While President Trump and FHFA Director Pulte continue to call for lower rates, mortgage rates have quietly marched down to their 2025 lows.

It’s kind of funny to see it play out because they’ve been barking up the wrong tree, yet still seeing desired results.

That wrong tree is Fed Chair Powell, who along with the other Fed members does not set consumer mortgage rates.

Despite that, it seems that almost daily he’s lambasted for waiting to cut rates, which makes you wonder if it’s a more elaborate move to cast blame if things go sideways.

In any event, the 30-year fixed is now near its best levels of 2025, and could get even better.

The 30-Year Fixed Mortgage Is Inching Back Toward 6.50%

Sure, 6.50% didn’t sound too hot back in 2022 when the 30-year fixed was still in the 3-4% range, but what a difference a few years make.

This is the beauty of the human mind, which makes adjustments after being exposed to changing conditions.

With regard to mortgage rates, once you see 8%, 6-something doesn’t sound half bad anymore.

You might forget (to be fair, not completely) where mortgage rates used to be, and just be happy they aren’t as bad as they were.

For reference, the 30-year fixed ascended past 8% in October 2023, before beginning to enter a falling rate trajectory. Albeit one with ups and downs along the way.

Now mortgage rates are just about at their lows for the year, 6.67% at last glance, the only exception being a couple days in early April when the trade war had rates dipping to 6.60%.

But that was very short-lived, and most probably missed it anyway. So for all intents and purposes, this is pretty much the bottom for rates in 2025 thus far, at least per MND’s daily rate.

In fact, we’re kind of back to October 2024, and if we keep moving in the right direction, we could get back to September 2024 when rates neared 6%.

That seemed to get things cooking again, so you have to wonder if it’ll recharge the flagging housing market if we get there once more.

Watch Out for the Jobs Report on Thursday!

While there’s hope mortgage rates could continue to inch lower this week, we’ll need a cool jobs report on Thursday to keep the momentum going.

The jobs report tends to be the most important data point when it comes to mortgage rates, especially today with all eyes now on labor instead of inflation.

Sure, inflation is still a concern, especially with all the unknowns related to tariffs, but jobs have taken center stage as bond traders fret about the health of the economy.

Forecasts are calling for a pretty weak jobs report as is, with just 110,000 new jobs created in June, down from 139,000 a month earlier.

The unemployment rate is also expected to climb to 4.3% from 4.2%, while wage growth is expected to slow.

Assuming that all happens, mortgage rates could break even lower, though if jobs data is unexpectedly hot, the opposite could happen. So watch out!

Either way, I expect a lot of rhetoric from Trump and perhaps Pulte on mortgage rates being too high, and for the Fed to keep cutting.

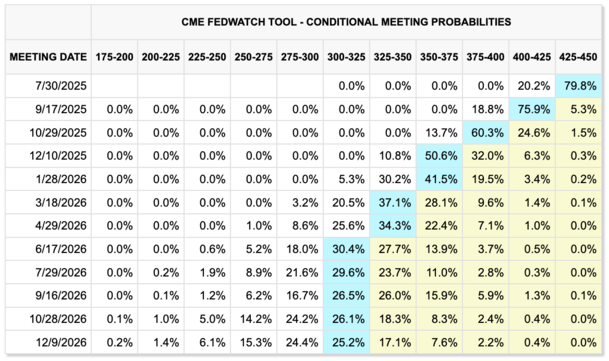

Three Fed Rate Cuts in 2025 Back on the Table?

Interestingly, the odds of the Fed cutting are rising by the day, and we somehow might be back to three cuts for 2025, assuming the CME forecast pans out.

Just remember that the Fed cuts don’t translate to mortgage rate cuts. The two are loosely correlated.

But if the Fed is cutting, chances are the 10-year bond yield will also be dropping beforehand and so too will mortgage rates.

And we might even see some of those more aggressive 2025 mortgage rate forecasts (including my own) come to fruition.

I’ve been saying for a while that there was still plenty of year left, despite many others throwing in the towel on mortgage rates for 2025.

So hang in there and perhaps things will turn out better than expected.

Read on: Is the Magic Number for Mortgage Rates Now Anything Close to 6%?