With home prices out of reach for many and affordability the worst it’s been in decades, a lot of folks are talking about another housing crash.

However, just because buying conditions aren’t affordable doesn’t mean we’ll see cascading home price declines.

Instead, we could just see years of stagnant growth or real home prices that don’t actually keep up with inflation.

All that really means is that homeowners won’t be seeing their property values skyrocket like they had in years past.

At the same time, it also means those waiting for a crash as a possible entry point to buy a home might continue to be disappointed.

This Chart Perfectly Sums Up Then Versus Now

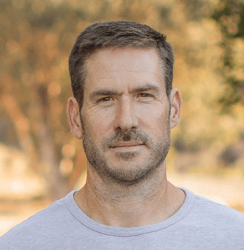

Just consider this chart from the Federal Reserve, which breaks down the vintage of today’s mortgages. In other words, when they were made.

It shows that a huge chunk of the outstanding mortgage universe was made in a very short window.

Basically 60% of outstanding home loans were made from 2020 to 2022, when 30-year fixed mortgage rates were at their all-time lows.

To contrast that, something like 75% of all outstanding loans were originated from 2006 to 2008.

Why does that matter? Because underwriting standards were at their absolute worst during those years in the early 2000s.

This meant the vast majority of home loans originated at that time either shouldn’t have been made to begin with or simply weren’t sustainable.

In short, you had a housing market that was built on a house of cards. None of the underlying loans were of good quality.

The Easy Credit Spigot Ran Dry and Home Prices Collapsed

Once the easy credit faucet was shut off, things came crashing down in a hurry.

Back in 2008, we saw an unprecedented number of short sales and foreclosures and other distressed sales. And cascading, double-digit home price declines nationwide.

It only worked as long as it did because financing continued to loosen on the way up, and appraisals continued to be inflated higher.

We’re talking stated income loans, no doc loans, loans where the loan-to-value ratio (LTV) exceeded 100%.

And serial refinancing where homeowners zapped their home equity every six months so they could go buy new cars and other luxuries.

Once that stopped, and you couldn’t obtain such a loan, things took a turn for the worst.

More Than Half of Recent Mortgages Were Made When Fixed Rates Hit Record Lows

Now let’s consider that the bulk of mortgages today are 30-year fixed-rate loans with interest rates ranging from 2 to 4%.

It’s basically the complete opposite of what we saw back then in terms of credit quality.

On top of that, many of these homeowners have very low LTVs because they purchased their properties before the big run-up in prices.

So they’re sitting on some very cheap fixed payments that are often significantly cheaper than renting a comparable home.

In other words, their mortgage is the best deal in town and they’d be hard-pressed trying to find a better option.

There has also been underbuilding since the 2010s, meaning low supply has kept low demand in check.

Conversely, in 2008 the mortgage was often a terrible deal and clearly unsustainable, while renting could often be a cheaper alternative.

Homeowners had no equity, and in many cases negative equity, combined with a terrible loan to boot.

Said loan was often an adjustable-rate mortgage, or worse, an option ARM.

So homeowners had very little reason to stick around. A loan they couldn’t afford, a home that wasn’t worth anything, and a cheaper alternative for housing. Renting.

There Are New Risks to the Housing Market to Consider Today

They say history doesn’t repeat, but that it rhymes. Yes, it’s a cliché, but it’s worth exploring what’s different today but still a concern.

It wouldn’t be fair to completely ignore the risks facing the housing market at the moment.

And while it’s not 2008 again, there are several challenges we need to discuss.

One issue is that all other costs have gone up significantly. We’re talking car payments, insurance, groceries, and basically all other non-discretionary needs.

For example, you’ve got homeowners insurance that may have gone up 50% or even more.

You have homeowners who have been dropped by their insurance who then need to get on a state plan that’s significantly more expensive.

You have property taxes that have jumped higher. You have maintenance that has gotten more expensive, HOA dues that have gone up, etc.

So while the mortgage might be cheap (and fixed), everything else has gone up in price.

Simply put, there’s heightened potential for financial stress, even if it has nothing to do with the mortgage itself.

This means homeowners are facing headwinds, but they are unique challenges that differ from the early 2000s.

What might the outcome be? It’s unclear, but homeowners who purchased pre-2021 and earlier are probably in very good shape.

Between a record low mortgage rate and a home price that was significantly lower than today’s prices, there’s not a lot to complain about.

Recent Home Buyers Might Be in a Tough Spot

You can see on the chart above that mortgage lending volume plummeted as mortgage rates jumped higher in early 2022.

This is actually a good thing because it tells you we have sound home loan underwriting today.

If loans kept being made at high volumes, it would indicate that the guardrails implemented because of the prior housing crisis weren’t working.

So that’s one big safety net. Far fewer loans have been originated lately. But there have still been millions of home buyers from 2022 on.

And they could be in a different boat. Perhaps a much higher loan amount due to a higher purchase price.

And a higher mortgage rate as well, possibly a temporary buydown that is going to reset higher. Not to mention higher property taxes, costly insurance premiums.

For some of these folks, one could argue that renting might be a better option.

It could in fact be cheaper to go rent a comparable property in some of these cities throughout the nation.

The problem is, it could also be difficult to sell if you’re a recent home buyer because the proceeds might not cover the balance.

It’s not to say short sales are going to make a big comeback, but you could have pockets where there’s enough downward pressure on home prices where a traditional sale no longer works.

Another thing that’s unique to this era is the abundance of short-term rentals (STRs).

Certain metros have a very high concentration of STRs like Airbnbs and in those markets it’s gotten very competitive and saturated.

For some of these homeowners, they might be interested in jumping ship if vacancy rates keep rising.

Of course, the vast majority probably bought in when prices were a lot lower and they have those ultra-low fixed mortgage rates as well.

So it’s unclear how much of an issue you would have if only a handful actually unload at once.

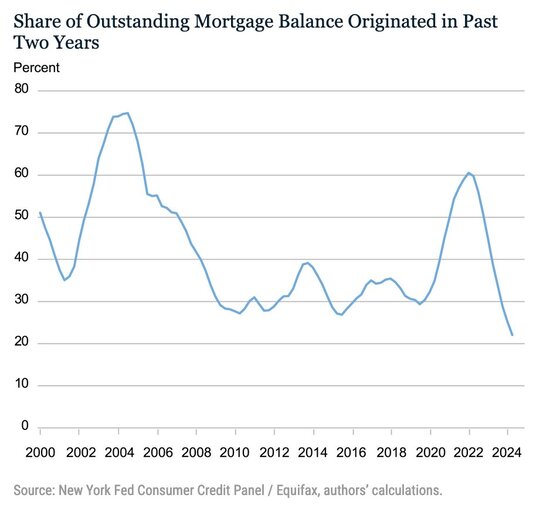

Housing Affordability Today Is Worse Than 2006

Still, there are risks, especially with affordability worse than it was in 2006, per ICE.

But given financing has been pretty tight and loan volume very low lately, it still seems difficult to see a big downturn.

That being said, real estate is always local. There will be cities under more pressure than others.

It’ll also be a pivotal year for the home builders, who have seen their housing inventory increase.

If anything, I would be cautiously watching the housing market as we head into 2025 as these developments play out.

However, I wouldn’t be overly-worried just yet because it remains an issue of unaffordability. And not a financing problem like it was back then, which tends to drive bubbles.