Well, summer is officially over and it is now September. And we’ve got a Federal Reserve meeting coming up in two weeks!

It’s potentially a big one because of all the pressure exerted on the Fed lately from the Trump administration to lower rates.

He has asked Powell to resign and more recently “fired” Fed governor Lisa Cook for occupancy fraud.

At the same time, there’s a new statistician in charge of the monthly labor report, which could drive a Fed decision.

So will an expected Fed rate cut on September 17th lower mortgage rates?

Mortgage Rates Went Up Last Time the Fed Cut

Fresh in everyone’s minds is the fact that mortgage rates went up the last time the Fed cut.

Or at least that’s how the story goes without any context. People love to say this.

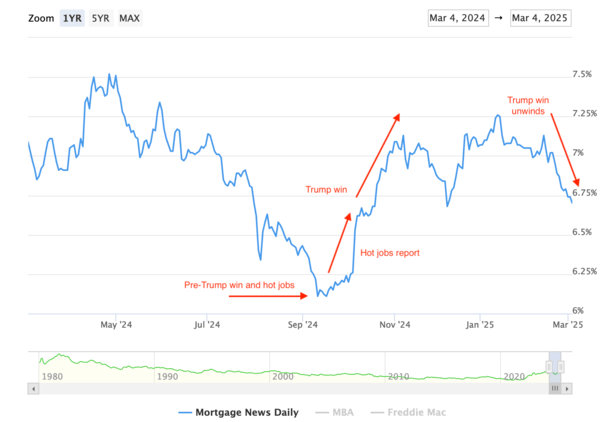

Yes, 30-year fixed mortgage rates rose when the Fed made its first cut last September after raising rates 11 times in a row.

But what did mortgage rates do prior to that cut? Well, I should remind everyone that mortgage rates were at a ~19-month low when that much-anticipated cut was finally announced.

The 30-year fixed had fallen from a high of just over 8% in October 2023 to just above 6% less than a year later.

That’s quite the move for mortgage rates in a such a short span of time, only really matched by the extraordinary ascent that preceded it.

Then if we take the time to consider that Fed policy moves are largely telegraphed ahead of time, it’s not at all surprising that rates bounced a touch.

What really made them go up though had nothing to do with the Fed or its cut. It had to do with an awkwardly timed jobs report that came in super-hot.

The jobs report is what reversed the trend for mortgage rates, not the Fed cut.

This was followed by a Trump presidential victory, which pushed up rates even further.

So What Will Happen This Time?

- Mortgage rates were at a ~19-month low when the Fed cut a year ago

- They bounced a little on the news but mainly went up because of a hot jobs report shortly after

- What happens this time will depend on the data that is released prior to and after the report

- Always follow the data since the Fed follows the data too!

It feels a little like déjà vu given it’s the same month where we could see a Fed rate cut.

We got one last September, and now it’s the upcoming September meeting that could bring another.

For the record, there were also two cuts in November and December last year, but there’s been a gap ever since because labor and inflation (and tariffs) and other unknowns gave the Fed pause. Literally.

Then we got that really bad jobs report for July and the Fed quickly changed their tune to a more dovish stance once more.

However, it’s the same deal this time. The 30-year fixed is now around 6.50%, its lowest point since around last October, before the hot jobs report.

Ironically, it’s basically at the same level it was right after that jobs report came out for September 2024.

That’s what pushed the 30-year fixed up to 6.50% from 6.25%. Not the Fed rate cut at the time.

The same thing could happen this time if a hot jobs report or CPI report were to be released shortly after they cut, assuming they cut on September 17th.

Granted, more cool data released around the same time could push mortgage rates down even further and make the Fed cut appear to be the reason why.

And that’s exactly what I’m trying to illustrate here. It’s not the Fed, but the economic data that comes out every week or month.

The Fed only meets eight times per year, while mortgage rates can change daily.

In other words, the underlying data matters a lot more than the Fed, and it’s that very data that drives the Fed’s policy anyway.

So with the Fed you’re really just getting a reinforcement of the data, not a unique or opposing opinion on where things are going.

Read on: How are mortgage rates determined?