A Ginnie Mae executive who played a key role in helping to establish tools to manage the government guarantor’s growing number of nonbank mortgage-backed securities issuers plans to retire this month.

Leslie Meaux Pordzik, senior vice president in the office of issuer and portfolio management, plans to leave Ginnie on Dec. 27 after more than 13 years. Harlan Jones, Ginnie’s director of issuer and portfolio management, will be her interim replacement.

In parting words delivered as she prepares to leave Ginnie and the larger mortgage capital markets she has worked in for over three decades behind, Pordzik reflected on what may lie ahead for both the agency and herself after she leaves.

“I’ve had a front row seat housing finance table for 36 years and it has been an incredibly interesting journey for me,” she said.

A key player in managing mortgage risk and operations

Pordzik, who is known for playing a key role in the effort to establish the government securitization guarantor’s issuer operational performance profile scorecard to reflect nonbank growth, said she will miss working with Ginnie’s mortgage company partners.

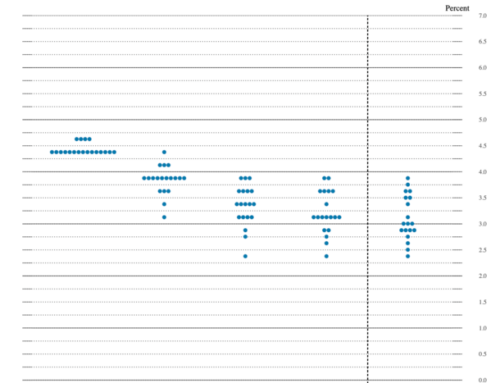

“We have built out a very robust set of metrics that we use whatever the cycle is, to keep our eye on all of our issuers. This current time period has been really difficult [due to interest rates]. Luckily, we’ve had fewer concerns than I think we would have anticipated,” she said.

Another project Pordzik has worked with that she hopes will continue include the Ginnie Mae Central platform. Such projects could be important in the context of efficiency goals considered likely to become even more of a focus next year.

“We have been evaluating several business initiatives to help bring efficiency to our business processes, although I don’t know how much more efficient we can get,” she said. “We send about a $1 billion or so back to the Treasury every year and if you divide the number of Ginnie Mae employees by that, it’s about $5 million an employee.”

Ginnie’s budget, staff and structure are different from the other two key government-related secondary mortgage market players Pordzik worked for during her previous 20-plus years in the business, but she does see one commonality: reliance on industry partners.

“I have managed institutions of all sizes, and for me, it came down to relationships,” said Pordzik, who has a background in psychology and worked for government-sponsored enterprises Fannie Mae and Freddie Mac before joining Ginnie.

Liquidity lessons from the pandemic

Pordzik’s sees the pandemic as one of the most significant periods during her tenure and one she hopes Ginnie will consider as it keeps building out issuer risk management after she leaves.

She points to how Ginnie set up the Pass-Through Assistance Program as a response to the concern forbearance would impose massive advancing responsibilities.

While the program ultimately was sparsely used due to the refinancing boom that relieved advancing concerns and would require conventional intervention to use more permanently, Pordzik sees it as having long-term significance in calling attention to a key servicing risk.

“The fact that Ginnie could put something out to the market like that and calm it was just, to me, a really seminal moment of when government was responsive,” she said. “We’re keenly aware, of the significant advancing obligations of our program, so we’re looking at a variety of proposals to address it.”

Future personal goals that draw on professional experience

After retirement, one thing Pordzik has an interest in pursuing that could provide some continuity in terms of her past work with Ginnie would potentially be work with organizations that advocate for veteran housing issues. (MBS Ginnie guarantees include loans for veterans.)

“I do want to stay engaged in the industry at some level, albeit a smaller role,” she said. “I’d like to use my expertise as we continue to try to ensure housing stays relevant for a lot of our citizens. Veterans are near and dear to my heart and on both housing and mental health issues, given my background. My uncles served, so that would be for them.”