Not all mortgage rates are created equal.

Why? Because lenders don’t price them the same for any number of reasons, whether it’s cost to originate or desire to make more profit.

Just like when you buy a new TV or a car, the price might vary depending on the company or salesperson you deal with.

The thing with a mortgage though is what you pay today could stick with you for the next 360 months.

So putting in the time to get it right is more important than those other purchases.

Home Buyers Will Overpay Their Mortgages by $11 Billion This Year

A new study from mortgage lender Tomo argued that home buyers will overpay by a whopping $11 billion in 2025.

Or put differently, seven out of 10 home buyers will pay an extra $4,500 (split between a higher rate and more fees) simply because they chose the more expensive lender.

This is due in large part to rate disparity, an issue I’ve talked about in the past. Essentially, mortgage rates vary by lender, despite home loans mostly being a commodity.

Even though two or three lenders can offer the same exact 30-year fixed product, its interest rate might differ tremendously, as can the loan origination fee.

The only real difference is the service you receive during the 30 to 45 days it takes to close the loan.

After that, there is no difference assuming it’s the same exact product. So you need to choose wisely, and most importantly, compare options.

Problem is, most borrowers typically only speak to one lender, gather one quote, and proceed with that lender.

In the process, they leave a lot of money on the table, as suggested by Tomo.

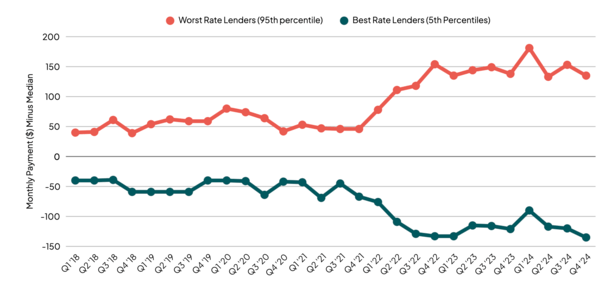

Lately, this phenomenon has gotten worse, with mortgage rate disparity widening among lenders (it often does in volatile periods).

For example, choosing the high-priced lender could cost you nearly $300 extra per month ($287) for the same exact loan.

Back in 2018, making this mistake would only cost you about $80, so it’s more important than ever to get it right.

How Efficient Is Your Mortgage Lender?

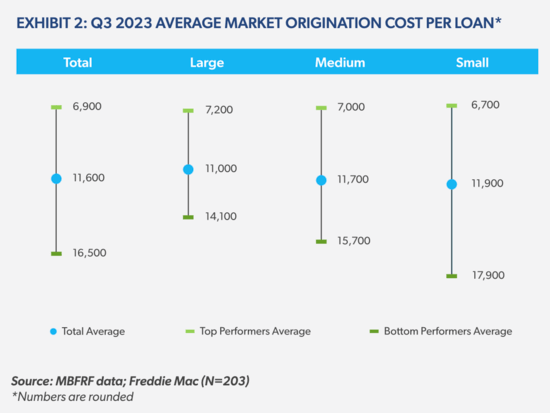

Part of this might have to do with how efficient a lender is, with costs to originate often passed along to consumers.

Despite new technologies designed to make mortgage lending quicker and easier, somehow the cost to originate has gone up 35% over the past few years.

Find a lender that spends less to make loans and you can benefit by receiving a lower rate and/or be subject to fewer lender fees.

The chart above from Freddie Mac’s 2024 Cost to Originate Study reveals that costs to make a loan can vary by $10,000 between lenders.

If you work with an efficient one you’ll probably be able to save some money because the margins will be better.

For its part, Tomo Mortgage gives its loan officers flat-fee commissions to ensure there isn’t any steering or different treatment based on loan amount size.

In the past, Better Mortgage didn’t have commissioned loan officers at all, or lender fees, but has since shifted to a more traditional commission-based model.

The Many Ways Mortgage Lenders Sell Higher Mortgage Rates

Tomo laid out four ways mortgage lenders are able to “sell” higher mortgage rates.

One is via point traps, where the advertised rate might be much lower than the competition, but requires a ton of discount points to buy down the rate.

When you pay points at closing, you are essentially paying prepaid interest for a lower monthly payment over time.

But you have to keep the loan long enough to realize the savings, which could take years. And you could miss out on a refinance opportunity in the process if you’re inclined to hang onto the existing rate.

With mortgage rates so volatile, sometimes it’s better not to pay a ton in points as you might be able to snag an even better rate in the near-future.

Be sure to keep a close eye on any points required for the advertised rate to get an apples-to-apples comparison.

Another issue is the “free refi” pitch, which I’ve written about in the past. Use the lender today and you’ll get a refinance without fees when rates drop.

Problem with this is their rate might be higher than competitors, and rates may not actually come down. So you could pay more to that lender today for a deal that never materializes.

Then there is undercounting the cash to close, which can be accomplished by not including the cost of title insurance, or discounting how many months of taxes and insurance you must pay at closing.

It directs the borrower’s eyeballs to a different part of the Loan Estimate to make it appear that they’re the better deal.

Lastly, they call out “standard” fees that perhaps shouldn’t even be charged, whether it’s a admin fee, processing or underwriting fee, doc prep fee, along with a loan origination fee.

Not all lenders charge some or any of these fees, while also offering a competitive or lower rate.

The Solution Is Typically Just to Shop More

I’ve talked about this before, on countless occasions. If you want to outsmart the lenders who try to charge you more, simply shop around.

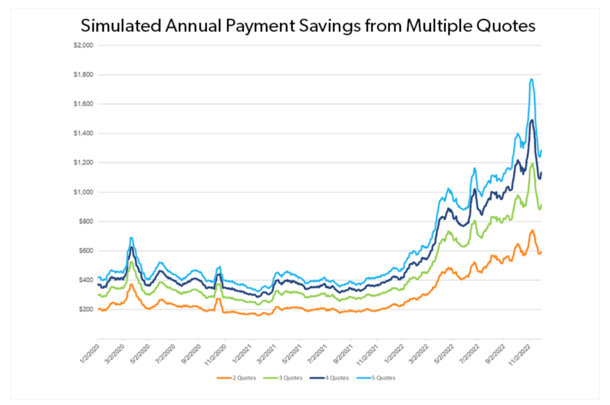

Several studies, including one from Freddie Mac, revealed that simply gathering an extra quote could save you $600 annually. And even more with three quotes, four quotes, and so on.

This benefit of shopping has increased over time as rate dispersion has widened, with lenders today offering a larger range of mortgage rates.

In addition, when you do put in the time to shop, you’ll also get the benefit of learning the mortgage lingo, seeing more Loan Estimates, fee breakdowns, etc.

And you should grow more comfortable dealing with loan officers and mortgage brokers.

This should give you the confidence to negotiate your mortgage rate, which is another key piece of the equation.

Tomo points out that anything in Section A of the Loan Estimate is fair game. This section covers origination charges, which can vary widely by bank or lender.

Of course, sometimes these fees can offset by a lender credit, and still result in a low mortgage rate for you.

So you have to look at how much cash is actually coming out of your pocket at closing and what interest rate you wind up with.

A combo that results in the lowest interest rate and out-of-pocket fees is the most desirable. Just make sure the lender doesn’t tack on the fees to your loan amount in the process!