Cheaper HELOC Rates, Cash Needs Might Finally Lead to a Home Equity Lending Boom

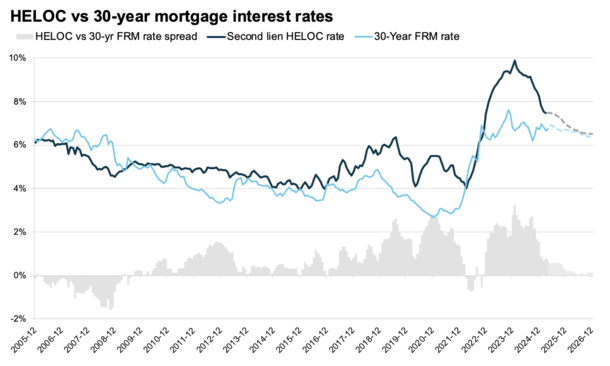

unitedbrokersinc_m7cmpd2025-06-02T17:22:30+00:00A new report found that the typical monthly payment to borrow $50,000 via a home equity line of credit (HELOC) has dropped by about $100 since 2024.And that payment could drop a further $50 per month if the Fed cuts rates as expected.Despite some near-term headwinds related to tariffs, trade, and government spending, the Fed is still projected to cut rates three times by January.Unlike long-term mortgage rates, which the Fed doesn’t control, HELOCs are tied to the prime rate, which moves up and down whenever the Fed cuts or hikes.This could lead to more home equity withdrawals as the spread between HELOCs and 30-year fixed rates narrows.When Is the Home Equity Lending Boom Going to Happen?I’ve been saying for a while that homeowners just haven’t been tapping equity this cycle.In the early 2000s, homeowners were maxed out, meaning they borrowed up to 100% of the value of their home, whether it was a cash-out refinance or a second mortgage.But this go around, homeowners (and lenders) have been a lot more conservative, which has kept the housing market in check.Part of it has to do with interest rates, which just aren’t that attractive for someone in need of cash.As you can see from the chart above from ICE, the spread between HELOCs and 30-year mortgage rates widened significantly in 2023 and 2024.This made it unattractive to take out a second mortgage such as a HELOC, especially when the first mortgage was typically locked in at 2-4%.But thanks to some recent fed rate cuts, HELOC rates have eased. And they’re expected to come down even more as the year progresses, with three more quarter-point cuts by January, per CME.Within a year, the prime rate, which is the basis for HELOC pricing, could be a full percentage point lower than it is today.This will likely make it much more attractive to consider a HELOC to pay for expenses such as remodeling, or to pay off other high-cost debt.Especially when you consider the amount of equity homeowners are currently sitting on, and rising costs of living.Home Equity Levels Hit Another Record HighICE noted that home equity levels hit another all-time high in the second quarter, with mortgaged properties holding an aggregate $17.6 trillion in equity.That was up 4% from a year earlier, or another $690 billion, thanks to rising home prices and falling mortgage loan balances.A staggering $11.5T of that home equity is considered “tappable,” meaning it could be borrowed while still maintaining a healthy 20% cushion (80% CLTV).Broken down by borrower, some 48 million mortgage holders have some level of tappable equity, and the average homeowner has a whopping $212,000 available to borrow if wanted.Despite this, your typical borrower remains very “lightly levered,” with the aggregate CLTV (outstanding loan balance vs. home value) just 45%.That means someone with a home valued at $500,000 only has an outstanding balance of $225,000.If we consider that same borrower in 2006, they probably had a home valued at $400,000 and a mortgage for the same amount!And over time, eventually an underwater mortgage as the property value fell below the balance of the mortgage.This is one of the main reasons why despite poor housing affordability today, the housing market remains in OK shape.Roughly a Quarter of Homeowners Are Considering a HELOCOf course, things can change pretty quickly, and if borrowers rush to tap their equity while home prices plateau or even move lower, the housing market could become a lot riskier.However, lenders aren’t doling out 100% financing anymore (unless it’s a home purchase), and most homeowners today have relatively tiny first mortgages at ultra-low fixed mortgage rates.So the risk is still pretty low, even if homeowners turn to equity to address cost of living increases.Per the 2025 ICE Borrower Insights Survey, about a quarter of respondents said “they were considering a home equity loan or home equity line of credit in the next year.”And younger homeowners were reportedly more likely to be considering taking out a second mortgage.While nearly $25 billion in home equity was tapped via HELOCs in the first quarter, a 22% YoY increase and the largest Q1 since 2008, it’s still less than half the “typical” withdrawal rate seen from 2009-2021.In other words, we’ve yet to see a home equity lending boom, despite home equity levels reaching new record highs.This will be a key metric to look at as the housing market begins to slow, and home prices start to experience downward pressure.If you consider the top chart, total market CLTV was also relatively low in 2004-2006 before it jumped to around 75%.The housing market has a very healthy cushion today, thanks to more prudent lending standards and a lack of home equity lending.But if/when prices cool and lenders/borrowers get more aggressive with second mortgages, we could see the national CLTV rise again.This could be driven by cash needs as Americans grapple with high prices on just about every item they buy. Before creating this site, I worked as an account executive for a wholesale mortgage lender in Los Angeles. My hands-on experience in the early 2000s inspired me to begin writing about mortgages 19 years ago to help prospective (and existing) home buyers better navigate the home loan process. Follow me on X for hot takes.Latest posts by Colin Robertson (see all)