Is Home Equity Lending Really That Crazy Today?

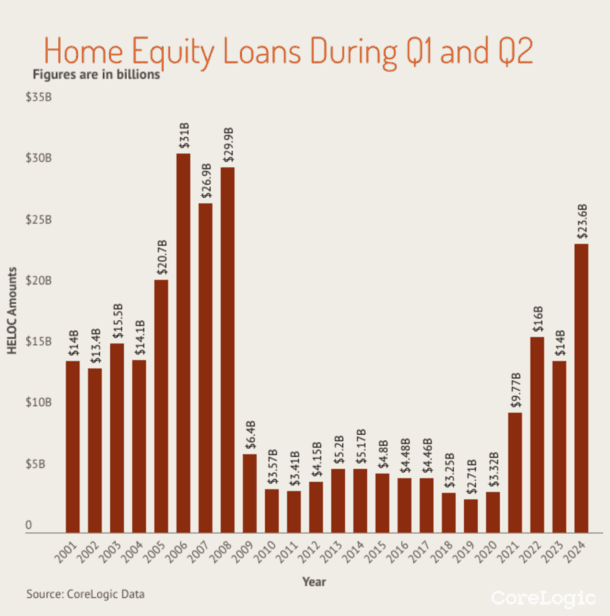

unitedbrokersinc_m7cmpd2024-10-17T18:22:29+00:00I came across a report from CoreLogic the other day that said home equity loan lending increased to its highest level since 2008.Whenever anyone hears the date “2008,” they immediately think of the housing bubble in the early 2000s.After all, that’s when the housing market went absolutely sideways after the mortgage market imploded.It’s the year we all use now as a barometer to determine if we’re back to those unsustainable times, which can only mean one thing: incoming crisis.However, nuance is important here and I’m going to tell you why the numbers from 2008 and the numbers from 2024 aren’t quite the same.First Let’s Add Some ContextCoreLogic economist Archana Pradhan noted that home equity loan lending (not HELOCs) grew to the highest point since the first half of 2008 during the first two quarters of 2024.During the first half of this year, mortgage lenders originated more than 333,000 home equity loans totaling roughly $23.6 billion.For comparison sake, lenders originated $29.9 billion in home equity loans during the first half of 2008, just before the housing market began to crash.It was the last big year for mortgage lending before the bottom fell out. For reference, home equity lending totaled just $6.4 billion in 2009 and barely surpassed $5 billion annually up until 2021.Part of the reason it fell off a cliff was due to credit conditions becoming frozen pretty much overnight.Banks and lenders went out of business, property values plummeted, unemployment increased, and there was simply no home equity to tap.Once the housing market did recover, home equity lending remained subdued because lenders didn’t participate as they once had.In addition, volume was low because first mortgage rates were also so low.Thanks to the Fed’s mortgage-backed securities (MBS) buying spree, known as Quantitative Easing (QE), mortgage rates hit all-time lows.The popular 30-year fixed went as low as 2.65% in early 2021, per Freddie Mac. This meant there wasn’t really much reason to open a second mortgage.You could go with a cash out refinance instead and secure a lot of really cheap money with a 30-year loan term.That’s exactly what homeowners did, though once first mortgage rates jumped in early 2022, we saw the opposite effect.So-called mortgage rate lock-in became a thing, whereby homeowners with mortgage rates ranging from sub-2% to 4% were dissuaded from refinancing. Or selling for that matter.This led to an increase in home equity lending as homeowners could borrow without interrupting their low first mortgage.What About Inflation Since 2008?Now let’s compare the two totals and factor in inflation. First off, $29.9 billion is still well above $23.6 billion. It’s about 27% higher.And that’s just comparing nominal numbers that aren’t inflation-adjusted. If we really want to compare apples-to-apples, we need to consider the value of money over the past 16 years.In reality, $24 billion today would only be worth about $16.7 billion in 2008, per the CPI Inflation Calculator.That would make the 2024 first half total more on par with the 2001-2004 years, before the mortgage industry went absolutely haywire and threw common sense underwriting out the door.Simply put, while it might be the highest total since 2008, it’s not as high as it looks.On top of that, home equity levels are now the highest on record. So the amount that is being tapped is a drop in the bucket in comparison.In 2008, it was common to take out a second mortgage up to 100% combined loan to value (CLTV).That meant if home prices dipped even a little, the homeowner would fall into a negative equity position.Today, the typical homeowner has a super low loan-to-value ratio (LTV) thanks to much more prudent underwriting standards.Generally, most lenders won’t go beyond 80% CLTV, leaving in place a sizable equity cushion for the borrowers who do elect to tap their equity today.There’s Also Been Very Little Cash Out RefinancingLastly, we need to consider the mortgage market overall. As noted, many homeowners are grappling with mortgage rate lock-in.They aren’t touching their first mortgages. The only game in town if you want to tap your equity today is a second mortgage, such as a home equity loan or HELOC.So it’s natural that volume has increased as first-mortgage lending has plummeted. Think of it like a seesaw.With very few (to practically no) borrowers electing to disturb their first mortgage, it’s only natural to see an increase in second mortgage lending.Back in 2008, cash out refinancing was huge AND home equity lending was rampant. Imagine if nobody was doing refis back then.How high do you think home equity lending would have gotten then? It’s scary to think about.Now I’m not going to sit here and say there isn’t more risk in the housing market as a result of increased home equity lending.Of course there is more risk when homeowners owe more and have higher monthly debt payments.But to compare it to 2008 would be an injustice for the many reasons listed above. Before creating this site, I worked as an account executive for a wholesale mortgage lender in Los Angeles. My hands-on experience in the early 2000s inspired me to begin writing about mortgages 18 years ago to help prospective (and existing) home buyers better navigate the home loan process. Follow me on Twitter for hot takes.Latest posts by Colin Robertson (see all)