For the first time since 2016, the number of American households who are homeowners declined on an annual basis, in another signpost that high home prices and elevated interest rates are taking people out of the market, a Redfin study of U.S. Census data found.

The study estimated about 86.2 million Americans own their home, a drop of 0.1% from the second quarter of 2024. At the same time, the number of households who rent rose by 2.6% to 46.4 million. Redfin termed this one of the largest increases in recent years.

This also follows a first quarter where the year-over-year change in the number of homeowner households was 0%. The peak for annual growth was in the second quarter of 2020 at 4.6%.

The largest annual decline in the number of homeowner households was in the first quarter of 2011, when it fell by 1.1%.

What is the current U.S. homeownership rate?

The homeownership rate for the second quarter was 65%, down from 65.1% in the first quarter and 65.6% one year prior.

The report comes out as Treasury Secretary Scott Bessent said the Trump Administration may declare a national housing emergency at some point this fall.

Along with affordability concerns, demographics may also be playing a part in why fewer people are homeowners, Redfin economists said.

“America’s homeowner population is no longer growing because rising home prices, high mortgage rates and economic uncertainty have made it increasingly difficult to own a home,” Chen Zhao, Redfin’s head of economics research, said in a press release. “People are also getting married and starting families later, which means they’re buying homes later — another factor that may be at play.”

Is income keeping up with the cost of buying or renting?

A separate report from the National Housing Conference found potential buyers in 176 metro areas last year needed a six-figure income to purchase a typically priced home with a 10% down payment; this is up from 30 metros in 2019.

On the other side of the table, 47% of those in occupations that NHC tracked do not earn enough to afford to rent a two-bedroom apartment; in 32 metro areas, renters needed to earn more than $75,000 annually.

For buyers, 14% earned enough to afford to purchase a home with 10% down in 2024, versus 37% in 2019, the NHC study, “Priced out: when a good job isn’t enough,” found.

“These findings underscore the depth and breadth of the housing crisis” that affects families regardless of their location or job, said David Dworkin, NHC president and chief executive, in a press release.

Redfin’s comments on rates cited last week’s Freddie Mac Primary Mortgage Market Survey, noting that the 30-year fixed at 6.56% is a good sign as this is the lowest level since Oct. 24, 2024.

Many current homeowners locked in 2%–3% mortgage rates during 2020 and 2021, and holding onto those loans has further tightened the supply of homes for sale.

Redfin noted the median home sales price rose 1.4% year-over-year in July to $443,867, the most for that month on record.

The role of property investor purchases in the shortage

Tom Hutchens, EVP of production at Angel Oak Mortgage Solutions, said rising investor ownership is adding to the housing supply crunch.

Angel Oak’s non-owner occupied debt service coverage ratio product makes up 30% to 40% of its non-qualified mortgage originations.

With the increase in appreciation comes higher property taxes, he said, along with higher property insurance premiums, especially in areas struck by natural disasters.

“We’ve just had a lot of things working against housing in general where calling it an emergency doesn’t seem that far-fetched,” Hutchens said. “It’s higher cost on top of higher cost.”

What should mortgage originators do about it

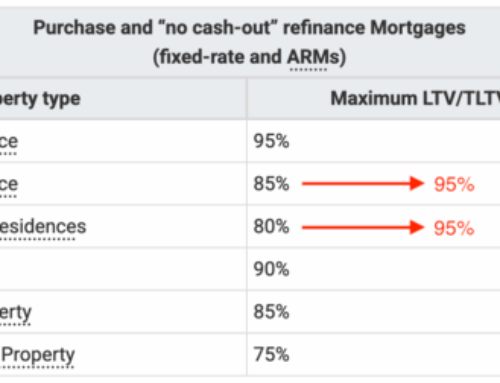

A big part of the solution for originators, Hutchens said, is to educate consumers of products outside of the agency box, including non-QM. A focus on conforming loans keeps people out of the market, such as self-employed consumers. Educating them about these alternatives can bring them back into the housing market.

If short-term rates do move lower, Hutchens expects a proliferation of adjustable rate mortgages. Those products tend to reflect shorter-term instruments. It differs from how rates for the 30-year fixed rate mortgage are calculated, which is benchmarked to the 10-year Treasury yield.

“The good news is that it’s still the American dream to be a homeowner, it’s still the best way to build wealth…through home ownership versus being a renter,” Hutchens said. “The desire is going to remain, it’s just some of these factors need to ease up.”