Fed chair Jerome Powell has had no shortage of critics, not least being President Donald Trump.

A month ago, there were even rumblings of Trump looking to oust Powell because he was “too late” on rate cuts.

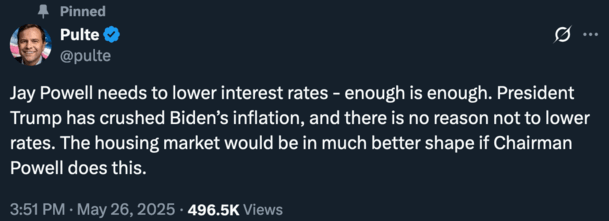

Now FHFA director Bill Pulte has joined in, saying enough was enough and that “Jay Powell needs to lower interest rates.”

He argued that doing so would help the housing market and that’s there’s reason not to with inflation apparently behind us.

The question is would it actually help mortgage rates, or would bond traders balk at a pressured rate cut?

Pulte Asks for a Fed Rate Cut to Boost the Housing Market

First a very brief background. The Federal Reserve does not set mortgage rates, it merely can influence long-term interest rates by setting monetary policy.

Even then, one could argue that the Fed simply makes policy moves based on underlying economic data, so it’s really the data that sets their policy.

And at the same time, bond traders make moves based on the data too, so the 10-year bond yield will rise and fall based on what the data says.

If the data shows inflation cooling, bond yields will fall and mortgage rates will too.

If the data shows inflation heating up, bond yields and mortgage rates will rise.

Demanding the Fed lower its federal funds rate wouldn’t do anything to help lower mortgage rates if the data didn’t warrant the move.

Instead, you’d likely see yields (interest rates) go up or simply stand pat based on the economic data.

Of course, Pulte tweeted that “President Trump has crushed Biden’s inflation, and there is no reason not to lower rates.”

If that were true, the Fed likely would have cut at its last meeting in May and would likely be cutting again in June.

Instead, there is a 97.8% chance of no change at the June meeting, per CME, and a 77.6% chance of nothing changing at the July meeting.

Ironically, the Fed could be holding off because of the uncertainty created by the Trump administration in its first four months in office.

But Economic Uncertainty Means Mortgage Rates Are Stuck

Despite economic data showing signs of cooling, which arguably could warrant a rate cut, the Fed is essentially handcuffed by the unknowns surrounding the tariffs and global trade war.

In their latest policy statement, the Fed said, “Uncertainty about the economic outlook has increased further.”

That stood out as one of the biggest changes to their typically benign FOMC statement.

They added that “the risks of higher unemployment and higher inflation have risen.”

In other words, the Fed acknowledged a heightened sense of uncertainty that could lead to another increase in inflation (and also higher unemployment).

This makes it tricky for the Fed to make any sudden moves if they’re unsure how the tariffs will affect the economic data.

If you haven’t been paying attention, President Trump seems to change his mind every week about tariffs.

The latest flip-flop was a proposed 50% European Union tariff, which was then rolled back to allow for negotiations.

How is the Fed able to make definitive policy decisions when they wake up to headlines like that?

The answer is they’re not, and it’s not personal or political but rather just data-driven.

Ultimately, not knowing what policies will be in force makes it even more difficult to make predictions about the economic trajectory.

It’s already hard enough, and now we’ve got the tariff threats happening each week, several of which are now delayed with future unknown.

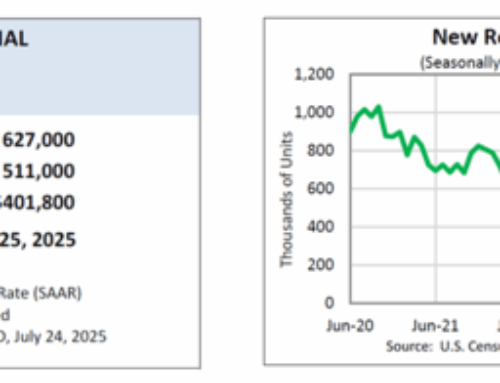

As such, the 30-year fixed mortgage remains stuck around 7%, at a crucially important time no less, the spring home buying season.

The Fed Can’t Cut Rates with So Many Unknowns

Bringing it all together, it’s essentially impossible for the Fed to cut rates right now, and might explain why the next cut has been pushed back to September or later.

Even if the Fed cuts, the only direct impact is to home equity lines of credit (HELOCs), which use the prime rate as a benchmark.

Mortgage rates are long-term interest rates, unlike the Fed’s short-term rates and prime, which is also a short-term rate.

So the bond traders and mortgage-backed securities (MBS) traders will be the ones who ultimately set mortgage rates.

If they see cooling inflation and rising unemployment, investors may make a risk-off trade, or flight to safety, and leave stocks while flocking to bonds.

If bonds see more demand, their price goes up and their yield (interest rate falls). That helps mortgage rates move lower.

And that’s basically the only way mortgage rates will move lower. The good news is this is expected to happen later on in the year, as inflation has significantly cooled.

But there are some near-term headwinds including the tariffs, which could drive up inflation, and the big, beautiful bill, which could increase bond issuance and lead to lower prices (too much supply).

Again, these are policy decisions driven by the current administration, and without them, one could argue that bond yields may have already been lower.

And a Fed rate cut may have already transpired, likely after mortgage rates made a move lower.

Read on: Is the Magic Number for Mortgage Rates Now Anything Close to 6%?