Mortgages in forbearance rose after two weeks of declines, following the trend of midmonth increases in active plans and the country’s surging coronavirus cases, according to Black Knight.

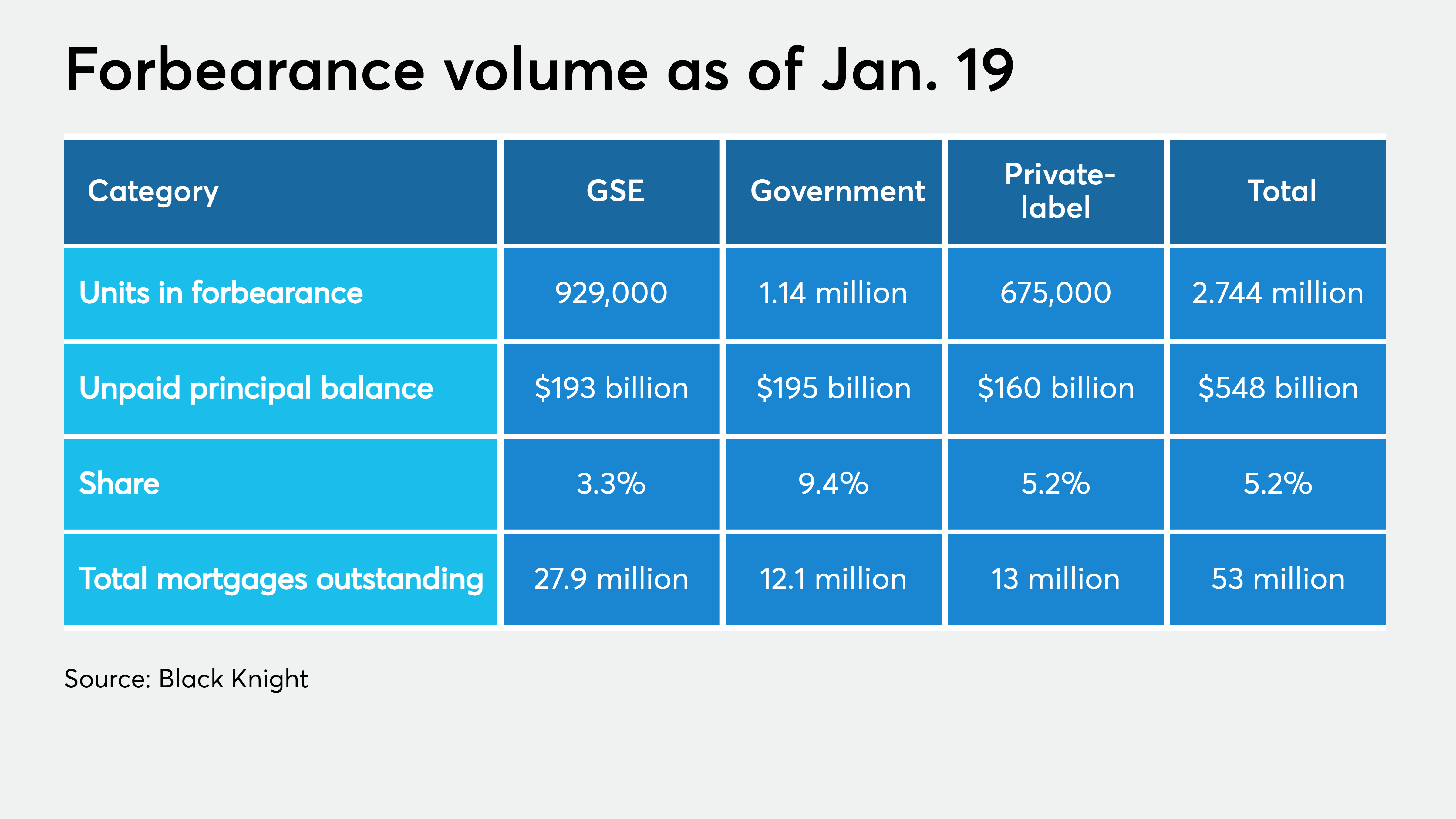

Forbearances jumped by 17,000 from one week earlier, growing to a total of 2.744 million plans as of Jan. 19. This forborne faction represents 5.2% of all mortgages and a combined unpaid principal balance of $548 billion, both up from 5.1% and $545 billion.

Loans backed by Fannie Mae and Freddie Mac were the only loan type to decrease week-over-week, dipping by 3,000 to a total of 929,000. Government-backed mortgages — backed by the FHA and VA — rose by 5,000 to 1.14 million overall. Portfolio and private-label securitized loans — which do not fall under CARES Act protections — increased by 15,000 to a total of 675,000.

“Removal rates have also slowed noticeably following the six-month point of forbearance plans,” Andy Walden, Black Knight economist and director of market research, said in the report. “This suggests that those borrowers who remain in forbearance were likely more heavily impacted by the economic downturn and thus are less likely to leave such plans before the full allowable 12-month period runs down.”

Mortgage servicers need to make monthly advances of $3.3 billion in principal and interest payments and $1.2 billion due in taxes and insurance per month, according to Black Knight’s analysis. Those breakdown to estimates of $1 billion and $400 million for government-sponsored enterprise loans, $1 billion and $400 million for FHA and VA, and $1.2 billion and $400 million for private labels.