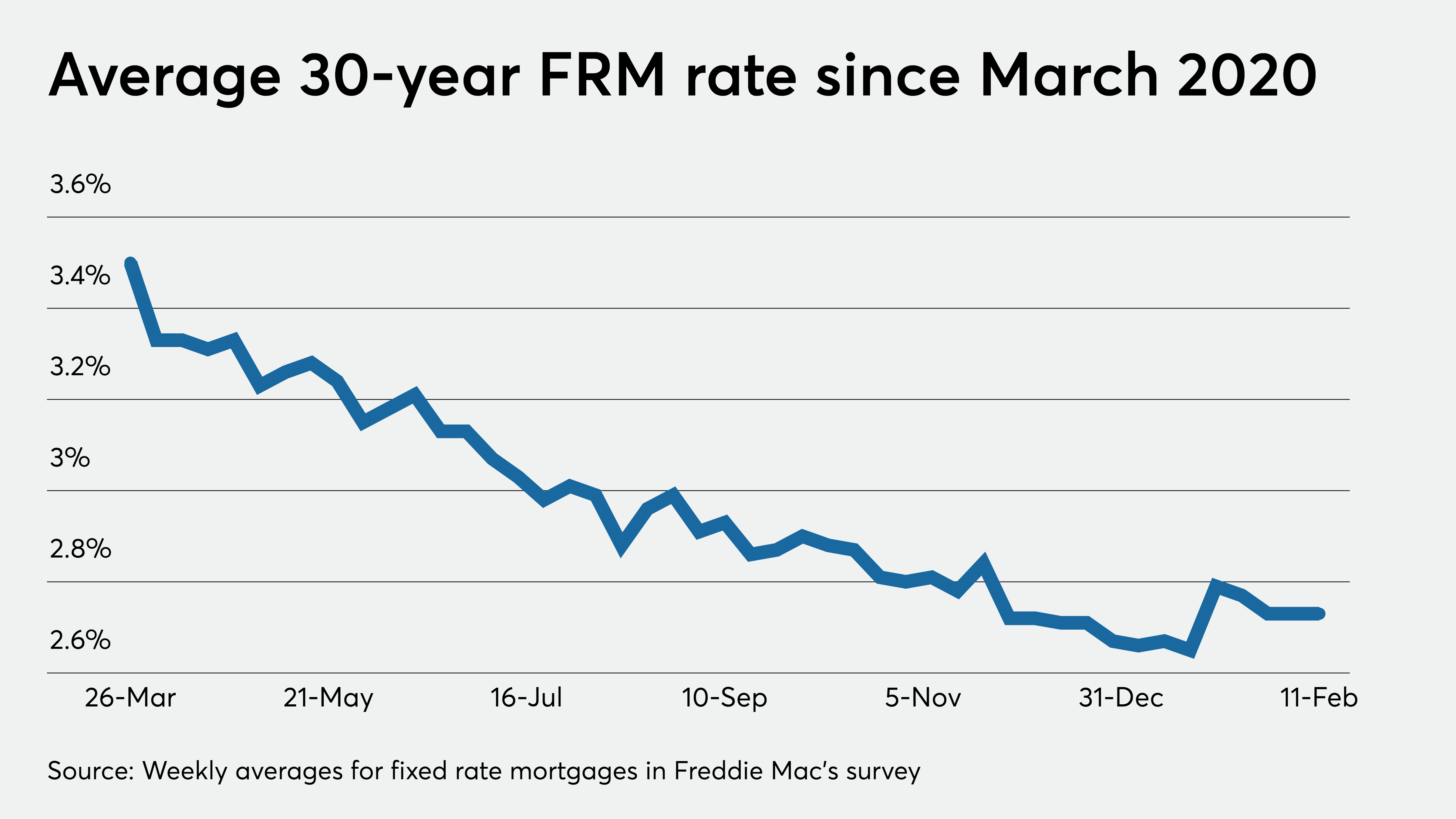

The lack of change in the average fixed rate for a mortgage this week added to evidence that refinancing opportunities are contracting slightly as economic signals point to a tepid recovery.

At 2.73% the 30-year Freddie Mac rate reprised its number from the previous week and was down from 3.47% a year ago following the release of a Consumer Price Index number that inched upward 0.3% on a seasonally-adjusted basis on Wednesday.

Because the CPI number only inched up slightly, it improved the odds that government officials will keep putting downward pressure on rates rather than tapering it. Stimulus has included federal purchases of bonds tied to long-term rates.

“Modest inflation should help keep mortgage rates low by limiting the likelihood that the central bank will tighten its monetary policy anytime soon,” Zillow Economist Matthew Speakman said in a separate press release.

The benchmark 10-year Treasury yield, which can be indicative of rate direction, was slightly higher early Thursday morning following the release of unemployment claims, which inched down a little but remained elevated compared to pre-pandemic levels at 793,000.

However, even if the bond market puts pressure on what have generally been strong profit margins, lenders may choose to offer lower rates to borrowers so they can compete.

“New COVID-19 cases are receding, which is encouraging and that has led to a rise in Treasury rates. But, the run-up in Treasury rates has not impacted mortgage rates yet, which have held firm,” Freddie Mac Chief Economist Sam Khater said in a press release.

An estimated 18 million-plus borrowers are prime candidates for refinancing with rates at current levels, according to Black Knight. That’s a significant population but it’s down slightly from one that exceeded 19 million last year. Borrowers are considered prime candidates for refinances if they can save at least 0.75%, have a 720 credit score and a home with a maximum 80% loan-to-value ratio.

Eventually mortgage activity will taper off if rates are stabilizing, because the group of people who can benefit from refinancing will shrink.

But in the short term, if rates show no sign of dropping any further, it may spur additional refinancing on the part of fence-sitters who have been trying to time the market.

While overall signs point to stability in rates, they are notoriously difficult to predict and at least one indicator this week suggested there’s still enough weakness in the economy that another downward move isn’t out of the question.

The U.S. is “a long way” from where it should be on employment, Federal Reserve Chairman Jerome Powell said in a speech on Wednesday, and that initially drove 10-year yields lower Thursday morning prior to the release of unemployment claims.

“It’s a tale of two economies. The services economy remains in the doldrums, but the production side of the economy remains strong,” Khater said.