Motto Mortgage, Remax’s mortgage brokerage franchising business, reported explosive growth in the past year, with its operators doubling their combined origination volume on a year-over-year basis.

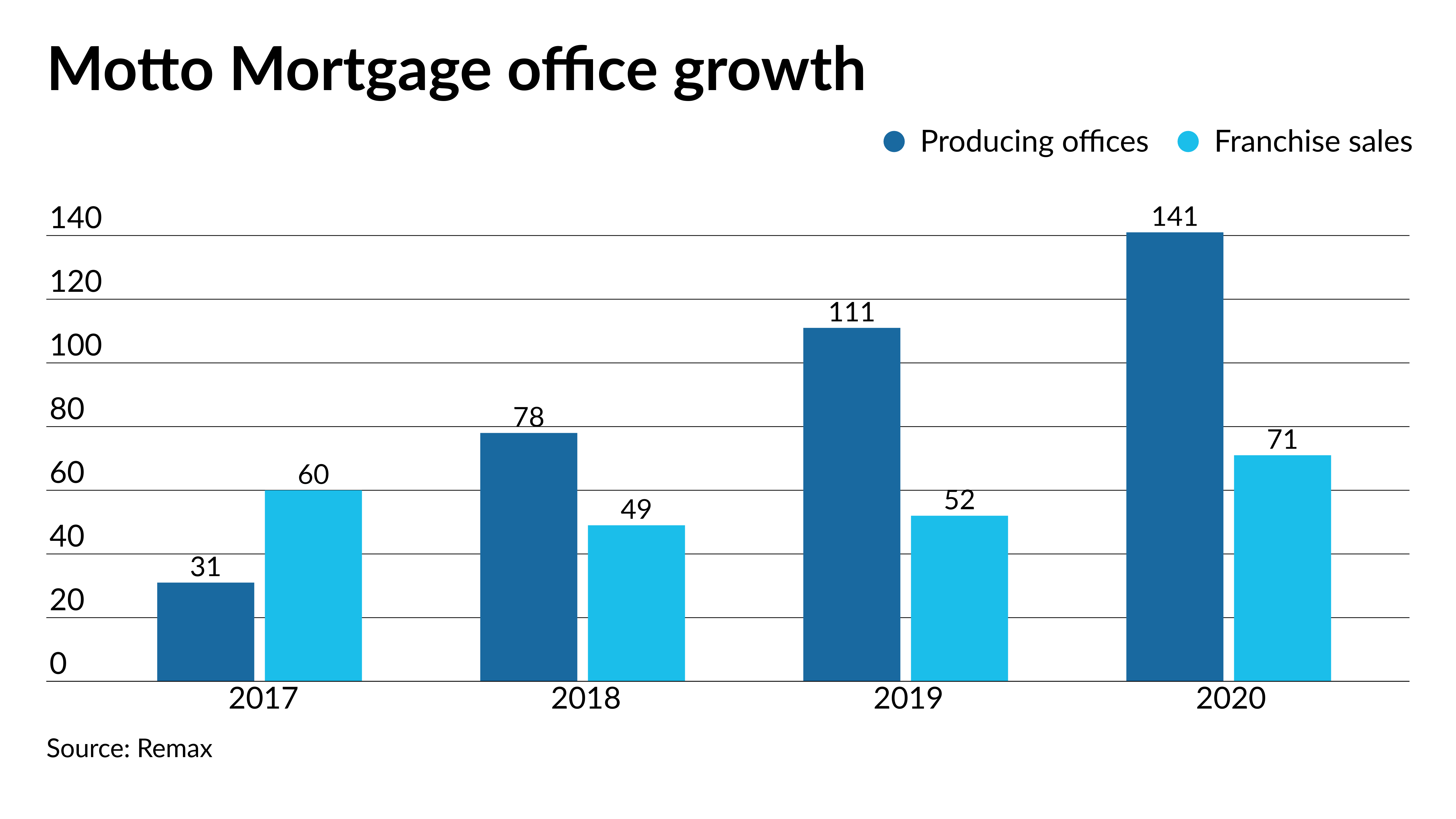

The 141 operating offices produced $2.47 billion in 2020; in 2019, the 111 locations the company had at the time did $1.1 billion.

“Closing nearly $2.5 billion in loan volume as a network is a remarkable feat in any year, but especially in a challenging one like 2020 – only our fourth full year of operations,” Ward Morrison, the president of Motto Franchising LLP, said in a press release. “2020 was a record-breaking year for Motto franchise sales, and the fourth quarter was our best quarter yet in company history.”

Remax rolled out Motto as a turnkey mortgage brokerage business in October 2016. Motto only collects franchise fees on a per-office basis from its operators. Each franchisee is responsible for brokering its own loans to the wholesaler.

During 2020, Motto sold 71 of its franchises. That’s both an annual record and an increase of more than 35% from 2019.

Even though Remax owns the franchisor, Motto branches also have been sold to real estate brokers affiliated with other companies as well as independent operators.

Motto is working on a new concept called the “Branchise,” the Remax 10-K filing said.

These offices, which are being offered to existing Motto franchisees, are similar to having a satellite office at a traditional mortgage lender. It allows them to expand their physical and/or virtual presence for a reduced contractual fee.

“The aim of these new models is to give franchisees the flexibility to expand their business to places where it would not have been feasible to support a full additional franchise while keeping offices compliant with state branch regulations,” the Remax 10-K said.

As of Jan. 31, there were two open Branchises, the company added.

Last August, Remax purchased Wemlo, which provides processing services to mortgage brokers. The company paid $6.1 million in cash and $3.3 million in common stock, plus an additional $6.7 million of equity-based compensation, the 10-K filing said.