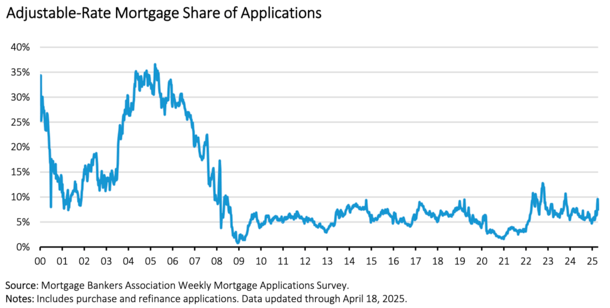

Long out of favor, adjustable-rate mortgages are quietly making a comeback.

To be fair, they are still pretty fringe, but the 30-year fixed is beginning to lose market share again.

At last glance, the ARM-share of mortgage applications was 7.5%, per the Mortgage Bankers Association (MBA).

This is still pretty low, but it has been on the rise over the past year – it was 6.4% a year ago.

Of course, back during the early 2000s it hovered between 25% to 35% at one point!

UWM Launches a 5/1 ARM for FHA and VA Loans

The nation’s largest mortgage lender by loan volume, United Wholesale Mortgage, announced the arrival of new adjustable-rate mortgage (ARM) products this week.

The offering includes a 5/1 ARM for both FHA loans and VA loans, both of which have seen their market share rise in recent months.

In fact, government purchase loan applications have risen about 40% year-over-year, per the MBA, possibly due to more lenient debt-to-income ratio (DTI) requirements.

Or maybe because mortgage rates on government-backed loans tend to be cheaper than conforming loans backed by Fannie Mae and Freddie Mac.

Now home buyers who work with a mortgage broker (who works with UWM) will be able to get their hands on an ARM.

As noted, it’s just one variety, which comes with a fixed interest rate for the first five years of the loan term.

After those five years are up, it becomes annually adjustable for the remaining 25 years. Like the 30-year fixed, it is also a 30-year loan.

The key difference is the interest rate is only fixed for the first 60 months.

This will require the homeowner to make a decision, whether it’s refinancing the mortgage, selling the property, or letting the ARM adjust, potentially higher.

Why Adjustable-Rate Mortgages Now?

So the obvious question here is why is UWM rolling out ARMs now? What changed? Why didn’t they have them before?

Well, for much of the past decade and change, it was a no-brainer to take out a fixed-rate mortgage. Why wouldn’t a homeowner choose a 30-year fixed with an interest rate between 2-4%?

Or perhaps a 15-year fixed mortgage with an even lower rate?

The answer is they wouldn’t unless they were super wealthy and got a sweetheart deal at a bank like the now-defunct First Republic.

But since early-2022, mortgage rates began rising, and fast. Today, they are no longer on sale, even if they remain below their long-term average of 7.75%.

So it makes perfect sense to offer additional options that could save home buyers money.

And it highlights the shift away from the 30-year fixed being the be all, end all home loan option.

Simply put, this new product allows mortgage brokers to offer lower mortgage rates and monthly payments to their customers versus comparable fixed-rate mortgages.

It also allows them to refinance these very loans in the near future if rates comes down!

Coming to Terms with Higher-for-Longer Rates

It also makes you wonder if UWM sees a higher-for-longer scenario for mortgage rates. As such, they might be moving away from temporary rate buydowns and giving borrowers more time.

Temp buydowns only last 1-3 years, before the payment goes up. These ARMs give borrowers five full years to hope for something better.

So perhaps it is a sign of the times, that the buy now, refinance later thing didn’t work, and now you’ve got to hunker down for the long-haul.

For the record, qualifying is easier on adjustable FHA and VA loans because you can generally use the initial start rate, whereas conforming loans require the start rate plus 2% for 5/1 ARMs.

For example, if the 5/1 ARM rate were 6%, the borrower would need to qualify at 8%, per Fannie Mae. That makes them a lot tougher to qualify for.

So there you have it. Perhaps folks are coming around to the idea that ARMs aren’t so bad.

They were certainly bad news in the early 2000s, but those ARMs were riddled with other problems, whether it was prepayment penalties, stated and no doc underwriting, or even negative amortization.

A 5/1 ARM is pretty innocuous in comparison, though risks do remain.

So if you’re considering an ARM, know what you’re getting into and formulate a plan for the first adjustment, which could be higher.

Read on: ARM versus Fixed-Rate Mortgage Pros and Cons

(photo: Elvert Barnes)