The big NAR settlement is expected to be finalized next week, but the changes already took effect back in August.

They include needing a written buyer agreement prior to touring a home and removing offers of compensation from the Multiple Listing Services (MLS).

That upfront agreement is also supposed to lay out the compensation charged by the agent, such as a flat fee dollar amount or percentage of the sales price.

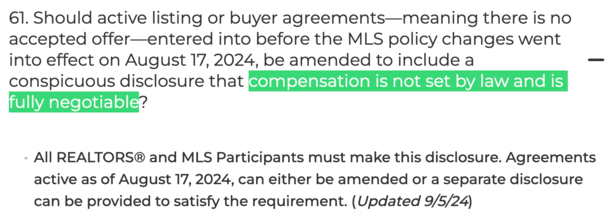

There also needs to be “a conspicuous statement that broker commissions are not set by law and are fully negotiable.”

Yet whenever I bring up the idea of a real estate agent reducing or discounting their fee, it is met with resistance.

Real Estate Agent Commissions Are Negotiable

NAR has been quick to point out that “agent compensation for home buyers and sellers continues to be fully negotiable.”

And that the negotiability of commissions needs to be communicated to the consumer explicitly via disclosures.

So we know whatever fee an agent proposes isn’t set in stone. For example, an agent might say they charge 3% of the purchase price.

On a $500,000 home, that’d be $15,000, though it is important to point out that this amount is often shared with the brokerage. Meaning an agent may only see a portion of that.

Conversely, if you walk into a retail store or a restaurant, you will likely see set prices. For example, a pizza might cost $15.99, and a stick of deodorant might be $5.99.

You can’t go up to the cashier and begin negotiations. They’ll tell you kindly (hopefully) to leave the store if you don’t like the price.

Now back to real estate agents. They too can set their price and not budge. Just because their fee is “negotiable” doesn’t mean they’ll negotiate.

Many will tell you to pound sand. That’s their prerogative. If they want to charge 3% they can charge 3% and no less.

However, as a consumer you can still attempt to negotiate. And if they aren’t willing to lower their fee, you can go speak with another agent. Or you can stick with them if you believe the fee is justified and you like them.

Problem is most agents all charge around the same amount, which was part of the issue with the settlement. The commissions seem fixed, even if they technically aren’t.

There Always Seems to Be Resistance If You Question the Fee

In my experience (I’m not speaking for anyone else), there is always resistance if you attempt to negotiate the real estate agent’s fee.

I get it. Why wouldn’t there be? You’re asking them to accept less money for their job. It’s their livelihood. Chances are they aren’t going to smile and say, “Sure!”

However, it’s not unreasonable to negotiate their fee, as you would many other things.

You can negotiate mortgage rates, you can negotiate with the buyer or seller on price. Or on necessary repairs, contingencies, earnest money, etc.

There’s lots of stuff you can negotiate in life. That doesn’t mean the other party has to oblige. But you can at least have the conversation.

In the past, I’ve negotiated discounts on real estate agent fees, usually in the form of a credit to be used toward closing costs.

Did I ask for half of their fee or most of it? No, I asked for maybe .50%, so instead of them earning 2.5%, they earned 2%.

Did they have the right to say no? Absolutely. This is all part of negotiating. In one particular situation, I asked for the credit and the agent was beside herself.

She told me she had never negotiated her fee in X amount of years, etc., etc. Then the next day she begrudgingly obliged to part with some of her compensation to make the deal work.

A lot of money is better than no money.

Buyers and Sellers Have to Negotiate Along the Way Too!

The irony when a real estate agent won’t negotiate is that home buyers and home sellers often have no choice to.

For example, a home seller might negotiate a list price with their agent, even if they don’t love the price.

Then they might have to lower the price by X amount if it doesn’t sell. Again, they can tell their agent they are holding firm if they choose to. But chances are they might lower the price.

And guess what. It hurts the seller more. Say the purchase price drops from $800,000 to $750,000 and the agent charges 2.5%.

The seller is out $50,000, while the agent receives $1,250 less in compensation. Remember, they are likely sharing it, so they probably lose even less than that.

The same thing can happen if a home buyer has to make a higher offer as part of their negotiation.

All of a sudden there are multiple offers and they need to bid another $50,000 to win the home.

In this case, maybe the buyer says to their agent, “Can I get a credit toward closing costs?”

After all, their out-of-pocket expenses are higher as a result and they might need a little help getting to the finish line.

Also, the agent is now earning more money because of the higher sales price, assuming they are charging a percentage fee.

[Can real estate commissions be financed?]

Should Agents Play the Long Game and Offer Discounts?

Now I’ve already mentioned that many real estate agents aren’t too keen about lowering their compensation. And it’s obvious why.

They’d earn less money! We all get it. But at the same time, everything is a negotiation when buying and selling a home. Real estate is one big negotiation.

So why should sellers accept lower prices for their homes, and buyers be forced to pay more, while agents hold firm?

Now it might also have to do with semantics. Real estate agents, like anyone else, don’t like to be referred to as “discount agents.”

Or that they’re accepting less than their worth.

But could they not still offer a credit toward closing costs, or a reduced fee, as a gesture to nurture a longer relationship?

Imagine an agent that offers a credit on one transaction, then gets referrals in the future. And additional transactions from that client.

The credit made that agent stand out. It didn’t cheapen them in any way. It was a well thought out negotiation to earn even more business down the line. Or to make a deal work.

And on aggregate, even if they accepted less on one transaction, they might make a lot more as a result.

Lastly, in light of the settlement requiring agents to clearly and conspicuously state that commissions are fully negotiable and not set by law, maybe it’s time to actually negotiate.

Read on: How does real estate agent commission work post-settlement?