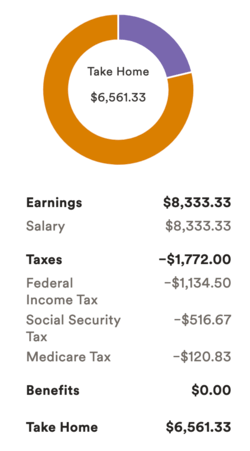

While folks debate whether mortgage rates are going higher or lower, most expect a boom if they eventually do come down.Even Dave Ramsey, who is known for being a very shrewd financial guru, thinks so.In a new interview with TheStreet, he said if rates sink a point or two, prospective buyers will likely return in droves.And that could create a “fire” in the housing market, which has suffered lately from a severe lack of affordability.But Ramsey also some very strict rules for home buying, which still might not pencil even if rates come back down to record lows.Ramsey Expects Lower Mortgage Rates, Housing Market ComebackWhile he wasn’t too specific, Dave Ramsey told TheStreet that mortgage rates will “probably fall,” and with that he expects “this market to come back.”He didn’t specify why mortgage rates might come down, just that they’d improve, perhaps because he’s an optimist.Maybe because like everyone else, he knows the housing market isn’t sustainable at rates and prices like these.To that end, he doesn’t believe homes prices are going to fall, even though inventory is beginning to rise and put pressure on sellers.In a nutshell, he said they aren’t going to come down because there’s more demand than supply.I suppose that varies based on the city in question, and there’s certainly been a shift to a buyer’s market in 2025 relative to prior years.But he believes there’s still a lot of pent-up demand from prospective home buyers, who continue to play the waiting game.And if mortgage rates somehow see a sizable drop, that could be the catalyst necessary to get things going again.For the record, 2024 saw the lowest existing home sales going back to 1995, and was similar to the depressed levels seen in 2023 as well.So far, 2025 doesn’t appear to be markedly better, though it depends on the direction of the economy, mortgage rates, and the trade war and tariffs.Does a Home Purchase Pencil Today Using Ramsey’s Math?One issue with Dave’s optimism is he’s pretty strict when it comes to home buying math.He’s got all sorts of rules you should abide by if you’re wanting to purchase a home, including a 25% rule, where only 25% of your take-home pay can be used toward the housing payment.This is much lower than the maximum DTI ratios allowed by Fannie Mae, Freddie Mac, the FHA, and so on, which accept ratios in the 40s and beyond.And those use gross income, not net, after-tax pay. That can be tough these days with home prices and mortgage rates where they are.On top of that, he has said in the past that “the only kind of mortgage I recommend is a 15-year, fixed-rate loan.”So let’s just pretend you make $100,000 annually and homes are going for $360,000, which is around the national average.Using ADP’s gross-to-net calculator, gross pay is $8,333 and take-home pay is $6,561 per month (using their default settings).If you can muster a 20% down payment, which Ramsey strongly advises, you’re looking at a loan amount of $288,000.So we’ll use a 6% 15-year fixed mortgage rate, which gives you a monthly principal and interest payment of $2,430.Next, we add in property taxes of roughly $375 per month and another $100 monthly for hazard insurance.All in you’re at $2,905, which would be about 44% of take-home pay using that ADP calculator.Ultimately, you can only allocate $1,640 toward PITI using Dave’s rules. And I was being pretty lenient here with a $100k salary and $360,000 purchase price.By His Rules, We Need Much Lower Mortgage RatesIf we abide by Dave’s many rules, we need significantly lower mortgage rates to make it all work.How low exactly? Well, using my example above we can only allocate $1,640 toward the housing payment.The property taxes and hazard insurance are fixed at about $475 per month and part of the housing payment.That leaves $1,165 for the principal and interest portion of the payment. Not a lot of money, especially when we have to take out a 15-year mortgage instead of a 30-year mortgage.Not even a 1% mortgage rate would get us there. But I suppose he knows the vast majority of home buyers out there don’t abide by all his rules.If they did, we wouldn’t have many homes sales (if any). Or we’d need salaries to be a whole lot higher. Or home prices a whole lot lower.But he said he doesn’t see home prices falling, so it appears the pent-up demand either makes a lot more money, or will break some of these stringent rules to get in the door and buy a home.One also has to wonder if mortgage rates actually do fall one or two percentage points, what will the economy look like?We all want mortgage rates to ease to boost housing affordability, but a big drop like that might only come from a major economic downturn. Before creating this site, I worked as an account executive for a wholesale mortgage lender in Los Angeles. My hands-on experience in the early 2000s inspired me to begin writing about mortgages 19 years ago to help prospective (and existing) home buyers better navigate the home loan process. Follow me on X for hot takes.Latest posts by Colin Robertson (see all)