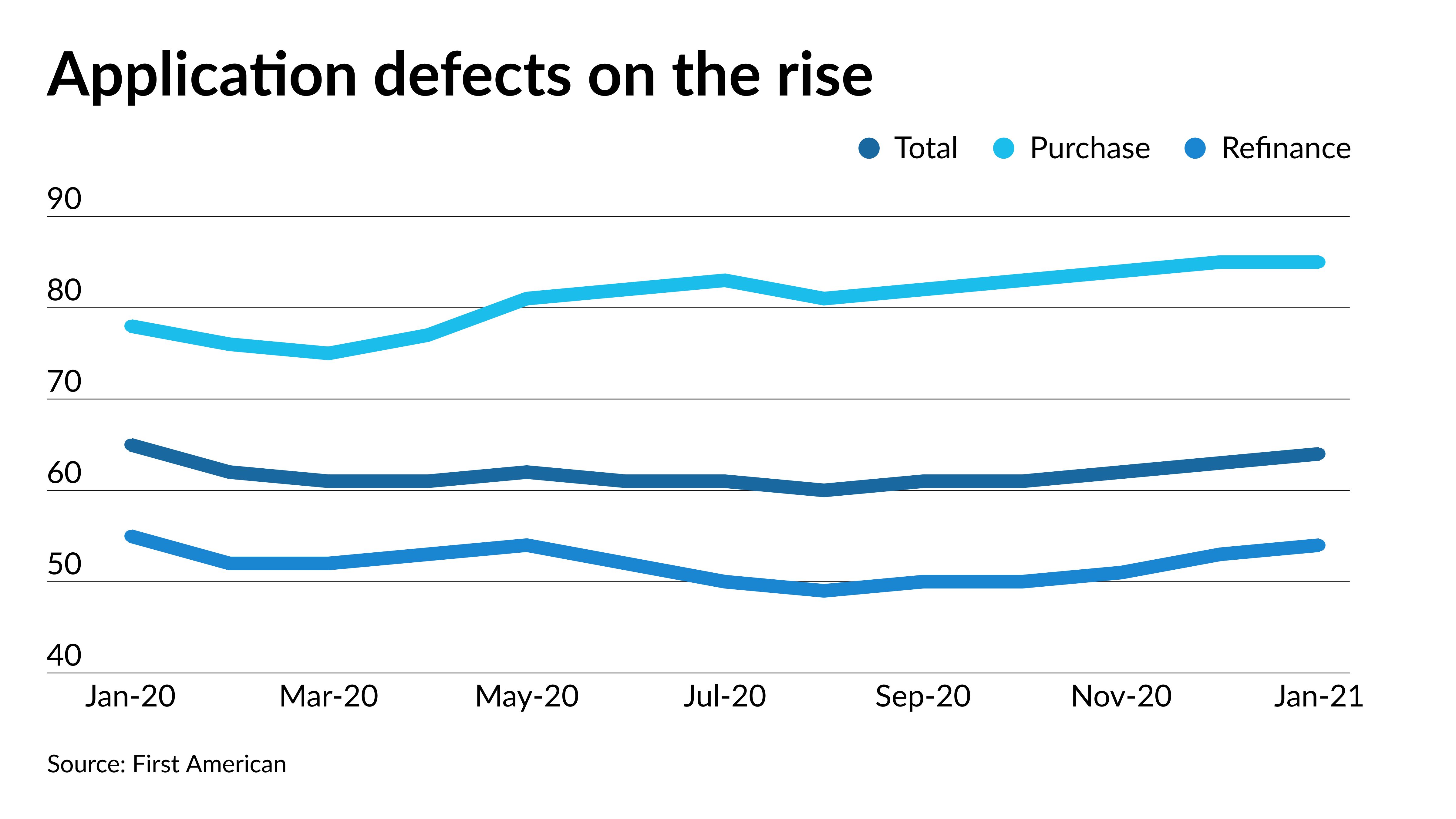

Rising interest rates caused an increase in refinance mortgage application defects in January and going forward, their impact will spread to purchase business, First American said.

While rates are expected to remain low by historical standards, even a modest increase is expected to cut refi demand as 2021 continues. Typically, refinancings are considered to be less prone to application defects than purchase loans because of the different motivations for seeking a loan.

“Modestly rising mortgage rates may cause existing homeowners who are ‘in the money’ to rush to refinance in order to capture low rates amidst fears rates will increase further,” First American Deputy Chief Economist Odeta Kushi said in a statement. “This rush may prompt existing homeowners to misrepresent information on a refinance application, resulting in rising refinance fraud risk.”

January’s First American Loan Application Defect was 64, up from December’s 63 but lower than 65 for January 2020. The increase came from the refinance component, which rose to 54 from 53 in December, and is now at its highest level since May 2020.

Meanwhile, the purchase component was flat compared with December at 85, remaining at its highest point since May 2019. The ongoing shortage of homes for sale helped to keep purchase risk elevated, as people are more likely to make misstatements on loan applications to help win a bidding war, Kushi noted.

An application defect is an indicator for, but not proof of, mortgage fraud.

This year “is looking more like a purchase transaction-dominated market, and a competitive one at that,” Kushi said. “This is not welcome news for overall fraud risk.”

The risk associated with conventional loan applications, remained elevated in comparison with government-guaranteed programs.

For the fourth straight month, the government defect index was 82. But for Federal Housing Administration, Veterans Affairs and U.S. Department of Agriculture-backed loans, January’s index was at 51, down from 52 in December.