While the number of distressed mortgages declined to a pandemic low in November, sustainable improvement won’t be made until the job market grows, CoreLogic chief economist Frank Nothaft said.

“Forbearance and loan modification helped struggling families rebuild their financial house in hard-hit places,” he wrote in the company’s Loan Performance Insights report. “While vaccination will mitigate the pandemic, the best cure for delinquency is income restoration through job creation.”

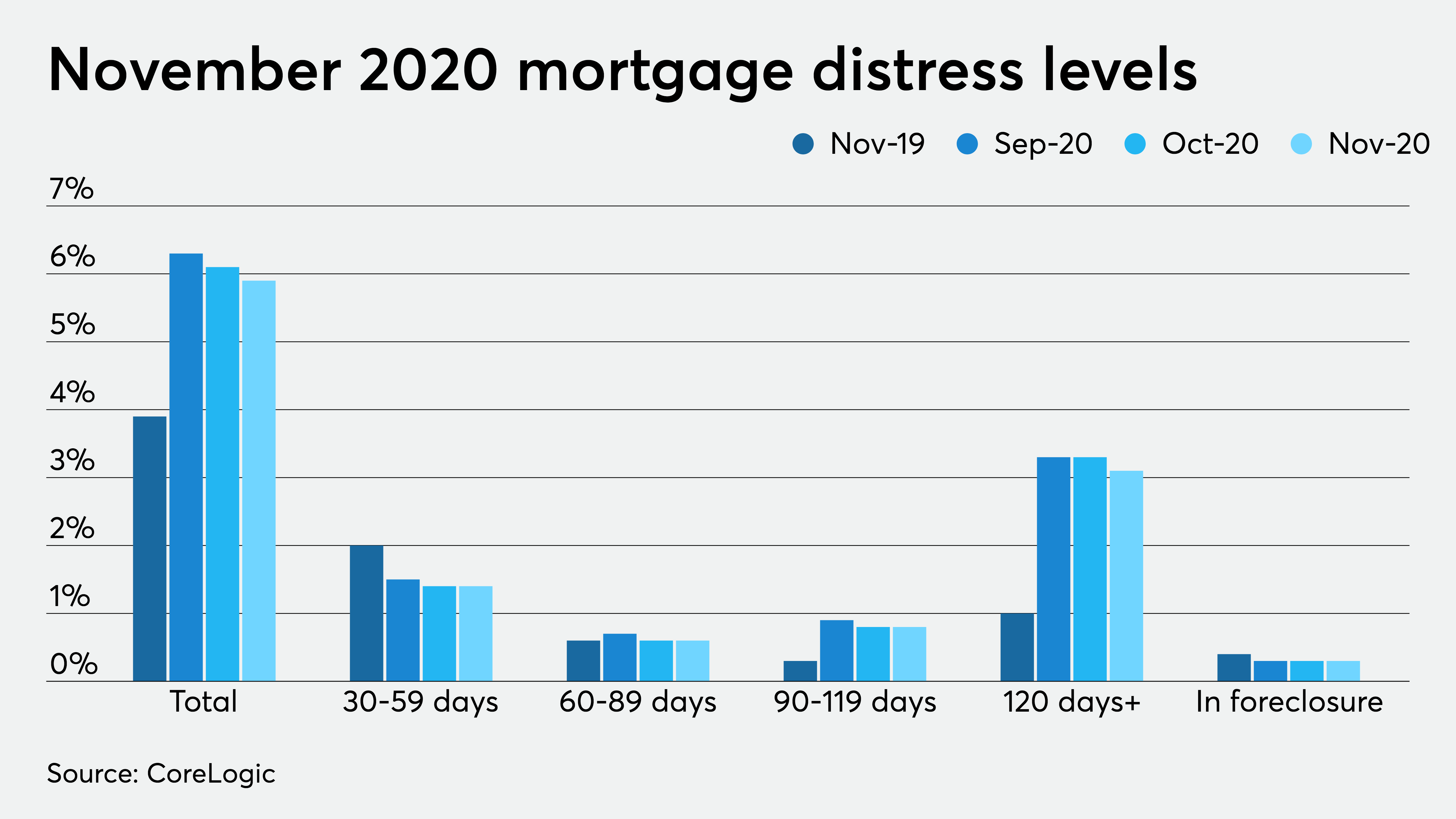

The CoreLogic report showed November’s overall delinquency rate dipped to 5.9% from 6.1% the month prior while climbing from 3.9% the year before. The downward trajectory since August’s high indicates more financial stability for consumers and a probable decrease for distressed sales, CoreLogic president and CEO Frank Martell said in the report.

With moratoria in place, the foreclosure rate remained at 0.3% dating back to April. The number edged down annually from 0.4%.

“People may sell their homes, but you’re not going to see the same level of short sales and foreclosure during the global financial crisis just given the amount of equity that people have,” Jeremy Sicklick, CEO and co-founder of HouseCanary, said in an interview.

Serious delinquencies — loans 90 days or more past due, including foreclosures — decreased to 3.9% from 4.1% one month earlier, while tripling November 2019’s rate of 1.3%. Mortgages past 120 days due but not yet in foreclosure also dropped monthly to 3.1% from 3.3% but jumped year-over-year from 1%.

The share of 30- to 59-day early-stage delinquencies held at 1.4% month-over-month while dropping from 2% year-over-year. The rate for 60- to 89-day delinquencies stayed static at 0.6% from both the month and year before, though not every housing market saw the same recovery in distressed loans.

The three states with the highest foreclosure rates remain unchanged from a month ago, with rates of 1.1% in New York and 0.8% in both Hawaii and Maine. A total of 16 states — up from 14 the month before — tied for the lowest rate at 0.1%.

The three highest delinquency rates also held from October with Louisiana at 9.7%, Mississippi at 8.9% and New York at 8.5%. Idaho again had the lowest delinquency rate at 3.1%, while Montana, Wisconsin and South Dakota tied for second at 3.4%.

In addition to reducing delinquency rates, a strong influx of jobs is a common denominator for metro areas predicted to outperform the rest of the country in home sales this year.