In a somewhat surprising move, mortgage financier Freddie Mac is upping maximum loan-to-value ratios on 2-4 unit primary residences.

The move comes amid a possible initial public offering for both Freddie Mac and Fannie Mae.

It’s unclear why the company is expanding eligibility for its mortgages, especially on multi-unit properties, but we’ll explore some possible reasons below.

Certainly interesting timing given the housing market’s struggles of late, with sky-high home prices and equally steep mortgage rates hindering affordability.

Perhaps this will lead to more home purchase demand while boosting market share for the company.

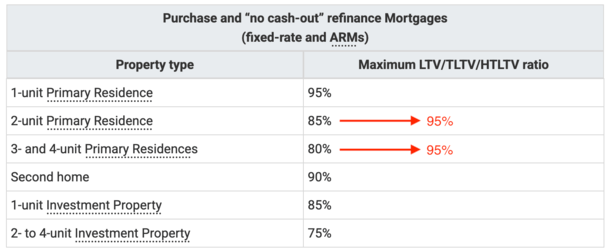

Max LTVs/CLTVs Upped to 95% for Multi-Unit Properties

As noted, you’ll soon be able to borrow up to 95% LTV on a 2-4 unit property with a loan backed by Freddie Mac.

This includes LTV/TLTV/HTLTV, which means you can get a second mortgage like a HELOC behind it up to 95% as well.

The jump is pretty significant. It’s currently a maximum of 85% for a 2-unit property and 80% for a 3-4 unit property.

So we’re talking an increase of 10% and 15%, respectively, at a time when home prices are already arguably too high.

Specifically, the new maximum LTVs apply to primary residences that are 2-4 units, meaning you must occupy one of the units, at least initially.

In addition, the mortgage must be either a home purchase loan or a rate and term refinance (known as a “no cash-out” refinance).

It does not apply to cash-out refinances, which remain at a more restrictive 75% for a 2-4 unit primary residence.

That’s a good thing given where we’re at in the housing cycle. We don’t want to go down the same path of allowing homeowners to get overextended again.

Whether this further exacerbates the lack of for-sale supply, or fills a need, remains to be seen.

But typically during times when home prices feel a bit frothy, you might see companies like Fannie Mae and Freddie Mac tighten their underwriting guidelines.

For the record, Fannie Mae already allowed 95% LTVs for 2-4 unit primary residences thanks to an October 2023 update, so this aligns guidelines between the pair.

At the time, Fannie said the move was to “expand access to credit and provide support for affordable rental housing.”

Why Are They Raising LTVs When Housing Affordability Is Already a Problem?

Given where the housing market stands today, with some drawing parallels to the GFC and mortgage crisis of the early 2000s, it’s a little strange.

Often lenders pull back when they’re concerned borrowers might be getting in over their heads.

Or if job security becomes more of a worry, this time thanks to emerging technology like AI and a possible recession.

For things to go the other way makes you wonder what they’re up to over at Freddie Mac.

Maybe they’ve been losing market share to non-agency lenders, specifically non-QM lenders.

This could be a way to drum up business, especially as they plan to go public at some point in the near future, and/or align guidelines with Fannie Mae if the two somehow merge.

At last glance, shares of Freddie Mac (OTCMKTS: FMCC) were trading at over $11 per share, up nearly 20% today and over 100% over the past six months.

It’s entirely possible that they’re expanding their product menu to compete with non-QM lenders and even FHA loans, which allow even higher LTVs up to 96.5% on 2-4 unit properties.

Given the popularity of so-called house hacking, where you live in one unit and rent the others, this makes sense.

The new guidelines go into effect on for mortgages with settlement dates on or after September 29th, 2025.

Note that the updated LTVs do not apply to manually underwritten mortgages or super conforming mortgages, the latter of which are reserved for borrower in high-cost markets.