Why Fannie Mae's profit dipped despite strong acquisitions

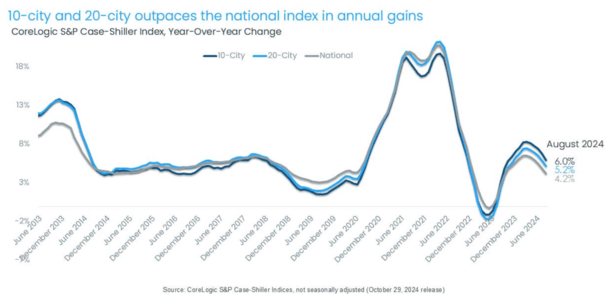

unitedbrokersinc_m7cmpd2024-10-31T15:22:23+00:00The drop in third-quarter interest rates drove single-family loan purchases at Fannie Mae up more than any other fiscal period in the year, but other developments reduced its profitability.The influential government-sponsored enterprise, which accounted for 27% of the market's single-family securities-related activity in the quarter, generated $4 billion in net income for the period.That number was down around $300 million to $500 million from comparable periods even though the period was its strongest quarter for the year for the single-family loan acquisitions that represent a cornerstone for its business. Single-family loan acquisitions climbed to $93.1 billion for the quarter, representing a high for the year, but the gains the GSE got from credit benefits and valuation gains were lower."Our third quarter revenues remain strong at $7.3 billion driven by steady guarantee fee income, but our benefit for credit losses was down $273 million this quarter," Chief Financial Officer Chryssa Halley said in an earnings call, comparing the current figure to the previous quarter.The GSE also recorded smaller fair value gains, which came in at $52 million versus $447 million the previous quarter.Fannie remains in the government conservatorship its been in since the Great Financial Crisis and therefore isn't that high-profile as a stock, although as the election has given its shares a boost at times on speculation that a second Trump administration could resume privatization.Its penny stock was down slightly on the day this morning, opening at $1.44 and trading closer to $1.42 later.While the seasonally strong single-family acquisitions in the past quarter weren't enough to boost Fannie's earnings during the third quarter, it did add to the net worth its been working to build with the aim of meeting certain targets in line with ensuring its financial soundness."Our net income increased our net worth to $90.5 billion at the end of September, making us even more financially stable. Plus just since the start of this year, we've reduced our minimum regulatory capital shortfall by $17 billion," said CEO Priscilla Almodovar.While Fannie Mae's loan acquisitions were strong in the quarter, they have been limited to an extent by market conditions."Although home prices increased by 1% during the quarter and 5.9% year-over-year, with existing home sales expected to be the lowest since 1995," Almodovar said.In line with its mission, Fannie reported providing funding that served homeownership needs of 300,000 renters and 117,000 first-time buyers during the period. For the full year, it projects home price growth of 5.8% and single-family mortgage originations at $1.7 trillion."Our mission is not just about helping people get into homes, but also helping them stay in their homes, especially during tough times," said Almodovar, noting that Fannie has been delivering temporary payment assistance to borrowers affected by recent hurricanes."These events can be tough and Fannie Mae is here to help," she said.The serious single-family mortgage delinquency rate climbed in for the first quarter inched up to 52 basis points from 48 the previous quarter. Ongoing issues in the multifamily market drove its arrears up to 56 basis points from 44 during the same period.Multifamily issues played into the reduction in the overall credit benefit during the period."In multifamily, we recorded a $424 million provision for credit losses of $176 million from the prior quarter. The third quarter provision was largely driven by ARM loans that were written down during the period and modest decreases in forecasted property values," Halley said, referring to the acronym for adjustable-rate mortgages.Fannie's numbers for net income the previous quarter and a year earlier were $4.5 billion and $4.7 billion, respectively.Smaller competitior Freddie Mac, recorded $3.1 billion in earnings in the third quarter, generating gains from the improved rate environment for originations during the period. The two have different balance sheet structures that can account for variations in their results.