While adjustable-rate mortgages are mostly a thing of the past, homeowners are still receiving notices about monthly payment increases.

But how is this possible if your typical homeowner has a 30-year fixed-rate mortgage?

A 30-year fixed-rate mortgage means the payment never changes for the entire 30 years.

However, that’s just the principal and interest portion of the payment. There’s also the T&I, or taxes and insurance to consider.

If your loan is impounded, which many are, you might receive a notice about a mortgage payment increase, even if your mortgage rate is fixed!

Why Did My Fixed-Rate Mortgage Payment Go Up?

The most obvious reason why would be related to an increase in property taxes or homeowners insurance.

As noted, the monthly mortgage payment consists of four components: principal, interest, taxes, and insurance.

Breaking that down, you’ve got the principal (what you borrowed), the interest on that amount borrowed, property taxes, and homeowners insurance.

Many loans have impound accounts, meaning the mortgage loan servicer collects a portion of these costs each month with the principal and interest.

Then when it comes time to pay your insurance company or the tax assessor, the servicer does so on your behalf.

It’s actually pretty handy because you won’t be hit with a big tax bill or insurance premium out of the blue.

Instead, money will be withdrawn each month with your regular mortgage payment, potentially lessening the blow.

After all, would you rather pay $5,000 in a oner, or $417 per month? Sure, some people like full control of their money, and I get that.

But impounds are handy because aside from lessening the blow, they also mean you can’t (as easily) spend above your means.

The money is taken each month, so it puts you on a budget you might not otherwise adhere to if you only have to pay these things once or twice a year.

Also, some states pay interest on the escrowed funds anyway, so you won’t necessarily miss out if the funds are held ahead of time.

The Escrow Shortage Is Becoming More Common These Days

With inflation still a thing, and potentially getting worse again, the escrow shortage is becoming more and more common.

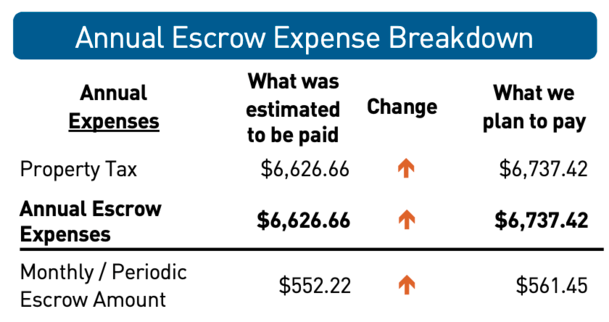

That impound account is funded based on estimates for taxes and insurance. As both rise, potentially more so than in the past, the estimates might fall short.

If and when they do, your loan servicer will let you know and request that you make a shortage payment each month to cover the difference.

On top of that, they’ll also review your escrow account annually to ensure there are sufficient funds to pay your property taxes and insurance premiums.

Assuming their estimates were previously lower, you’ll be on the hook for a higher escrow payment each month as well.

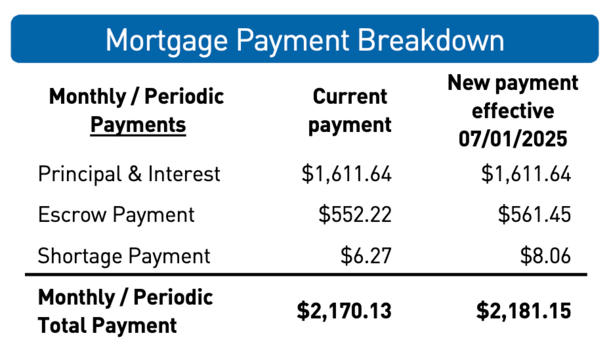

Taken together, you’ll see your monthly mortgage payment rise compared to the prior period, even if you have a fixed-rate mortgage.

And you can expect this to continue rising over time as inflation further erodes the value of the dollar.

Though the bright side is your property value should also be increasing as well, and the payment effectively gets cheaper with inflation.

The other good news is you can spread any shortage over 12 months interest-free and this is done automatically on your behalf.

You can call the servicer and pay the shortage as well if you want keep your monthly payment lower.

Note that in the screenshot above the difference in payment was pretty negligible, but only because this particular loan only has property taxes impounded.

If you have both homeowners insurance and taxes impounded, which is more common, you might see a much more sizable difference in escrow payment and escrow shortage.

Perhaps enough to have you on the phone with the bank asking what’s going on.

Long story short, your mortgage payment can go up even if you have a fixed-rate mortgage! Be warned!

Read on: 4 Ways Mortgage Payments Can Increase