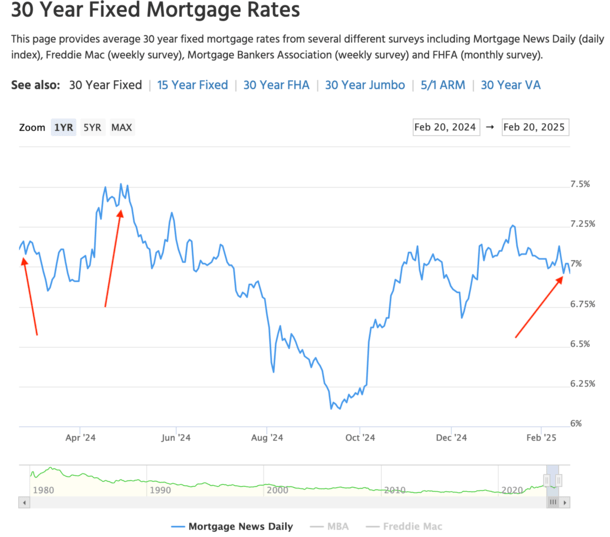

As anticipated, mortgage rates are back below their year-ago levels.

I had suspected they would be, despite a rough couple of months pre- and post-election.

There’s been a lot of uncertainty lately, but bond yields have also cooled thanks to friendlier economic data and a reprieve on most tariffs.

Mortgage rates are also simply better today than last year because they’ve been more and less drifting lower since peaking at 8% in late 2023.

The question is will it continue, and if so, can it save the spring housing market?

Where Mortgage Rates Stand Today: Lower Than Last Year

Both Freddie Mac and Mortgage News Daily posted a 30-year fixed back in the 6s today, which after seeing 7 and 8 doesn’t sound half-bad.

Sure, it’s a far cry from 3%, but it’s all psychological and lower is better, even if it’s higher than it was previously.

Specifically, mortgage rates fell to 6.85% during the week ending February 20th, which was just below last year’s average of 6.90% at this time, per Freddie Mac.

Meanwhile, MND pegged the 30-year fixed at 6.96%, which was below the 7.11% seen in late February of 2024.

It’s not a massive improvement, yet, but it is an improvement. And it does jibe with my take that mortgage rates remain in a falling rate environment.

If you consider where the 30-year fixed was in late 2023, rates have improved by over 100 basis points (1%).

And if you compare them to last spring, which is peak home buying season, they’re about 50 bps lower.

In much of April of last year, the 30-year fixed was hovering around 7.50%, which put a damper on home sales and hurt home buyer sentiment.

[2025 Home Buying Tips as the Buyer’s Market Returns]

Can They Move Even Lower Over the Next Couple Months?

The big question now is can they keep it up or will they snap back to the 7s and stop prospective home buyers in their tracks?

That’s anyone’s guess, as always, but we know Trump wants lower mortgage rates to win favor with voters.

And we know his Treasury Secretary Scott Bessent is also fixated on getting long-term interest rates lower.

So if they stay true to their word, and economic data plays ball, e.g. inflation continues to cool, we could be in luck.

The latest development, mass government layoffs and buyouts, could also work in mortgage rates’ favor.

After all, interest rates tend to respond well to higher unemployment on the basis that it equates to less consumers spending, slower growth, etc.

Given how many jobs cuts have been announced in such a short period, it has the power to move the dial on bond yields.

If the 10-year bond yield continues to fall because of it, 30-year fixed mortgages could follow suit (how to track mortgage rates).

While clearly a negative for the many government employees affected, it would be a tailwind for home buyers and those looking to refinance a mortgage.

Be Hopeful, But Don’t Count on Lower Rates If You’re Buying a Home This Spring

The takeaway here is that mortgage rates continue to inch lower after climbing considerably post-election.

They still remain quite a bit higher than their 52-week lows, when the 30-year fixed was basically averaging 6% flat.

That took place back in September, before a hot jobs report, and incidentally before Trump became the clear frontrunner to win the election.

If his administration continues to say rate-friendly things, like Bessent’s talk of being a “long way” from boosting longer-term debt sales.

And possibly tapping the brakes on Quantitative Tightening (QT), mortgage rates could continue to improve.

Especially if inflation and employment reports continue to come in favorably.

I don’t think it would take a lot for buyers to get excited about lower mortgage rates, as a low-6 or even high-5 likely would be palatable at this juncture.

But we also have to keep a close eye on the debt ceiling and the $4.5 trillion in tax cuts that Republicans want extended.

Somehow that will need to be paid for and it’s unclear if cutting a bunch of government jobs is going to really offset those costs.

In other words, there is a very real threat to mortgage rates that could completely derail their recent move lower.

And seriously dampen the mood of the spring home buying market, which already appears to be suffering in many parts of the country, namely the Sun Belt.

The upside, if rates do go up again, is you might have even more bargaining power with sellers.

Read on: 2025 Mortgage Rate Predictions