Another big tie-up has been announced in the mortgage space, this time between the nation’s top mortgage lender and a credit card company.

Bilt announced that is raised another $250 million at a mouthwatering $10.75B valuation, with United Wholesale Mortgage (UWM) investing $100M.

That’s a pretty big chunk of money, which appears to be tied to mortgage expansion plans at Bilt.

One of those plans seems to be allowing homeowners to pay the mortgage with a credit card, or at least via the Bilt network.

And chances are UWM will look to tap into their big renter customer base to turn those folks into future homeowners.

Bilt Card 2.0 Arrives in February 2026, Will You Be Able to Pay the Mortgage with It?

As part of the announcement, the company said the Bilt Card 2.0 will launch in February of next year.

It actually comes in three flavors and is being developed by a company called Cardless, which was behind the new American Express Coinbase card.

The lineup will include a no annual fee option, along with two premium versions of the card with a $95 and $495 annual fee.

Bilt will also move away from Wells Fargo as the card issuer as a result of this change, and details regarding the new issuing partner will be announced in early fall.

While it’s unclear what each version will offer, one thing they did say is there will be “enhanced rewards including points on both rent and mortgage.”

So it sounds like you’ll soon earn Bilt points for paying the mortgage with their credit card, though perhaps not on the annual fee-free version?

Of course, how it works remains to be seen. If you recall, their competitor Mesa also lets you earn points on the mortgage each month.

But it’s a unique setup where you don’t actually pay your loan servicer via credit card.

Instead, Mesa verifies your mortgage payment amount via linked bank account and gives you a point per dollar each month, assuming you spend a minimum of $1,000 in non-mortgage spend during that billing cycle.

Perhaps Bilt will be arranged the same way. I can’t imagine them allowing you to pay the mortgage lender directly, so chances are it will.

The question, other than any annual fee, is what the minimum spend will be, assuming it’s like Mesa.

Exciting nonetheless to get another option to pay the mortgage with a credit card (in a roundabout sort of way).

UWM Rewards Program Coming Soon?

Other than the new Bilt cards in development, UWM announced a $100 million investment in Bilt.

That’s a lot of money so I expect some big things to come of this partnership. And it doesn’t surprise me too much because their main rival Rocket Mortgage has been pretty busy lately.

They just closed on their acquisition of Redfin and they expect to close on their acquisition of Mr. Cooper soon as well.

If UWM wants to stay the #1 mortgage lender in America, they better start ramping up the partnerships as well.

The tricky part with UWM is they’re a wholesale lender, meaning they work solely with mortgage brokers, not the public.

However, UWM CEO Mat Ishbia hinted that there could be some sort of rewards program for UWM customers in the works, similar to Rocket Rewards.

He said, “Bilt’s platform will drive tremendous value for our brokers by delivering a better servicing experience and everyday rewards that create loyalty, while also creating a new pipeline of origination for our broker network.”

Again, it’s unclear exactly what this means, but it sounds like a loyalty program for UWM customers, and perhaps a referral system as well.

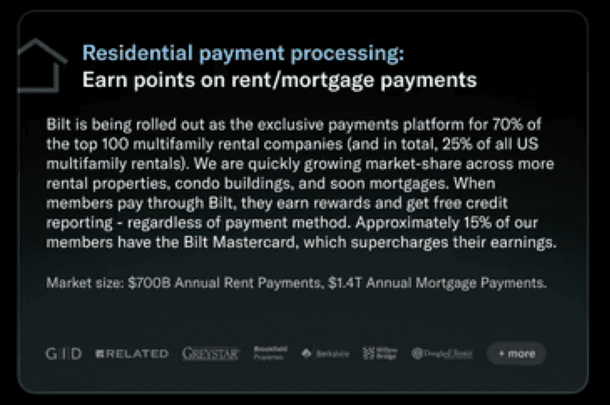

For example, Bilt users who are renters (that’s their main product, you earn points back on rent) could be thrust into the mortgage ecosystem via a UWM connection.

So a renter on Bilt looking to buy a house might get paired up with a local mortgage broker who happens to be approved to work with UWM.

That seems evident in Ishbia’s note about “creating a new pipeline” for its broker network.

As for the servicing side, that could include earning Bilt points when refinancing the mortgage via a partner such as UWM.

It’d be another way for UWM to recapture business, similar to how Rocket will mine the Mr. Cooper servicing portfolio for repeat business.

Bilt already gives users the ability to earn points when purchasing a home through an eXp Realty agent. And you can use Bilt points to make a down payment on a home.

The mortgage piece would bring renters and homeowners together and allow Bilt to have a hand in the entire home buying journey.

Ishbia would surely want to be involved in that, knowing his competitors are doing the same.

And a referral/loyalty program would be a big win for the wholesale lender to reach a little further into the retail side while staying B2B.