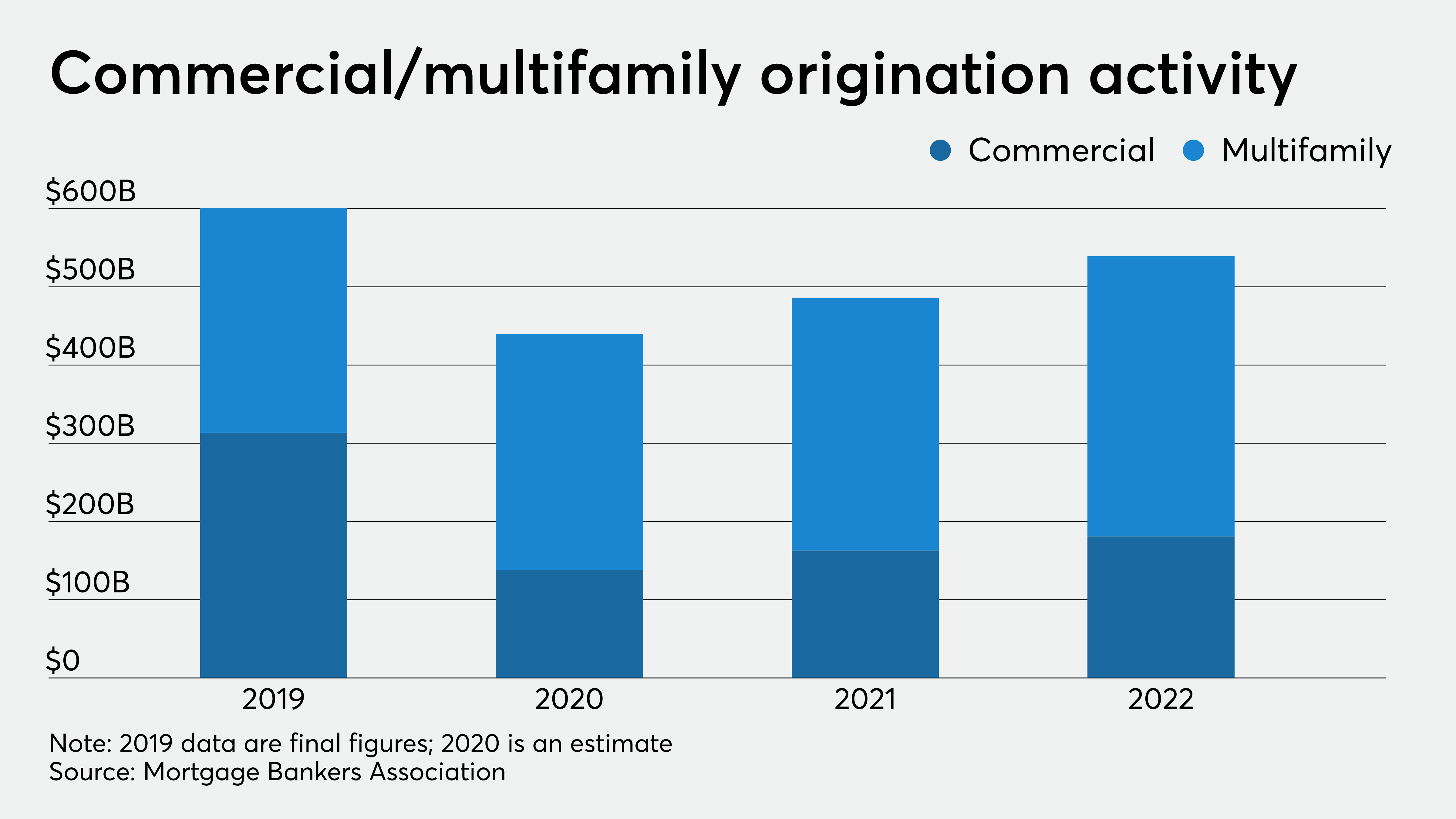

Commercial and multifamily mortgage origination volume should recover somewhat in 2021, the Mortgage Bankers Association said.

The trade group forecasts $486 billion in loans secured by income producing properties will be originated this year, compared with an estimated $440 billion in 2020, a year in which commercial real estate was heavily impacted by COVID-19, especially lodging and retail.

“The economic rebound MBA anticipates in the second half of the year should bring greater stability to the markets, but with continued differentiation by property type,” Jamie Woodwell, vice president for commercial real estate research, said in a press release. “Much of the path forward will depend on the virus and our confidence and ability to move past it.”

That will carry through to 2022, with the MBA forecasting $539 billion in commercial and multifamily lending that year.

Even so, that preliminary estimate of last year’s activity was well below the MBA’s January 2020 prediction of $683 billion.

For the multifamily segment only, the MBA predicts $323 billion in originations in 2021, up from an estimated $302 billion last year. Heavy refinance activity for government-backed mortgages boosted the 2020 total, Woodwell said.

For 2022, the MBA is projecting $358 billion in multifamily mortgage originations.

Commercial originations are likely to be helped by the expected 36% year-over-year increase in maturities for mortgages held by nonbank lenders this year.

A total of $222.5 billion of the $2.3 trillion of outstanding commercial and multifamily mortgages held by this group will mature in 2021, the most since 2009, Woodwell said in a separate press release. About $163.2 billion in nonbank commercial and multifamily mortgages matured in 2020.

“Many life company, government-sponsored enterprise and Federal Housing Administration loans that would have been coming due this year were instead refinanced or prepaid early,” Woodwell explained. “Those declines have been more than made up for by shorter-term loans with 2021 maturity dates made by commercial mortgage-backed security and investor-driven lenders.”

In 2020, there was an increase in commercial and multifamily mortgages that reached maturity but remained outstanding: 1.5% as of Dec. 31, versus 0.8% on the same date in 2019. It’s likely that these loans were not refinanced due to challenges raised by the pandemic.

But this amount was still much lower than the share of such mortgages during the financial crisis years between 2009 and 2012, when the rate of matured loans still outstanding ranged between 2.25% and 2.75%.

CMBS lenders have the largest total outstanding balance of commercial and multifamily mortgages maturing this year at $100 billion; that represents 16% of their holdings.

Then there are $72.6 billion or 30% of the commercial mortgages held by credit companies and other investors that are coming due.

Life insurance companies have $39.8 billion (6 %) of their outstanding mortgages maturing.

For the government-guaranteed investors, $10.1 billion (1%) of the outstanding balance of multifamily and health care mortgages held or guaranteed by Fannie Mae, Freddie Mac, FHA and Ginnie Mae will mature in 2021.