Lately we’ve been hearing a lot about trigger leads due to legislation trying to ban them.

If you’re unaware, when a lender pulls your credit, the credit bureaus will happily sell your information to competing banks and lenders letting them know you’re shopping for a mortgage.

The result is getting absolutely bombarded by phone calls and text messages with offers to use them instead.

They have yet to be outlawed, partially because agencies like the CFPB actually want consumers to comparison shop more. And this is one way to kind of enforce it.

Even if you haven’t applied for a mortgage recently, homeowners (including myself) have received official-looking mailers that appear to be from their existing bank or loan servicer.

What on Earth Is an Equity Reserve Summary?

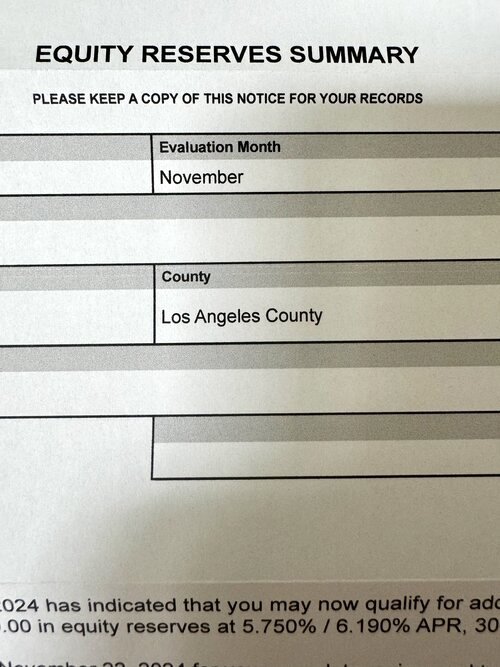

Recently, I got an “Equity Reserve Summary” in the mail (that I’m glad I opened so I can share it with you).

First off, I’ve never heard this phrase in life, but I believe some version of it is used by mortgage lenders to solicit homeowners.

The gist of it is that you have “equity reserves” that can be tapped if you call the number on the notice.

My particular letter listed the name of my old loan servicer (they didn’t know my loan got transferred to a new one I guess), my property address, and a hypothetical amount of equity available to tap.

It’s also featured some arbitrary file ID number and a customer support center phone number with hours listed, but oddly no physical location.

It also said, “Please keep a copy of this notice for your records.”

Sure thing.

Is This an Official Notice or Officially Nonsense?

Basically, the companies that send out these forms do their absolute best to make it look like it’s an official notice. And that you NEED to respond as if it’s something urgent or obligatory.

In reality, it’s just a cash-out refinance offer masquerading as an official-looking notice.

Now there’s nothing wrong with sending a refinance offer in the mail. I get all types of junk mail for countless products on a daily basis. That’s just life.

The problem is when it appears to be an official notice when it’s actually just an advertisement.

Not until you really study the fine print do you see that it’s from a third-party mortgage lender.

The lender in question was one I’ve never heard of. Again, it’s fine for them to advertise.

But when it doesn’t look like an ad and instead looks like something being sent from my loan servicer, it feels a bit misleading.

Mortgages are complicated enough, so we don’t need more confusion.

People already don’t understand things like loan servicing transfers, where the company that originated your loan sells it off to another company to collect monthly payments.

Or how one servicer can transfer your loan to a new servicer. This also happens way too often!

So when companies start making up silly reports like this, there’s the potential for even more misunderstandings.

And then you have to question whether you want to work with a lender like this.

Always Read the Fine Print to Determine What’s Actually Going On

If you put in the time to read these offers, be sure to get all the way down to the fine print section. You might need to pull out a pair of reading glasses.

When you read it, you’ll quickly find out that it’s an offer for a mortgage refinance.

And despite a sample (low) mortgage rate of 5.75% being listed, it noted that all offers will have different terms.

In addition, it stated that it’s from a third-party lender, which is not approved by or affiliated with my current lender.

With the disclosure that your actual rate and payment may be different based on X, Y, Z, blah blah blah.

And finally, that all information herein was obtained from public record.

So unfortunately, once you become a homeowner, a lot of your information is out there for businesses to solicit you with.

That’s all good and well, but companies need to be more upfront and honest.

Personally, I would want a prospective mortgage lender to be a lot more transparent if making me an offer.

But I get it, these notices are probably more eye-catching and may result in a better conversion rate for the lenders who send them.

Just let this serve as a warning. Next time you receive an official looking notice, it might just be an advertisement.

And as I always say, if a lender reaches out to you, reach out to other lenders.

Like the CFPB says, obtain multiple quotes instead of just going with the first one you hear or see.

Especially when they include a line that says you need to call by a certain date for them to complete your “review.”