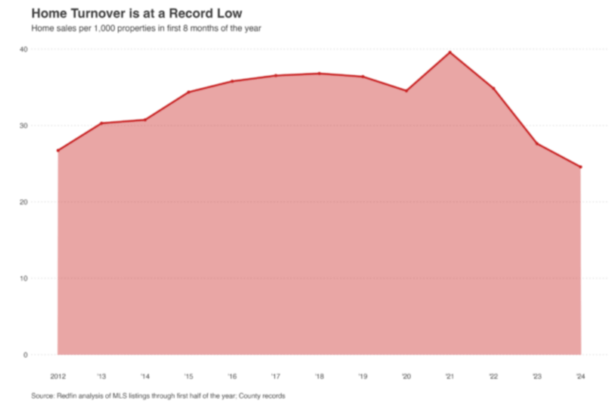

When mortgage rates surged off their record lows in early 2022, the housing market ground to a halt.In the span of less than 10 months, 30-year fixed mortgage rates climbed from the low-3% range to over 7%.While a 7% mortgage rate is historically “reasonable,” the percentage change in such a short period was unprecedented.Mortgage rates increased about 120% during that time, which was actually worse than those 1980s mortgage rates you’ve heard about in terms of velocity of change.The rapid ascent of interest rates was severe enough to introduce us to a new phrase, mortgage rate lock-in.In short, existing homeowners became trapped in their properties seemingly overnight because they couldn’t leave their low rates behind and exchange them for much higher ones.Either because it was cost-prohibitive or simply unappealing to do so.And there isn’t a quick fix because your typical homeowner has a 30-year fixed mortgage in the 2-4% range.Mortgage Rates Have Come Down, But What About Loan Amounts?There’s been so much focus on mortgage rates that I sometimes feel like everyone forgot about sky-high loan amounts.Mortgage rates climbed as high as 8% a year ago, but have since fallen to around 6%. And can be had for even lower if you pay discount points.So in some regard, mortgage rate lock-in has eased, yet housing affordability remains constricted.For the typical home buyer who needs a mortgage to get the deal done, there are two main components of the purchase decision. The asking price and the interest rate.As noted, rates are a lot higher than they used to be, but have come down about two percentage points from their 2023 highs.The 30-year fixed hit 7.79% during the week ended October 26th, 2023, which wasn’t far away from the 21st century high of 8.64% set in May 2000, per Freddie Mac.However, home prices haven’t come down. While many seem to think there’s an inverse relationship between mortgage rates and home prices, it’s simply not true.Sure, appreciation may have slowed from its unsustainable pace, but prices continued to rise in spite of markedly higher rates.And if we consider where home prices were pre-pandemic to where they stand today, they’re up about 50% nationally.In certain metros, they’ve risen even more. For example, they’re up about 70% in Phoenix since 2019, per the latest Redfin data.So when you look at how mortgage rates have come down, you might start to focus your attention on home prices.While a 5.75% mortgage rate seems fairly palatable at this juncture, it might not pencil when combined with a loan amount that has doubled.This might explain why just 2.5% of homes changed hands in the first eight months of 2024, per Redfin, the lowest turnover rate in decades. Listings are also at the lowest level in over a decade (since at least 2012).An Example of Loan Amount Lock-InHome Purchase Then vs. Now (2019 and 2024) $265k sales price$450k sales priceLoan Amount$212,000$360,000Interest Rate3.5%5.75%P&I Payment$951.97$2,100.86Payment Differencen/a$1,148.89Let’s consider a median-priced home in Phoenix, Arizona. It used to be $265,000 back in August 2019, per Redfin.Today, it’s closer to $450,000. Yes, that’s the 70% increase I referred to earlier. Now let’s imagine the home buyer put down 20% to avoid PMI and get a better mortgage rate.We might be looking at a rate of 3.50% on a 30-year fixed back in mid-2019. Today, that rate could be closer to 5.75%.When we factor in both the higher mortgage rate and much higher loan amount, it’s a difference of roughly $1,150 per month. Just in principal and interest.The down payment is also $90,000 versus $53,000, or $37,000 higher, which could be deal-breaker for many.This explains why so few people are buying homes today. The one-two punch of a higher mortgage rate AND higher sales price have put it out of reach.But what’s interesting is if the loan amount was the same, the difference would only be about $285, even w/ a rate of 5.75%.So you can’t really blame high rates too much at this point. Sure, $300 is more money, but it’s not that much more money for a monthly mortgage payment.And it’s a lot better than the $1,150 difference with the higher loan amount.In other words, you could argue that existing homeowners looking to move aren’t locked in by their mortgage rate so much as they are the loan amount.What You Can Do to Combat Loan Amount Lock-InIf you already own a home and are struggling to comprehend how a move could be possible, there’s a possible solution.I actually had a friend do this last spring. He was moving into a bigger home in a nicer neighborhood, despite holding a 2.75% 30-year fixed mortgage rate.To deal with the sharp increase in interest, he used sales proceeds from the sale of his old home and applied them toward the new mortgage.The result was a much smaller balance, despite a higher-rate mortgage. This meant far less interest accrued, despite monthly payments being higher.He did this when rates were in the 7% range. There’s a good chance he’ll apply for a rate and term refinance to get a rate in the 5s, at which point he can go with a new 30-year term and lower his monthly.If he prefers, he can make extra payments to principal to continue saving on interest, or simply enjoy the payment relief.Either way, knocking down the loan amount to something more comparable to what he had before, using sales proceeds, is one way to bridge the gap.And the big silver lining for a lot of existing locked-in homeowners is they got in cheap and have a ton of home equity at their disposal. Before creating this site, I worked as an account executive for a wholesale mortgage lender in Los Angeles. My hands-on experience in the early 2000s inspired me to begin writing about mortgages 18 years ago to help prospective (and existing) home buyers better navigate the home loan process. Follow me on Twitter for hot takes.Latest posts by Colin Robertson (see all)