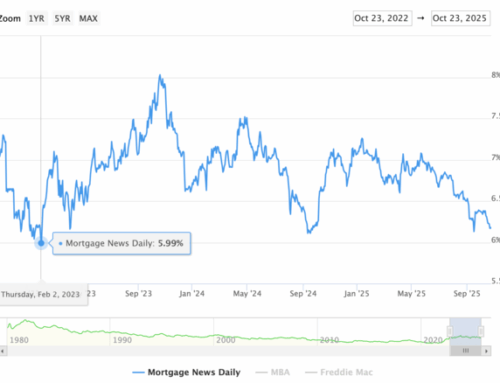

Limited economic data has economists expecting the Federal Reserve to maintain its rate-cutting posture, but other factors might be having a greater effect on mortgage lending, with the 30-year fixed rate mortgage interest rate average now at a 2025 low.

Even with the relatively flat movement of yields, which often sway the direction of mortgage rates, the 30-year fixed average dropped 8 basis points over the past week to 6.19%, according to Freddie Mac’s Primary Mortgage Market survey. One week earlier, the 30-year rate came in at 6.27%, while 12 months ago, it finished at 6.54%.

“Mortgage rates continued to trend down this week, hitting their lowest level in over a year,” said Freddie Mac Chief Economist Sam Khater in a press release. “At the start of 2025, the 30-year fixed-rate mortgage surpassed 7%, while today it hovers nearly a full percentage point lower.”

The 15-year average similarly trended downward, falling to an average of 5.44% compared to 5.52% one week earlier. In the same week of 2024, the mean 15-year fixed mortgage rate was 5.71%.

The now three-week-old government shutdown and other economic concerns continues to result in cautious market trading, with investors flocking to the bond market and leaving 10-year Treasurys near par with last week’s level. As of 11 a.m. Thursday, 10-year notes sat at 3.99%, up from 3.98% at closing on Oct. 22. Over the past seven days, yields bottomed out at 3.95%, the lowest in over a year, with current levels still below 4.15% posted on Sept. 30, the day before most federal activities ceased.

What influence does next week’s Federal Reserve meeting have?

Aside from the Treasury markets, many of the usual indicators that help mortgage lenders set their rates are now unavailable, providing little guidance in the near term.

As the release of key government economic data remains delayed during the latest shutdown, economists expect the Federal Reserve to cut rates for its second straight meeting next week as earlier predicted. Forecasts called for up to three slashes of the government short-term interest rate before the end of the year.

“Markets now see an October rate cut as near certainty, as alternative data point to a cooling labor market that was already losing momentum before the data blackout,” said Kara Ng, senior economist at Zillow Home Loans in a Wednesday evening research statement.

Economists and housing researchers will pay close attention, though, to the numbers in September’s Consumer Price Index, which was rescheduled to be issued on Friday, to gauge current sentiment. No matter what CPI delivers, the Fed is unlikely to deviate from what pre-shutdown expectations, agreed Chen Zhao, head of economic research at Redfin.

“It is expected that tariffs will continue to provide upward pressure on inflation while ‘trend inflation’ (inflation net of tariff effects) is expected to soften,” Zhao noted.

Whatever the central bank decides, it may have little immediate impact on mortgage rates. Prior forecasts of Fed rate cuts led investors to price in expectations well before the meetings, resulting in limited change once the decisions became official. A new study from Wallethub this week also found a majority of Americans thought a 25 basis point cut would bring little benefit to their own personal finances.

Economists have warned, though, that cutting federal interest rates too quickly could lead to an unwanted spike in inflation on top of existing concerns for the housing market.

“The combination of tariff-fueled price hikes on goods and uncertainty from the shutdown is weighing heavily on overall consumer confidence, making a commitment to a massive big-ticket item like a home purchase the primary area of financial restraint,” said Cotality Chief Economist Selma Hepp.

While the recent wave of rate drops brought with it a surge in refinancing, many economic forecasters see only modest downward shifts in the year ahead, as the mortgage industry looks for solutions to current home affordability challenges for buyers.

At its annual conference in Las Vegas this week, the Mortgage Bankers Association advised the industry that the current rate situation would likely be the norm for the foreseeable future.

“While the mortgage rate environment remains volatile, MBA’s new forecast calls for rates to remain in the 6% to 6.5% range over the next year, with total mortgage volume increasing 8% to $2.2 trillion in 2026,” said the trade group’s President and CEO Bob Broeksmit in a published statement.