The Consumer Financial Protection Bureau (CFPB) has finalized a rule that will remove medical debts from consumer credit reports.

In doing so, Americans’ credit scores should rise by an average of roughly 20 points, increasing the number of mortgage applicants who get approved for a home loan.

The agency noted that “medical debts provide little predictive value to lenders about borrowers’ ability to repay other debts.”

And are often reported by consumers to be inaccurate or in dispute, leading to more harm than good.

Going forward, the inclusion of medical bills on credit reports will be banned and lenders will be prohibited from using medical information in their credit decisioning.

No More Medical Debt on Credit Reports

Specifically, the new change from the CFPB will amend Regulation V by removing an exception that allowed creditors to obtain and consider medical debt in credit eligibility determinations.

As such, the Fair Credit Reporting Act (FCRA) will now prohibit creditors from considering medical information when underwriting new loans.

And the credit reporting bureaus (Equifax, Experian, TransUnion) won’t be able to provide consumer credit reports to lenders that contain information related to medical debt.

Previously, the trio had announced the removal of medical collections if the amounts were under $500.

And the two main credit scoring companies, FICO and VantageScore, had adjusted their algorithms to lessen the degree to which medical bills impacted a consumer’s credit score.

But now all medical bills will be banned on credit reports, other than medical-based forbearance plans and medical expenses with an associated loan.

Lenders will also be prohibited from considering medical information, such as requiring that medical devices serve as collateral for a loan in the case of a repossession.

Long story short, you shouldn’t see much if any medical information on your credit report going forward.

But Weren’t Medical Collections and Charge-Offs Already Ignored?

Before this new rule change, the likes of Fannie Mae, Freddie Mac, the FHA, and VA already implemented underwriting guideline updates to ignore medical collections and charge-offs.

This meant even if they were listed on a credit report, they wouldn’t be factored into the borrower’s DTI ratio or required to be paid off prior to loan funding.

While that provided some much-needed relief, the presence of medical debts on credit reports still meant that a borrower’s credit score may have been adversely impacted.

As such, a hypothetical borrower could have seen their FICO score fall 20 points or more, pushing them into a more expensive pricing bucket.

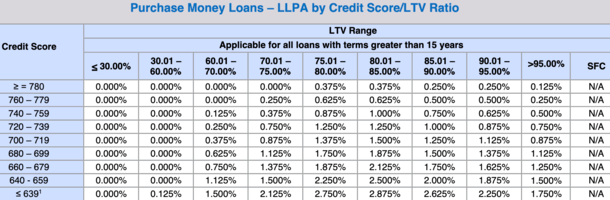

For example, a borrower with a 695 FICO score is subject to a 1.75% pricing hit for credit score alone.

Meanwhile, a borrower with a 700-719 FICO is only subject to a 1.375% pricing hit.

This difference in loan cost is then either passed onto the borrower in the form of higher closing costs or a higher mortgage rate.

For some prospective borrowers, the lower credit score may have been enough to completely disqualify them from loan approval.

22,000 More Mortgage Approvals Projected Annually

Thanks to this new rule, the CFPB projects that an additional 22,000 Americans will be approved for “affordable mortgages” each year.

This means the presence of a questionable medical bill will no longer serve as a barrier to homeownership.

It’s in large part due to borrowers with medical debt on their credit reports seeing an average credit score rise of 20 points once such information is removed.

For example, if a borrower had a 680 midscore prior this change, they might have a 700+ FICO going forward.

Remember, up until this point FICO and VantageScore still assigned weight to medical debt in their scoring models, despite lessening the impact of such occurrences.

They will now be banned from doing so, which all else equal will result in higher credit scores across the board.

In addition, borrowers may have had to provide a letter of explanation for the medical collection in the past, which resulted in more legwork and had the potential to jeopardize their approval.

This will no longer be the case, which should result in more approved loans at lower mortgage rates that reflect the higher credit scores.

The CFPB also expects the closure of this special “carveout” that allowed creditors to consider medical debts to increase privacy protections and reduce coercive debt collection practices.

So aside from it perhaps getting easier to qualify for a mortgage, consumers will be less likely to be burdened by pesky debt collectors.