in the third quarter, with the number of equity-rich homes growing by over two million in two years.

“For now, homeowners are sitting pretty on a growing reserve of personal wealth,” Todd Teta, Attom’s chief product officer, said in the report. “As with many other housing-market metrics, the prospects for equity building even further in 2021 are wholly uncertain because of many questions surrounding the pandemic and the U.S. economy.”

Vermont held its place leading all states in proportion of equity-rich homes at 47.8%. Shares of 46.1% in California, 42.7% in Idaho, 41% in Washington and 40.4% in Hawaii rounded out the top five. Of the 107 metro areas with populations above 500,000, California accounted for the highest shares of equity-rich properties. San Jose maintained first place with a 65.7% share. Followed by San Francisco at 57.5%, Los Angeles at 51.7%, Santa Rosa at 45.1% and San Diego at 44.5%.

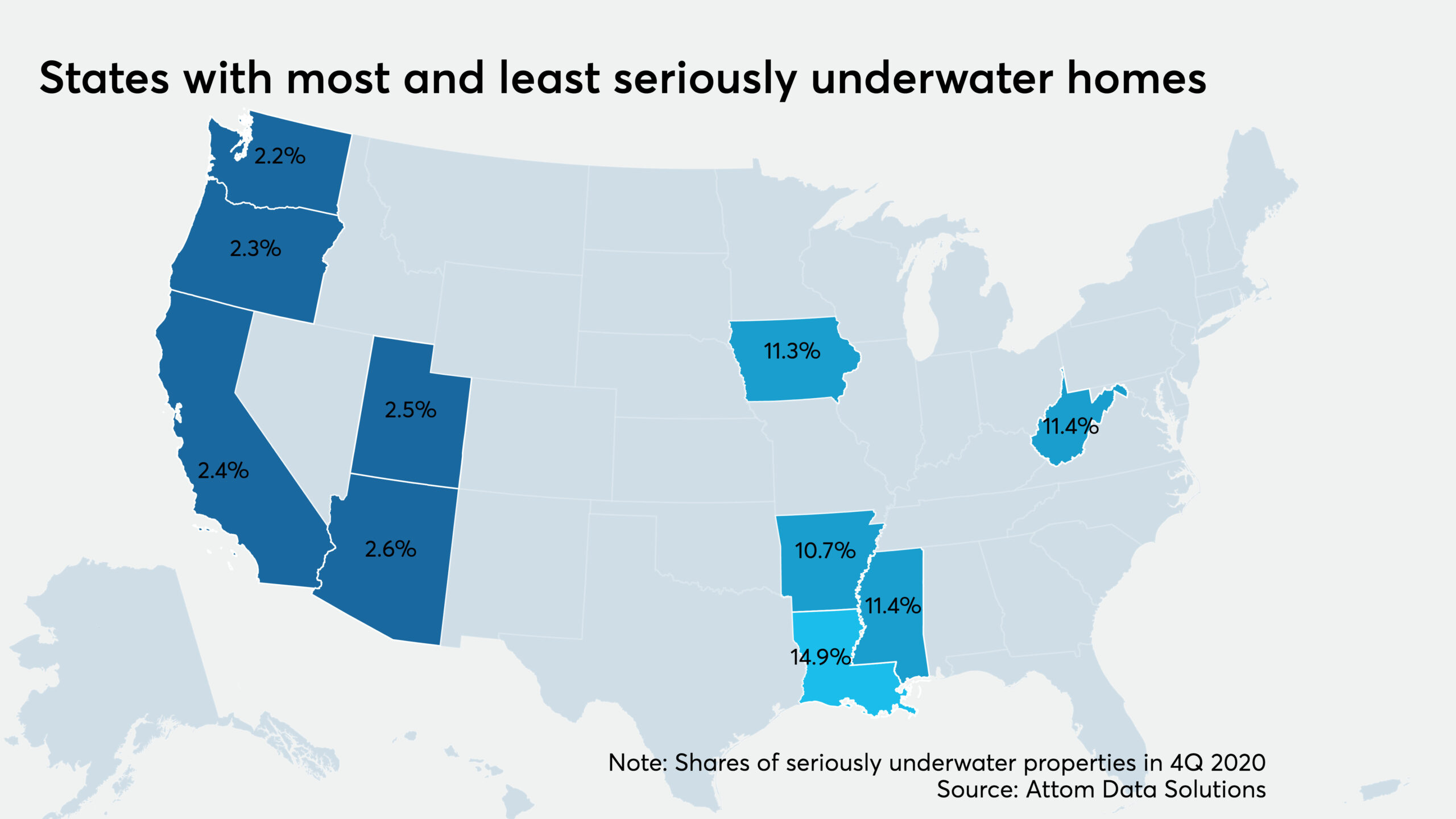

At the opposite pole, 3.2 million U.S. properties — or 5.4% — were considered seriously underwater with LTV ratios above 125%. The numbers also sat on an improved trajectory, declining from 3.5 million and 6% the previous quarter and a 1.8 million drop in two years.

Louisiana had the highest share of seriously underwater properties in the country at 14.9%. Mississippi and West Virginia tied at 11.4%, while Iowa’s 11.3% and Arkansas’s 10.7% trailed closely. At the metro area level, Baton Rouge, La., posted the highest share of seriously underwater homes at 14.2%. Syracuse, N.Y. (14%), Youngstown, Ohio (12.5%), Toledo, Ohio (11.3%) and Scranton, Pa. (11.2%) filled out the bottom five.

“The good news is that fewer and fewer homeowners across the country are underwater on their loans,” said Rick Sharga, executive vice president of RealtyTrac, an ATTOM Data Solutions company. “But for those homeowners who are, the uncertainty of the economy during the pandemic looms large. The dual-trigger effect of losing a job and being underwater on a mortgage often, unfortunately, leads to a foreclosure.”