Welp, another day in 2025, another mortgage lender calling it quits. This time it’s depository Washington Federal Bank, or WaFd for short.

The Seattle-based bank, which has been in the home loan business for over 100 years, cited lower profits and more risk for the decision.

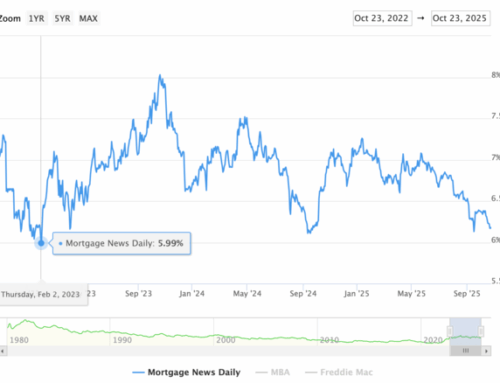

As we all know, it’s also been a very tough few years in the mortgage industry, with mortgage interest rates nearly tripling during that time.

This has made refinancing a lot less common, while also putting pressure on prospective home buyers.

The decision represents yet another loss for banks in the residential mortgage space, which continue to see their market share decline as nonbanks gain.

WaFd Will No Longer Offer Home Loans to Its Customers

Washington Federal Bank (NASDAQ: WAFD) made the announcement to exit its home loans business in its first quarter earnings release yesterday.

And it was a pretty interesting revelation because they went into detail about why they’re exiting.

Unlike the fast and loose days of the early 2000s when banks and lenders went under because of shoddy underwriting, today it’s more about mortgages being a commodity.

In other words, they’re all pretty much the same these days. Boring old 30-year fixed-rate mortgages backed by government-entities such as Fannie Mae and Freddie Mac, or the FHA/VA.

This means borrowers can get the same loan just about anywhere, so if you’re not serious about competing, what’s the point?

That competition all fighting for the same thing, and a lot less of it these days with rates much higher, also means profitability falls and credit risk increases.

That was reason #1 for why they are exiting the residential mortgage space.

The other main reason is that while technology has made it easier for homeowners to refinance a mortgage, “it increases the interest rate risk for banks that hold mortgages.”

And unlike the nonbanks, they were keeping their loans in portfolio.

Another related issue is that they grew less comfortable offering low- and no-down payment offerings as a lender that retains all the loans on their balance sheet.

“For example, there are multiple government programs that require no down payment, and our performance is being compared to lenders who offer these programs and originate to sell.”

Long story short, banks are taking more risk than nonbanks that turn around and sell their loans almost immediately after origination. So it doesn’t make sense to stick around.

The Move Will Result in an 8% Workforce Reduction

WaFd said its “aim is to always offer products and services to our customers where WaFd Bank can add value,” but concluded that’s no longer happening in the mortgage space.

They will also cease offering HELOCs, which tend to only come from depository banks, another blow to homeowners looking to tap their equity without disturbing a low-rate first mortgage.

Their exit from residential mortgage lending will result in an 8% reduction in their workforce.

It’s unclear how many layoffs that’ll be, but it’s yet another loss for the mortgage industry as we start 2025.

They did say they’ll keep all existing home loans and HELOCs on their books to ensure there is no disruption for current customers.

This means nonbanks will need to pick up the slack, though that comes with its own risks and perhaps fewer loan options for home buyers today.

It also makes you wonder if banks will continue to reduce and/or leave the residential mortgage space if things don’t change.

Read on: Check out the latest mortgage layoffs, closures, and mergers