President Trump has called on the big home builders to build more homes in a new social media post.

It’s no secret that housing affordability is terrible at the moment, and one of the reasons is a lack of available for-sale supply.

As we all know from economics 101, or simply daily life, the greater the supply of something, the lower the price.

So if the builders decided to build more homes, we’d arguably see asking prices fall, thereby improving affordability.

The problem is the home builders are already sitting on a supply glut and they’re for-profit companies.

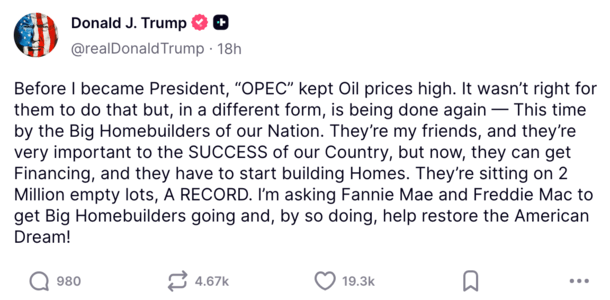

Trump Accuses Big Home Builders of Sitting on Empty Lots

While Trumps’ Truth Social post above might be well-intentioned (who doesn’t want a cheaper house to buy), it’s not necessarily feasible.

In his post, he compared the big home builders to OPEC, claiming the latter “kept Oil prices high.”

He added that “it wasn’t right for them to do that,” and said it was now “being done again.”

However, this apparent cartel is being committed “by the Big Homebuilders of our Nation” this time around, who he goes on to say are his friends.

The President pointed out that “they’re sitting on 2 Million empty lots,” which he claimed is a record, while simultaneously asking for Fannie Mae and Freddie Mac to get them building more.

It’s unclear what that plan to get them going might be, but you’d assume some sort of financing deal to make homeownership more attractive if it involves the GSEs.

Some sort of incentive for first-time home buyers to put the American Dream back within reach.

While it sounds good on the surface, it’s hard to blame the home builders for the current supply shortfall.

They’re already sitting on too many homes in the communities where they’ve built, which explains why they’re offering record incentives to their customers.

If they have to offer major incentives, including massive mortgage rate buydowns, to move inventory, it makes little sense to build more.

Exacerbating this is the cost of supplies to build homes thanks to tariffs, something the Trump administration implemented.

And perhaps the cost of labor, which has possibly been disrupted due to sweeping raids of illegal immigrants.

Poor Housing Affordability Has Already Led to a Supply Glut of Newly-Built Homes

Now let’s consider new home supply, which increased to 490,000 units as of the end of August 2025, per the Census Bureau.

While it was 1.4% below the July 2025 estimate of 497,000, it was 4% above the August 2024 estimate of 471,000.

And the only reason it’s not much higher is because of a surprise hot new home sales print last month.

That surprise print also pushed the supply of new homes for sale down to 7.4 months, which was below the 9.0 months in July and the August 2024 estimate of 8.2 months.

However, prior to this unexpected turn lower it was approaching 10 months of supply, which only happened in September 2022 when mortgage rates more than doubled.

And in 2008, when the mortgage crisis led to one of the worst housing downturns in history.

What’s more, economists don’t even seem to believe the August new homes report data, which is subject to big revisions.

It also seemed to conflict deeply with home builder sentiment, which has been quite poor, and industry chatter that has pointed to weak buyer activity.

Just consider a recent quote from Lennar’s Co-CEO Stuart Miller during their third quarter 2025 earnings release.

He said, “We believe that now is a good time to moderate our volume and allow the market to catch up.”

During the quarter, the company delivered 21,584 homes and recorded 23,004 new orders, but not without major concessions.

“Achieving these results required additional incentives, resulting in a reduced average sales price of $383,000, and our gross margin drifted down to 17.5%, while our SG&A expenses came in at 8.2%, reflecting the soft market conditions.”

Then there’s D.R. Horton, the nation’s top home builder, whose Executive Chairman David Auld said, “New home demand continues to be impacted by ongoing affordability constraints and cautious consumer sentiment.”

“We expect our sales incentives to remain elevated and increase further during the fourth quarter,

the extent to which will depend on the strength of demand during the remainder of summer, changes in mortgage interest rates and other market conditions.”

Buyer Demand Is Weak and New Homes Aren’t Located in the Right Places

In other words, the nation’s two largest home builders are saying the same thing. Buyer demand is weak due to a lack of affordability.

And the only way to move homes right now is to offer huge incentives to customers.

One major strategy lately has been the mortgage rate buydowns, which both builders employ via their captive mortgage lenders, Lennar Mortgage and DHI Mortgage, respectively.

Asking them to build even more homes and take a haircut on pricing just didn’t make sense.

Also, the places where they have land and build aren’t necessarily where we need more new homes.

Unfortunately, home builders often only build in the outskirts of major metros, where there’s already ample supply.

Building even more homes in faraway places won’t solve this housing crisis.

We need more existing home supply in places where families actually want to live. But much of it is off the market due to things like mortgage rate lock-in.

Perhaps incentivizing existing homeowners to sell is a better strategy than continuing to build where people don’t want to buy.

Read on: Should I buy a new home or a used home?