It seems pretty clear that the housing market has cooled, and is now more of a buyer’s market than a seller’s market.

While this does and will always vary by metro, it’s becoming increasingly common to see higher days on market (DOM), price cuts, and rising inventory.

This all has to do with record low affordability, which has made it difficult for a prospective home buyer to make a deal pencil.

The stubbornly high mortgage rates aren’t helping matters either, calling into question if it’s a good time to buy a home. Or if it’s better to just keep renting.

But if you do go through with a home purchase today, expect to keep the property for many years to come.

Home Price Gains Have Cooled and Could Even Go Negative This Year

While economists at CoreLogic still forecast home prices to rise 3.6% from January 2025 to January 2026, it seems as if the gains are rapidly slowing.

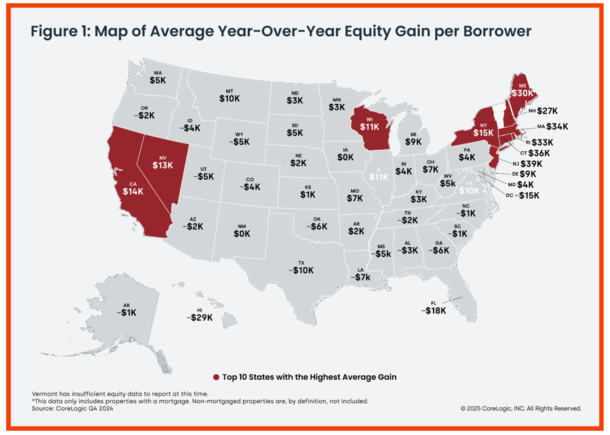

And in some markets, particularly Florida and Texas, home prices have already turned negative and have begun falling year-over-year.

For example, home prices were off 3.9% YoY in Fort Myers, FL, 1% in Fort Worth, TX, and 1.1% in San Francisco.

I expect more markets to turn negative as 2025 progresses, especially with more properties coming to market and sitting on the market as DOM goes up.

It’s a simple matter of supply and demand, with fewer eligible (or interested) buyers, and more properties to choose from.

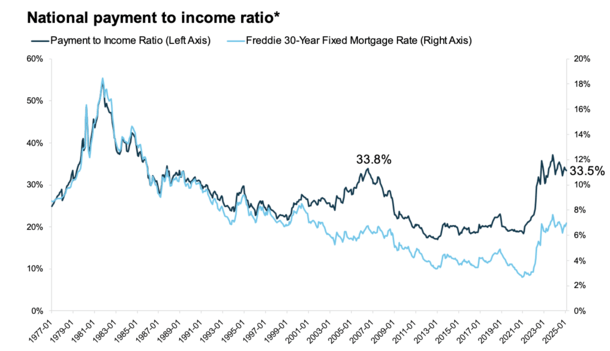

There are many culprits, but it’s mostly an affordability problem, with the national payment to income ratio still around GFC bubble highs, per ICE.

This explains why home purchase applications are still pretty flat despite some recent mortgage rate improvement.

Sprinkle in rising homeowners insurance and property taxes, and everyday costs of living and it’s becoming a lot more difficult to buy a home today.

While it might be good news for a prospective buyer who has a solid job and assets in the bank, for the typical American it probably means renting is the only game in town.

If this persists, I expect more downward pressure on home prices, though mortgage rates can fall in tandem as well.

Still, I wouldn’t expect any spectacular gains after a home purchase today in most scenarios.

Appreciation is expected to be pretty flat in most markets at best for the foreseeable future.

This mean the only way to make a dent is via regular principal payments (one of four key components to PITI).

Your Mortgage Is Being Paid Down More Slowly When Rates Are Higher

| $400,000 loan amount | 2.75% mortgage rate | 6.75% mortgage rate |

| Monthly payment | $1,632.96 | $2,594.39 |

| Interest paid in 3 years | $31,938.47 | $79,698.01 |

| Principal in 3 years | $26,848.09 | $13,700.03 |

| Remaining balance | $373,151.91 | $386,299.97 |

The problem is mortgage rates today are closer to 6.75%. On a $400,000 loan amount, that means just $345 of the first payment goes toward principal.

The remaining $2,250 goes toward interest. Yes, you read that right!

As a result, your mortgage is being paid down a lot more slowly today if you take out a home loan at prevailing rates.

Contrast this to the folks who took out 2-3% mortgage rates, who have smaller loan amounts and much faster principal repayment.

On the same $400,000 loan amount at 2.75%, $716 goes toward principal and just $917 goes toward interest.

The effect is these homeowners are gaining equity much faster, and creating a wider buffer between what they owe and what their home is worth.

To go back to our 6.75% mortgage rate borrower, they’d still owe $386,000 after three years of ownership.

A Low-Down Payment Makes It Harder to Sell Your Home

Now let’s pretend the 6.75% mortgage rate owner put just 3% down on their home purchase.

This is the minimum for Fannie Mae and Freddie Mac, the most common type of mortgage (conforming loan) out there.

The purchase price would be roughly $412,000 in this scenario, meaning just $12,000 down payment.

It’s great that the down payment is low I suppose, but it also means you have very little equity.

And as shown, you’ll pay very little down over the first 36 months of homeownership.

In three years, the balance would drop to just over $386,000, which is a cushion of roughly $26,000.

During normal times, we could expect home prices to rise around 4.5% annually, putting the home’s value at say $470,000.

This would give our hypothetical homeowner about $84,000 in home equity, between appreciation and principal pay down.

That works out to roughly $58,000 in appreciation, $14,000 in principal, and $12,000 down.

Now let’s assume you want to sell because you don’t like the house for whatever reason, or need a different one, or simply can’t afford it anymore.

There Are Lots of Transactional Costs Involved with Selling a Home

| $412,000 home purchase | 1% gain annually | 4.5% gain annually |

| Value after 3 years | $424,500 | $470,000 |

| Balance after 3 years | $386,000 | $386,000 |

| Home selling costs | $42,500 | $47,000 |

| Sales proceeds | -$4,000 | $37,000 |

Selling a home isn’t free. It comes with a lot of transactional costs, whether it’s transfer taxes, escrow fees, title insurance, real estate agent commissions, moving expenses, and so on.

While these fees vary by locale, one might expect to part with 10% of the sales price in total closing costs.

So let’s pretend the home is able to sell for $470,000 after three years. Costs to sell are roughly $47,000.

This means the effective sales price is a lower $423,000. You walk away with $37,000 in your pocket, the difference between that and the $386,000 loan balance.

Remember you parted with $12,000 to buy the place too, so your “profit” is $25,000. Even less when you consider you just paid back your loan.

Now imagine the home doesn’t appreciate in value by that 4.5% per year, and instead appreciates at say 1% per year.

It’s only worth $424,500 after three years and you want to sell it. The same 10% in selling costs apply, lowering the proceeds to $382,050.

But you owe $386,000 on the mortgage. Even though you didn’t have an underwater mortgage, where the balance exceeds the home value, once selling costs are factored in, it’s negative.

You would have to bring money to the table in order to sell the property.

For this reason, you need to think about a longer time horizon when buying a property today.

This isn’t to say home prices won’t go up over the next three years, but you can see how easily a scenario like this could unfold.

In recent years, home prices were going up by double-digits each year, with cumulative gains of 50% in just three or four years in some cases.

At the same time, these homeowners were paying down their mortgage balances much faster thanks to a 2-3% mortgage rate.

This made it much, much easier and faster to quickly turn around and sell if they wanted to. Or had to.

Now you’re likely going to have to keep a property for many years if you want to sell for a profit. So make the decision wisely.