Mortgage rates rose 12 basis points this week, reflective of the environment even before the Federal Open Market Committee announced its latest reduction in short-term rates, Freddie Mac found.

The 30-year fixed-rate mortgage averaged 6.72% as of Dec. 19, up from last week’s 6.6%, the Freddie Mac Primary Mortgage Market Survey reported. Only the last day of data gathering for this report would have had any impact from the market reaction to the 25-basis point cut and Chairman Jay Powell’s comments. Meanwhile, the 30-year FRM is again higher than it was a year ago at this time, when it averaged 6.67%.

Meanwhile, the 15-year FRM also increased, but by just 8 basis points week-to-week, to 5.92% from 5.84%. For this same week last year, it was at 5.95%.

“This week, mortgage rates crept up to a similar average as this time in 2023,” said Sam Khater, Freddie Mac’s chief economist in a press release.

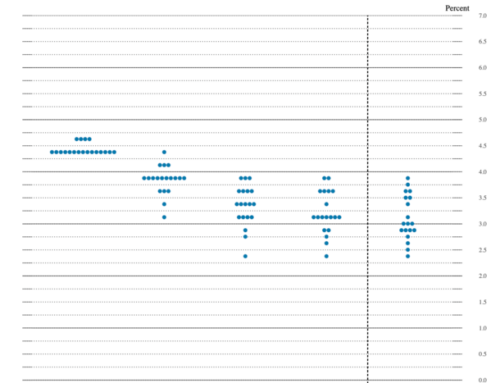

He noted that the 30-year FRM has moved in a range between 6% and 7% over the last 12 months, excluding a six-week period in April and May. “Homebuyers are slowly digesting these higher rates and are gradually willing to move forward with buying a home, resulting in additional purchase activity,” Khater said.

In the immediate aftermath of the FOMC announcement, both mortgage rates and the 10-year Treasury yield that is used as a benchmark in pricing them zoomed higher, tracking data showed.

As of 11 a.m. Thursday morning, Lender Price data for the 30-year FRM on the National Mortgage News website moved well above the 7% mark, to 7.117%. At the same time one week earlier, it was at 6.881%.

On Zillow’s mortgage rate tracker, which measures offers through the site, the rate at that time was 6.6%. But that was up by 5 basis points from Wednesday and 24 basis points higher than last week’s average of 6.36%.

Meanwhile, the 10-year Treasury yield at 4.56% was at its highest level since the end of May. It rose 11 basis points to 4.49% on Wednesday following the FOMC news.

This continued the rise since Dec. 6, when the yield closed at 4.15%; earlier that day it was at 4.13%.

Joining others in this viewpoint, Kara Ng, senior economist at Zillow Home Loans expects mortgage rates to bounce around in 2025.

“Home buyers should expect mortgage rates to continue on their bumpy path and be ready to act when an opportunity arises,” Ng said, adding this was likely the last “easy cut” from the Fed for a while.

“Many homeowners who locked in mortgage rates at record lows are coming to terms with the reality that sub-3% rates may not return soon,” Ng continued. “If mortgage rates dip, sidelined buyers and sellers should come rushing back, as seen when rates hit a two-year low in September.”

Taking a more positive view of the market is Bob Broeksmit, president and CEO of the Mortgage Bankers Association.

“Despite mortgage rates hovering in the high-6% range, homebuyer demand is holding steady,” Broeksmit said in a Thursday morning commentary on the group’s Weekly Application Survey. “Purchase activity was higher on a weekly and annual basis, and both the slow uptick in housing inventory and slower home-price growth bode well for prospective buyers next year.”

Commenting on the existing home sales report, Jeremy Foster, chairman of Calque, said stronger demand should come from areas where data and information services drive employment, especially in emerging technology hubs where housing costs aren’t already prohibitive.

“While we do not expect mortgage rates to fall as quickly as the federal funds target rate, even modest reductions should lead to higher sales of existing homes as affordability improves for buyers and the lock-in effect of a lower existing mortgage rate eases for sellers,” said Foster, whose company markets the Trade-in Mortgage.