Servicing platform Haven is naming Figure Technologies leader Daniel Wallace to be its next CEO, tapping the industry veteran who has been heavily involved in blockchain efforts.

The Brooklyn-based Haven allows customers to pay their mortgage bills and purchase other home services on a same platform, potentially giving real estate players more retention and recapture opportunities. The company covers 1.4 million loans and works with firms including LoanCare.

“With 85% of outstanding mortgages having a rate below 5%, and application volumes at a 30 year low, engaging with existing borrowers is more important than ever,” said Wallace in a press release Tuesday. “Haven enables all stakeholders to remain connected with their borrowers, throughout the life of their loan.”

Jonathan Chao, Haven’s co-founder and CEO, will move to a chief product officer role this month.

Companies using Haven’s platform don’t have to pay a large upfront fee but rather share some of the revenue the service generates. Haven says its efforts help investors in mortgage servicing rights by increasing recaptures, and it also collects propensity data without large fixed costs.

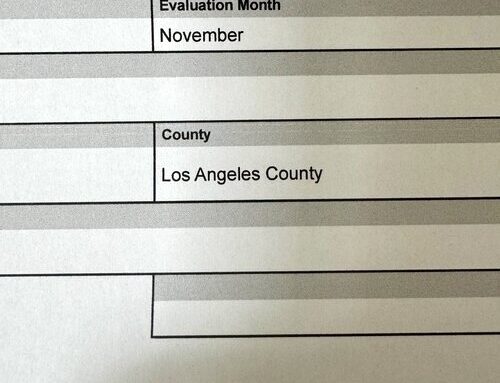

The service can be white-labeled, and Haven as of last year counted six unnamed servicer partners and five homeowners and life insurance partners. The fintech founded in 2020 has raised $13.5 million since its inception, including an $8 million Series A funding round last November.

Wallace was Figure’s general manager of lending. He helped the company become the largest non-bank originator of home equity line of credit loans, with over $6.5 billion in volume from over 100,000 borrowers and partnerships with major lenders.

The new CEO also previously led FirstKey Mortgage and servicer Capitol Crossing, and is a former managing director at Lehman Brothers.

Figure has been a pioneer in the blockchain space, completing an eNote mortgage sale to an asset management firm last March. The business, founded by SoFi Technologies founder Michael Cagney in 2018, also created a digital lien and eNote registry and aided the development of the Provenance Blockchain marketplace.

That firm also has plans to go public, although it recently dropped plans to pursue a national bank charter. A merger with Homebridge Financial also fell through. Figure however has continued to grow, completing its first HELOC securitization in April.