At first glance, assumable mortgages sound like an awesome solution to a problem home buyers have been facing lately.

With mortgage rates now closer to 6.5% instead of 3%, housing affordability has suffered greatly. It’s now at its worst levels in decades.

Coupled with ever-rising home prices, many would-be buyers have essentially been locked out of the housing market.

But with an assumable loan, you can take on the seller’s mortgage, which these days is often super low, sometimes even sub-3%.

While that all sounds good and well, there’s a pretty sizable (literal) problem: the down payment.

Wait, How Much Is the Down Payment?

As noted, an assumable mortgage allows you to take on the seller’s mortgage. So the mortgage rate, the remaining loan balance, and the remaining loan term all become yours.

For example, say a home seller got a 2.75% 30-year fixed five years ago when mortgage rates hit record lows. Let’s pretend the loan amount was $500,000.

Today, they’re selling the property and the outstanding balance is roughly $442,000. The remaining loan term is 25 years.

It’d be great to inherit that low-rate mortgage from the seller instead of settling for a rate of say 6.5%.

Here’s the tricky part. The difference between the new sales price and the outstanding loan amount.

Let’s pretend the seller listed the property for $700,000. Remember, home prices have surged over the past decade, and even over just the past five years.

In some metros, they’re up about 50% since 2019. So a price tag of $700,000 wouldn’t be unreasonable, even if the seller originally paid closer to $500,000.

Do You Have $250,000 Handy?

Putting these numbers together, a hypothetical home buyer would need more than $250,000 for the down payment.

Most don’t even have 5% down to put on a house, let alone 20% down. This is closer to 36%!

To bridge the gap between the new purchase price and the existing loan amount. Using simple math, about $258,000.

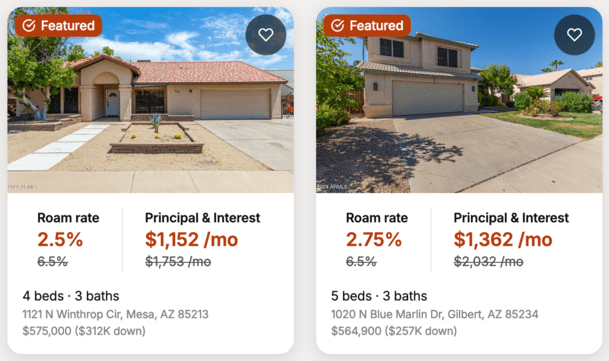

While that might sound crazy, just take a look at the real listings above from Roam, which lists properties with assumable mortgages.

Not only is that a large amount of money, it also means a good chunk of the purchase price will not enjoy the 2.75% financing.

It will be subject to whatever the rate is on a second mortgage, or it’ll simply be tied up in the home and illiquid (assuming the buyer can pay it all out-of-pocket).

Let’s pretend they’re able to get a second mortgage for a good chunk of it, maybe $200,000.

If we combine the 2.75% first mortgage for $442,000 and say an 8% second mortgage for the $200,000, the blended interest rate is roughly 4.4%.

Yes, it’s lower than 6.5%, but not that much lower. And many mortgage rate forecasts put the 30-year fixed in the 5s by next year.

If you pay points at closing on a rate and term refinance, you might be able to get a low-5% rate, or potentially even something in the high-4s, assuming the forecasts hold up.

Then it becomes a lot less compelling to try to assume a mortgage.

Are You Choosing the House for the Mortgage?

The other issue here is you might start looking at homes that have cheap, assumable mortgages.

Instead of considering properties you might like better. At that point, you could wind up choosing the house because of the mortgage.

And that just becomes a slippery slope of losing sight of why you’re buying a home to begin with.

If you’re home shopping and happen to find out the loan is assumable, that’s perhaps icing on the cake.

But if you’re only shopping homes that feature assumable mortgages, maybe it’s not the best move.

Also note that the loan assumption process can be cumbersome and the seller might list higher knowing they are offering an “asset.”

So in the end, once you factor in the blended rate and the higher sales price, and potentially a property that isn’t even ideal for your situation, you might wonder if it’s actually a deal.