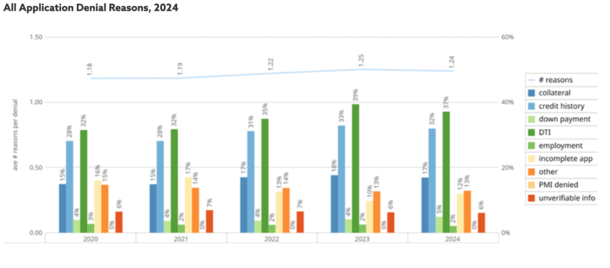

Last year marked yet another year where high debt-to-income income ratios were the leading cause of denial for mortgage applicants.

While a low credit score can also be a significant factor, often it might just lead to a higher mortgage rate.

That means you can still get approved for a home loan with marginal credit, but it’ll be more expensive.

In other words, you want to focus on keeping your other liabilities as low as possible when applying for a mortgage.

Interestingly, this should actually help your credit score in the process as well!

High DTIs Top Reason Mortgages Are Declined

In 2024, the top reason mortgages were declined was due to an elevated debt-to-income ratio (DTI).

This was the case across all types of applications, according to a new study from iEmergent.

And it has been a continuous trend, “increasing steadily from 32% in 2020 to 39% in 2023,” though there was a slight drop to 37% in 2024.

This didn’t come as much of a surprise given the increase in both home prices and mortgage rates in recent years, not to mention rising property taxes and homeowners insurance costs.

Long story short, the higher the mortgage payment, the higher your DTI ratio, all else equal.

The second leading cause of denial was credit scores, aka low ones.

Lenders have minimum credit score thresholds, but they are often quite liberal.

As a result, you can get approved for a mortgage with the score as low as 620 for Fannie Mae and Freddie Mac.

And even get approved with a score below 600 for other types of loans such as an FHA loan.

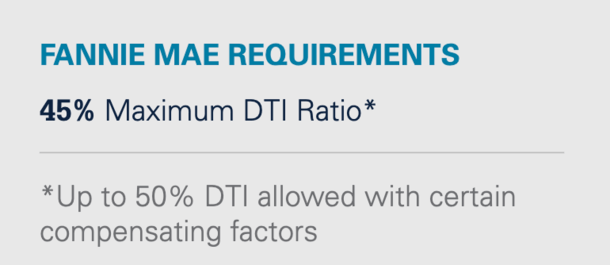

When it comes to DTIs, the guidelines are a little more gray and flexible.

Instead of a hard cut off, you might see a range that factors in income, assets, down payment, etc.

It’s more of a holistic view of total risk, which may allow DTIs to go higher if you have compensating factors.

For example, Fannie Mae generally allows DTIs as high as 45%, but up to 50% if you have lots of liquid reserves, or a strong credit history.

A good way to look at this is that you can get away with a low credit score, but you might be locked out entirely if you’re DTI is too high.

DTIs and Credit Scores Are Within Your Control

While some might throw their hands up and say it’s not fair, or that these things are outside their control, it’s simply not true.

Both of these variables are within your control. Whether it’s paying bills on time or limiting your outstanding credit balances.

What’s also interesting is DTIs and credit scores go hand-in-hand as well.

Someone with more outstanding revolving debt will likely have a lower credit score, all else equal.

But you’re more likely to get denied outright if you have a high DTI than you are a low credit score.

What this means is you should pay close attention to your monthly liabilities when determining how much you can afford.

Two borrowers with the same amount of income aren’t necessarily created equal if they have different amounts of outstanding debt.

For example, a borrower with a $600 car lease payment versus a borrower with a paid off vehicle.

If you have $600 less per month available for a mortgage, it will lead to a higher DTI ratio.

As noted, this can also have the unintended consequence of lowering your credit score as well.

In a nutshell, the credit bureaus will view you as more risky if you have more outstanding revolving debt (or installment debt for that matter).

A best-case scenario for a mortgage applicant would be having little to no revolving debt.

This would mean all or most of their monthly income could go towards the home loan obligation instead.

And this would lead to a lower DTI ratio, which would boost their approval odds.

The beauty of this is these things are intertwined so if you do well to limit debt, you can also enjoy a higher credit score.

So if you’re a perspective home buyer, or someone looking to refinance an existing mortgage, paying close attention to your DTI can help your credit score as well.

Two Borrower’s Incomes Might Not Be Created Equal

This also explains why it’s difficult to provide a universal answer when people ask how much house can I afford?

As noted, two people at the same exact income level will be able to afford different loan amounts based on their other, non-housing related debt.

Your DTI ratio is actually two numbers, a front-end ratio for your proposed housing payment, and a back-end ratio that includes all monthly debts.

If you’re able to keep all the other stuff low, whether it’s an auto loan or credit card debt, you’ll have more income available for your mortgage.

Bringing it all together, less debt typically results in a higher credit score, which in turn results in a lower interest rate on your mortgage.

And by definition, that gives you a lower housing payment, which would further lower your DTI. You see how it’s all connected?

So the two biggest things to pay attention to if you want to qualify a mortgage are your DTI and your credit score. But your DTI can dictate your credit scores, meaning putting even more emphasis on that.

Aside from saving for a down payment, you should also pay down any other outstanding debt to increase your home purchasing power (if necessary).

Doing so should increase your odds of getting approved for a home loan.

While there are many other reasons you can get declined for a mortgage, these are the leading causes and they should be your focus.

Keeping a close eye on these issues will ideally help you avoid any unwanted surprises once you do apply.

(photo: Joel Kramer)