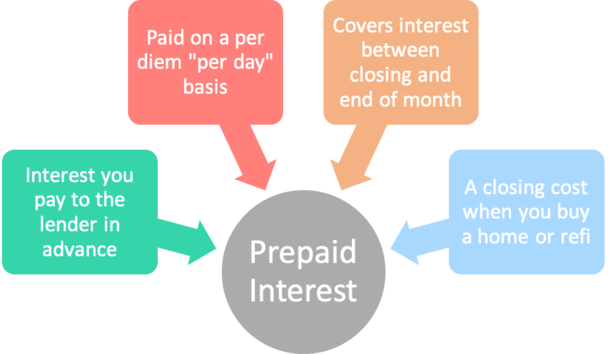

As the name implies, “prepaid interest” is money you owe to a bank or mortgage lender that is paid in advance of when it is actually due.

In terms of why it needs to be paid before the due date, there are several reasons, though it mostly boils down to the fact that mortgages are paid in arrears.

This means mortgage payments are due after the month ends, because interest must accrue (over time) before it can be paid.

This differs from rent, which is paid in advance of the month in which you occupy a rental unit.

If buying a home or refinancing an existing mortgage, prepaid interest will often be listed as a line item along with your other closing costs. Let’s learn why.

Prepaid Interest on a Home Purchase

Mortgages are generally due on the first of the month, though there is also typically a grace period to pay until the 15th.

Additionally, mortgage lenders don’t accept partial payments, so an entire month’s payment must be paid each month.

When you purchase a home, there’s a good chance you’ll close on a random day of the month, say the 10th or the 15th, or the 24th.

This means your mortgage will accrue interest for an odd number of days during that initial month.

Instead of asking you to pay that odd amount of interest as your first mortgage payment, you simply take care of it at closing.

By take care of it, I mean pay it in advance at a daily rate so you start with a clean slate once the loan funds.

Using one of our closing dates above, those who close on the 10th would owe 20-21 days of “per diem interest” at closing. Per diem simply means per day. It is also known as interim interest.

This ensures the lender is paid interest for the time you hold the loan and reside in the property, despite a full mortgage payment not being due yet.

However, as a result of that prepaid interest, your first mortgage payment is pushed out a month.

Remember, a full month of interest must accrue before a payment is generated.

So if your home loan closed on January 10th, you’d pay 21 days of prepaid interest at closing, but the first mortgage payment wouldn’t be due until Match 1st.

Why? Because you already paid the interest that would normally be included in your February 1st payment at closing.

And now you must wait until interest accrues throughout the month of February to pay that amount in March, along with a portion of the principal balance (the loan amount).

This is often referred to as “skipping a mortgage payment,” though it’s not really skipping, it’s deferring and paying the interest portion only.

Prepaid Interest on a Mortgage Refinance

If you already own a property with a mortgage attached, interest accrues daily throughout the month.

Assuming you decide to refinance that loan by taking out a replacement loan, interest will be due on both the old loan and the new loan at closing.

Similar to a home purchase loan, the interest will be calculated by taking the mortgage interest rate and how many days each lender holds your loan.

This will be broken up between old lender and new lender, with interest before your closing date going to your old lender, and prepaid interest from closing date to month-end going to your new lender.

So if you close on January 20th, you’d pay 20 days of interest to your old lender and 11 days of interest to your new lender.

This way the full month’s interest is squared away when you close, and you can start fresh with no interest due.

Then after a month’s time, enough interest will have accrued to make a full payment, which will be due on March 1st.

For the record, the payment due on January 1st would cover interest for the month of December.

In terms of how that interest is paid, you’d owe daily interest to the old lender based on the current principal balance and mortgage rate.

For example, if your loan payoff was $250,000 and your mortgage rate 3.5%, daily interest would be roughly $24. That’s about $480 for 20 days.

On the new loan, you’d owe 11 days of interest based on the new loan amount and interest rate.

If we’re talking a rate and term refinance with a 3% interest rate, it’d be $20.55 a day for 11 days, or $226.

Together, you’d owe about $706 to both lenders for the month of January.

As you can see, interest is paid to both the old lender and the new lender at closing when it’s a mortgage refinance.

How to Calculate Prepaid Interest

While you shouldn’t have to calculate prepaid interest on your own, thanks to the escrow officer assigned to your loan, it’s good to know how it works.

You can also check their math and better understand how mortgage lending works.

Let’s look at an example of prepaid Interest.

Loan amount: $200,000

Mortgage rate: 3%

Daily interest: $16.44

First, you take the mortgage rate and divide it by 365 (days) to determine the per diem interest amount.

For example, if the mortgage rate is 3%, it’d be .03%/365, or 0.00008219.

Next, you multiple that by the loan amount (we’ll pretend it’s $200,000) to get $16.44. I rounded it up from $16.438.

Finally, you multiple that amount by the days in which you’re required to pay per diem interest, which will be the total amount of prepaid interest due.

So if you need to pay it for 12 days, it’d be $197.28, and that would be included with your other closing costs, such as your loan origination fee, home appraisal, etc.

Tip: Prepaid interest isn’t a junk fee or an unnecessary add-on. It’s mostly unavoidable unless you close on the very last day of the month.

When Is the Best Time to Close Escrow?

- Most home buyers choose to close at the end of the month

- This can help keep closing costs down (including prepaid interest)

- May also align better with your old rental lease if it renews on the first of the month

- But if you close early in the month your first payment won’t be due for a long time

Ultimately, you don’t always get to pick when you close, whether it’s a home purchase or a refinance, but there are some considerations here.

If it’s a home purchase, closing late in the month means less prepaid interest will be due. And possibly less wasted rent will be paid out to your landlord.

For example, if you close on the 30th of the month and per diem interest is $50, you’d pay maybe $100.

And you wouldn’t have to pay another month’s rent assuming your lease renews on the first of the month.

Conversely, if you close on the 8th of the month you may owe roughly $1,150 in per diem interest at closing. This means higher closing costs, which could jeopardize your loan approval.

The caveat is your first mortgage payment wouldn’t be due for about seven weeks, versus four weeks for the mortgage that closes on the 30th.

So you get extra time until that first payment is due, which can be nice. And it’s also possible to receive a lender credit that covers the prepaid interest anyway.

Many transactions are structured as no cost loans these days, meaning the lender covers closing costs via these credits and they aren’t paid out-of-pocket directly.

The home sellers may also provide seller concessions to cover these costs.

The flipside is that the interest you pay doesn’t actually go toward paying down your loan amount and is basically just extra interest.

If you close near month’s end, beware that lenders are often extremely busy so there could be delays or mistakes.

If you close very early in the month, such as on the 4th, your lender may provide a “credit” for those days of interest and make your first mortgage payment due less than 30 days later.

The downside is your first payment is due the following month, but the upside is you don’t pay any unnecessary interest.

Best Day to Close a Refinance

- Generally favorable to close late in the month to avoid higher closing costs

- But the very last week of the month can be extremely busy and cutting it close

- Also consider the rescission period that tacks on 3 days to your closing date

- Signing loan docs on a Wednesday or Thursday could help you avoid extra interest charges

When it comes to a refinance, the same logic basically holds, though you’re paying interest to the old lender and the new lender.

Those who are refinancing to a significantly lower interest rate will want to get it done ASAP to avoid paying the higher per diem rate of interest.

You could argue avoiding the end of the month due to how busy lenders are, and maybe shoot for the third week of the month to keep interim interest at bay.

That would still give you five weeks or so until the first payment is due on the new refinance loan.

And as noted, a lender credit could absorb the interest paid to the old lender and new.

If you time it absolutely perfectly, it might be possible to skip two payments if you close early in the month, though this isn’t for the faint of heart.

Also consider the right of rescission, if applicable, which pushes your loan closing out at least three days.

If you sign docs on a Monday, the lender won’t be able to fund until Friday, and there’s a decent chance you pay “double interest” through the weekend if the old loan isn’t paid off immediately.

To avoid this, even though it’s not a major cost, you’d ideally want to sign on say a Wednesday or Thursday, then fund on a Monday or Tuesday.

Simply put, the earlier in the month you close, the longer it will be until the first payment is due on the new loan.

Tip: If you pay discount points at closing, these are also considered prepaid interest because you’re paying money upfront for a lower mortgage rate during your loan term.

(photo: Abhi)