If you’re hoping for lower mortgage rates, you might be thrilled to hear what Treasury Secretary Scott Bessent has to say.

During a television interview today, he said “a series of rate cuts” could be on the table, including a big 50-basis point cut in September.

That would mirror the cut seen last September when mortgage rates happened to go up. Of course, the Fed and mortgage rates have a complicated relationship.

So those who think Fed cut = lower 30-year fixed might be in for a surprise.

However, Bessent added that the September cut could be the first of many…

Bessent Says Rates Should Be 150 to 175 Basis Points Lower

Speaking today on Bloomberg, Treasury Secretary Bessent argued for bigger rate cuts than what’s currently forecast.

For starters, he believes the September Fed rate cut, currently a lock at 99.9% on CME, should be not 25 basis points but instead 50 basis points.

The backdrop there is that he suspects we could (should) have cut back in June and July, but didn’t. So in essence playing a little bit of catch up.

Of course, this is all predicated on that really ugly jobs report we got for July, which included massive downward revisions for June and May.

Had that not come, it’d be hard to fathom anyone talking about a 50-bp rate cut, or perhaps even a 25-bp rate cut.

In fact, CME had odds of a quarter-point rate cut at just 57.4% one month ago, just to illustrate how fluid this all is.

Now there’s word of removing the monthly jobs report until it can be proven to be accurate.

This was a suggestion from E.J. Antoni, who replaced fired Bureau of Labor Statistics (BLS) commissioner Erika McEntarfer after that mess of a report.

But Bessent believes that’s just the start, and that “we should probably be 150, 175 basis points lower.” Whoa!

The Fed Funds Rate Isn’t Mortgage Rates

I’ve said this a million times, but it bears repeating. The Fed doesn’t set consumer mortgage rates.

When they cut, mortgage rates could go up, sideways, or down. Same if they hike. The correlation isn’t all that strong.

The only real argument you can make is Fed rate expectations correlate somewhat with mortgage rates.

So if they’re planning to cut, long-term mortgage rates can drift lower too. But, and it’s an important but, you need the economic data to support the move lower.

While the Fed could feasibly cut its own fed funds rate, it’s unclear how bond yields would react, especially without a monthly jobs report leaving them in the dark.

Bonds are supposed to be a safe haven, and with so much uncertainty in the air, it’d be hard to imagine any major movements there until there’s more clarity.

However, the 10-year bond yield did slip nearly six basis points today, which might be a reflection of reduced inflationary fears related to tariffs.

That would put all eyes on the labor market, which is what got this latest mortgage rate rally going in the first place.

And could be the underlying reason why folks like Bessent are calling for these sizable rate cuts.

Is Bessent signaling that not all is well in the economy, even if the administration argues that the economy is hot?

Ultimately, continued job losses and higher unemployment is what would get mortgage rates even lower.

It’s clearly a double-edged sword, as you’d have more households under stress, which kind of takes away from the expected windfall of lower rates.

But that’s kind of the thing with rates. They tend to come down with bad economic times and vice versa.

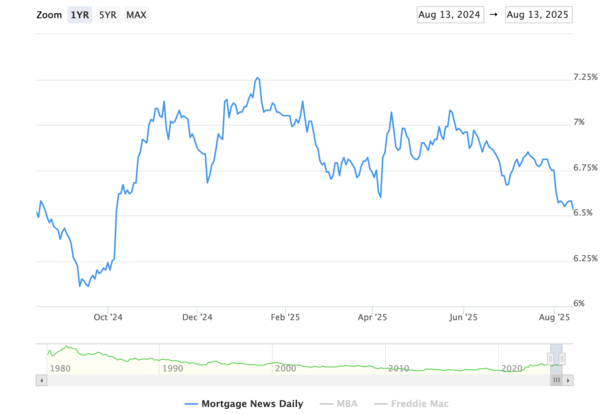

Mortgage Rates Already Lowest Since Early October

As it stands now, 30-year fixed mortgage rates are the lowest they’ve been since early October. They’re nearly back to September levels, per MND.

So Fed rate expectations and weak economic data might already be mostly baked in. Rates can go lower, but need a reason (even more economic weakness).

Maybe they’ll get back there this September, when the 30-year fixed was hovering closer to 6% than 6.5%.

That would certainly lead to a pick up in mortgage refinancing, and potentially home buying as well.

We saw a mini refi boom back then, which only got cut short due to a hot jobs report, ironically.

Perhaps we are unwinding that move a year ago and getting back to the narrative that the labor market is cracking and the economy is cooling.

All this despite fears of inflation rising again due to tariffs, or simply more businesses raising prices as they manage rising costs.

This is where that stagflation idea comes in. Slowing growth, higher unemployment. It’s certainly possible.

But it appears this administration, who is also looking to make the Fed a lot more accommodative once Powell’s term is over, is fixated on cutting rates.

If nothing else, this means HELOC rates will come down, as they are directly tied to the prime rate, which is dictated by the federal funds rate.

It could also make adjustable-rate mortgages cheaper, as they are short-term loans unlike the 30-year fixed.

The big question is if this policy direction puts us at greater risk of inflation reigniting. Or if the administration sees the writing on the wall, that the economy is in dire need of support.