As I’ve said before when talking about mortgage, what a difference a week makes. Or even a couple days.

If you’re new to mortgage rates, know that first and foremost, they can be very volatile. And can change from one day to the next.

Similar to a stock, the price might not be the same tomorrow (it could be higher or lower or possibly unchanged).

On top of that, the price could even change multiple times per day, typically when there’s a lot going on.

That happened today, with an afternoon reprice coming in after rates had already improved from the day before.

Why Did Mortgage Rates Fall Today (and Yesterday)?

In short, weak economic data was the driver and lower mortgage rates were the beneficiary.

We had several economic reports come in cooler-than-expected this week, including PPI, CPI, initial jobless claims, and retail sales.

It was basically the best you could ask for in terms of economic data. And as we all know, weaker economic data leads to lower mortgage rates (and vice versa).

So if you’re rooting for lower mortgage rates, unfortunately you also kind of have to root for the economy to cool off.

Granted you don’t have to root for it to collapse, so it’s not totally cynical to hope for some weakness.

Inflation has been running hot for years, and it’s okay if it comes down while the economy continues to move forward at a more reasonable pace.

There’s a good middle ground, generally known as a “soft landing,” which is when the economy slows down but doesn’t fall into recession.

It remains to be seen what happens there, but if you’re curious what mortgage rates do during a recession, I wrote about that too.

On top of this data win, the confirmation of new Treasury Secretary Scott Bessent took place today.

Bonds got a bounce when he was first announced back in November too, and the market seemed to like him again today.

He’s basically seen a voice of reason in what might be a tumultuous administration. In addition, he has played down tariffs as being inflationary.

Lastly, Federal Reserve Governor Christopher Waller chimed in to say that the Fed might cut rates faster and sooner if the inflation outlook continues to be favorable.

Long story short, these events assuaged many of the reasons mortgage rates jumped over the past few months.

How Much Did Mortgage Rates Improve?

While it’s hard to get a perfect gauge, since not all banks and lenders offer the same rates, nor adjust them accordingly, we can at least ballpark it.

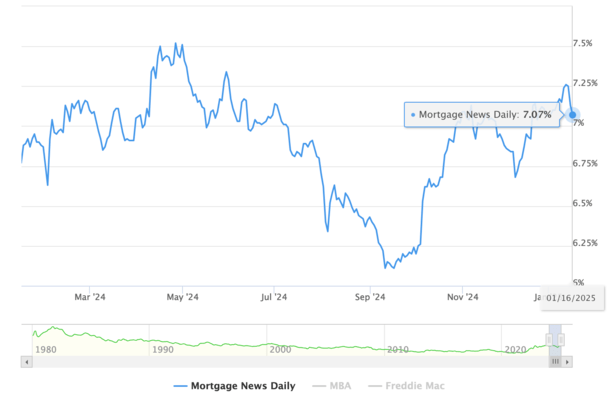

One great place to see daily rate movement in composite form is via Mortgage News Daily, which posts daily 30-year fixed mortgage rates.

They had a posted rate of 7.26% on Tuesday, which was the highest rate since May 2024!

Rates have since fallen to 7.07% as of today. And there a reprice in the afternoon as well, as noted.

The first release put the 30-year fixed at 7.11%, before an additional release dropped it another four basis points to 7.07%.

In reality, most borrowers locking their rates now are getting loans that start with a 6 instead of a 7.

That’s because the real-time lock data from Optimal Blue put the 30-year fixed at 6.96% as of Wednesday.

It probably dropped a decent amount today as well, which we’ll find out tomorrow. In other words, borrowers might be locking in rates around 6.875% instead of 7.125% or 7.25%.

So perhaps weekly improvement of .25% to .375%, plus the psychological win of going from 7 to 6.

Can the Mortgage Rate Rally Keep Going?

The million-dollar question is if this can keep going or if it’ll face an inevitable setback. Perhaps it won’t be inevitable.

If the data continues to cooperate and the new administration, which takes the reins Monday, doesn’t rattle markets, the rally can continue.

And mortgage rates can continue to move lower. How much lower is another question, but if the data, such as unemployment and inflation, come in favorably, we could get back to where we were in September.

If you recall, the 30-year fixed was nearly 6% back then, right before the Fed ironically cut its own fed funds rate. Then we got hit with a hot jobs report, which further piled on the pain.

Assuming those things unravel and inflation comes down and the labor market doesn’t look as hot, mortgage rates could return to those levels.

But there’s also government spending to worry about and Treasury issuance, which a lot of folks are worried about under Trump. Not to mention many other inflation-inciting ideas that may or may not come to fruition.

I’ve written about what might happen to mortgage rates during Trump’s second term if you’re curious.

The cliffnotes are it depends what he actually does versus what he said he’ll do, and how such actions will affect the economy.

But some of it might be out of his hands anyway, if for example, we’re already barreling toward a recession.

To sum things up, like all other years, there will be opportunities as rates ebb and flow, so if you’re buying a home, pay very close attention to rates every day.

Read on: 2025 mortgage rate predictions