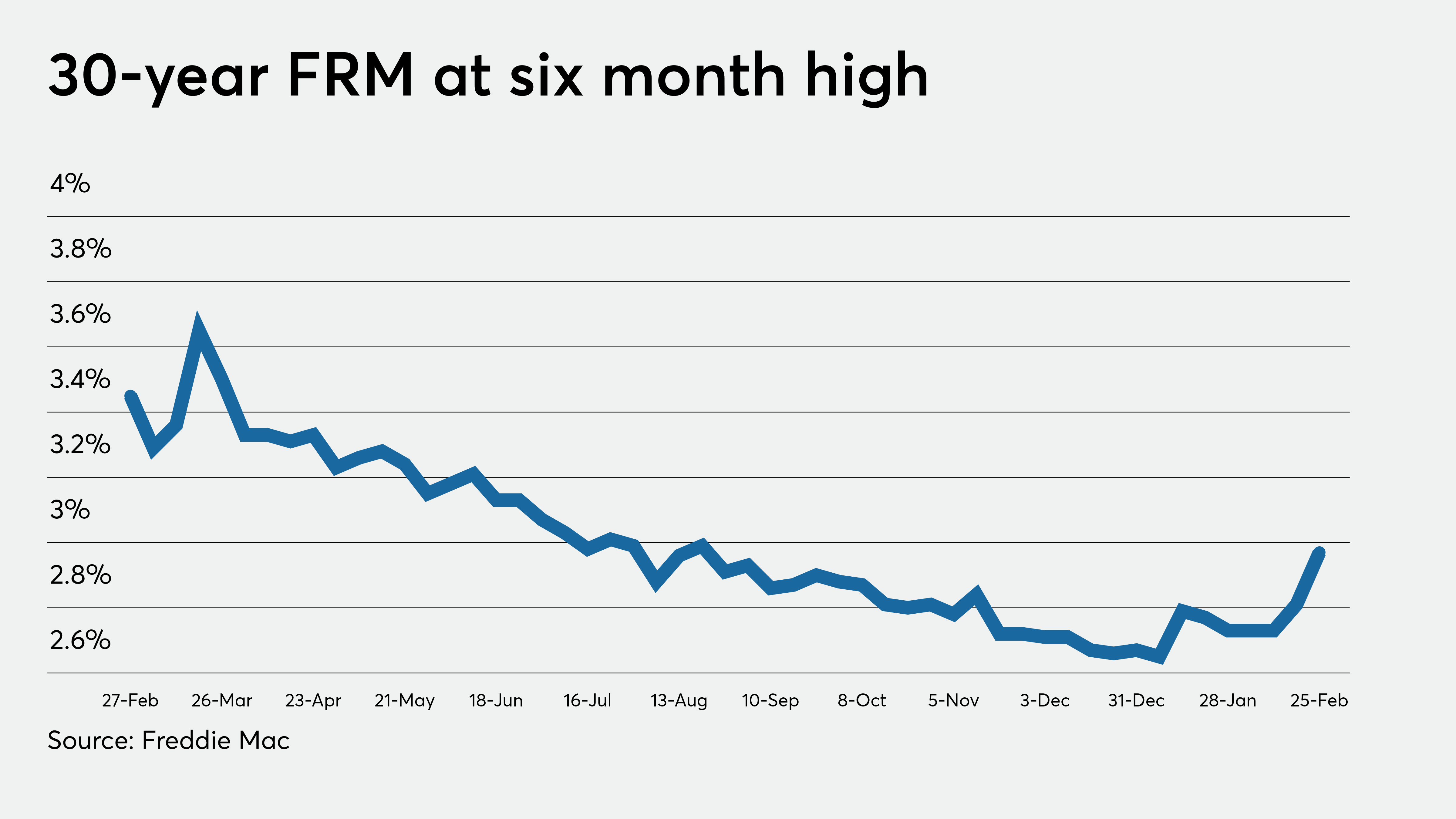

The mortgage rate surge went on for a second week with the 30-year fixed rate reaching its highest point since last summer as generally positive economic news outweighed concerns about inflation.

Average rates for the 30-year FRM rose to 2.97%, a 16 basis point increase compared with the previous week’s 2.81%, according to Freddie Mac’s Primary Mortgage Market Survey. But the rate was still significantly lower than the 3.45% posted for the same week one year ago.

This is the highest the 30-year FRM has been since the week of Aug. 20, 2020, when it was 2.99%.

“Optimism continues as the economy slowly regains its footing, thus affecting mortgage rates,” Sam Khater, Freddie Mac chief economist, said in a press release. “When combined with demand-fueled rising home prices and low inventory, these rising rates limit how competitive a potential homebuyer can be and how much house they are able to purchase.”

Mortgage rates are finally keeping pace with the recent increases in the yield on the benchmark 10-year Treasury, which on the morning of Feb. 24 reached its highest point in exactly one year.

The jump in Treasury yields comes from investors feeling both positive and negative about the U.S. economy at the same time, according Matthew Speakman, an economist at Zillow who issued comments on Wednesday night.

The markets are “bullish on falling COVID-19 case counts and encouraging improvements in vaccine distribution, yet fearful that ambitious fiscal relief and accommodative monetary policy will result in higher inflation — something that would theoretically cause the Federal Reserve to scale back on their policies that have helped keep interest rates low,” Speakman said. “Rates are still very low by historical standards, but the ultra-low rate environment that became the norm in the second half of 2020 appears to have come to an end.”

The average for the 15-year FRM also had a double digit increase, up 13 bps to 2.34% from 2.22% the week prior; one year ago it was 2.95%. The five-year Treasury-indexed hybrid adjustable-rate mortgage rose by 22 bps to an average 2.99% with a 0.1 point average, up from 2.77% week-over-week but lower than 3.2% for the same week in 2020.