Mortgage rates came down after a softer-than-expected CPI print.

But only a little bit. Instead of a 30-year fixed quote of 7%, you might see 6.875% instead.

It’s not a big difference, but it does provide some savings as buyers grapple with poor affordability.

Problem is rates continue to stay in a range and can’t break meaningfully lower with so many unknowns still unresolved.

Weak data is great for rates, but can only do so much when tariff impact is yet to be seen.

CPI Cools, Pushing Mortgage Rates Back Away from 7%

The much anticipated CPI report came in favorably for mortgage rates yesterday.

Prices rose just 0.1% in May, per the Bureau of Labor Statistics (BLS), down from 0.2% in April.

The monthly tally also beat the 0.2% forecast.

At the same time, prices climbed 2.4% annually, which was in line with expectations.

Core CPI, which strips out food and energy, beat expectations both by month and by year.

That led to a bit of a bond rally, with the 10-year yield falling about six basis points to 4.41%.

It was enough to push mortgage rates down to around 6.875% from closer to 7%.

Certainly good news for prospective home buyers after a hot jobs report last Friday.

But not enough to make a huge impact. For your typical homeowner it’s a negligible difference in monthly payment.

The issue at hand is tariffs, which have yet to be resolved or reflected in the consumer price data.

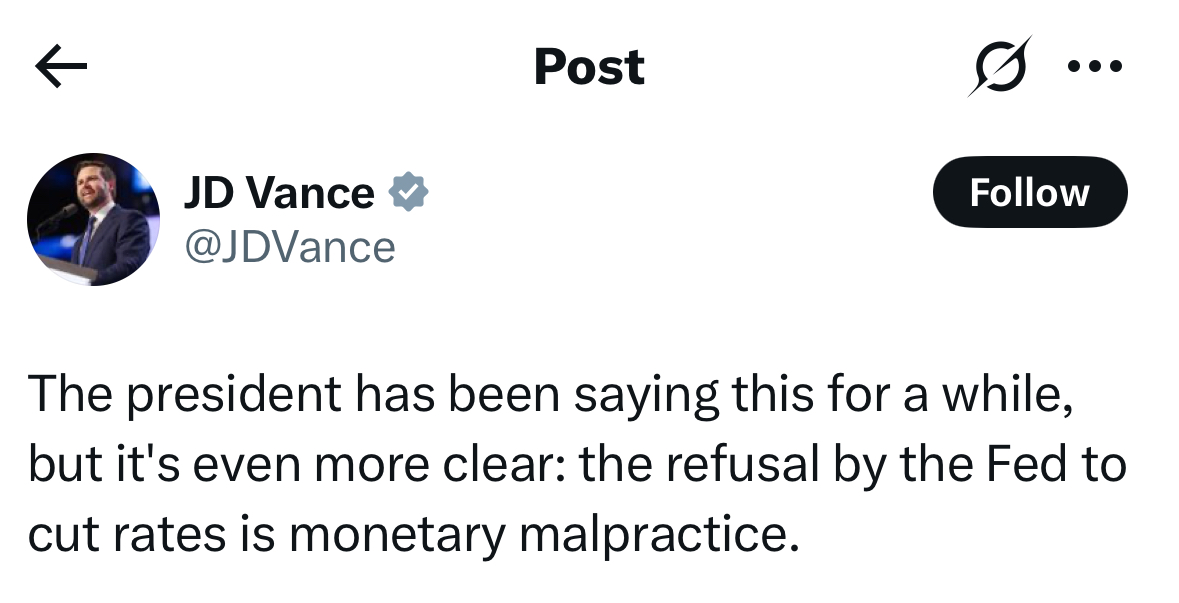

VP Vance Calls for Interest Rate Cuts

Meanwhile, Vice President J.D. Vance joined Trump and others in calling for rate cuts.

On X, he said, “The refusal by the Fed to cut rates is monetary malpractice.”

Problem is, how can they with an ongoing trade war that has yet to be resolved?

Arguably, if the tariffs were never introduced, the Fed may have cut by now.

Or would be at the next meeting. Instead, they have pushed back more and more due to uncertainty.

What began as three rate cuts this year is now maybe none.

And the irony in asking for rate cuts is that they wouldn’t need to ask if not for their own policy.

The Fed’s hands are tied because even if inflation is lower, it might rise again due to the tariffs.

So asking for rate cuts after potentially exacerbating inflation is like saying you’re going on a diet (but doing the opposite) then asking for dessert.

Crude analogy, but the best I could come up with.

End of the day, the Fed would lower rates if it could, but it can’t because of tariff unknowns.

In addition, the Fed doesn’t even control mortgage rates, so it wouldn’t necessarily help anyway.