Enjoy complimentary access to top ideas and insights — selected by our editors.

Frank Gargano

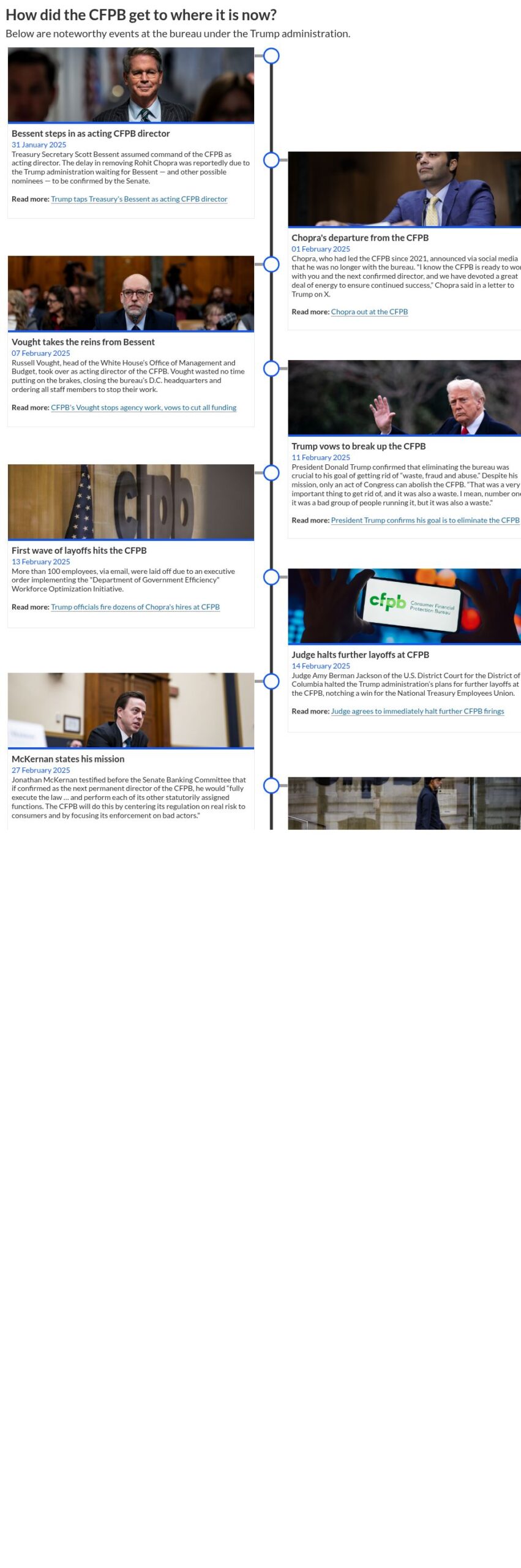

The Consumer Financial Protection Bureau has been in a freefall since former Director Rohit Chopra was ousted in February, kickstarting a game of musical chairs at the top of the agency and beginning the current campaign to defang the regulator. More change is on the horizon, for the better and the worse.

President Donald Trump has remained unabashedly honest while in office that his mission is to dismantle the CFPB, which he said “was set up to destroy people” and was used by its architect Sen. Elizabeth Warren, D-Mass., “as her personal agency to go around and destroy people.”

That campaign seems to have made significant progress since the beginning of the year, as Treasury Secretary Scott Bessent and Office of Management and Budget head Russell Vought have overseen massive on again, off again layoffs and the rollback of many Biden-era policies.

This month alone, the bureau has unwound enforcement and supervision of the small business loan data rule named after section 1071 of the Dodd-Frank Act, overturned the rule that would have capped overdraft fees at $5 and rescinded roughly 70 guidance documents as per the new deregulatory attitude.

“Our policy has changed,” Vought wrote in the document outlining the changes on May 9. “Historically, the bureau has released guidance without adequate regard for whether it would increase or decrease compliance burdens and costs.”

Enforcement has all but ceased at the bureau as well, as the CFPB dismisses cases against Reliant Holdings, Comerica Bank and others.

Read more: Trump’s CFPB has dropped half of all pending litigation

Below is a timeline of CFPB events that have happened since Trump returned to the White House.