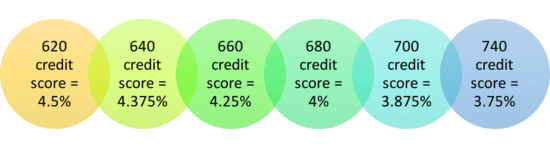

A reader recently asked, “What mortgage rate can I get with my credit score?” So I figured I’d try to clear up a somewhat complex question.With mortgage rates no longer at all-time lows (sigh), borrowers looking to refinance a mortgage or purchase a home are facing an uphill battle.Today, it’s much more common for your rate to start with a 6 or 7 as opposed to a 2 or 3. While these higher rates aren’t bad historically, the velocity of change over the past few years has been dramatic.This contrasts those 1980s mortgage rates, which were already high before simply moving even higher.But no matter where mortgage rates are, your credit score will play a huge role in determining whether you get a good, average, or not-so-good rate.What you see advertised isn’t always what you get, and could in fact be a lot higher if you’ve got marginal credit scores.Conversely, you might be able to score a below-market rate if you’ve got an excellent FICO score.Let’s explore why that is so you can set the right expectations and avoid any unpleasant surprises when you finally speak to a lender.Mortgage Rates Are Based on Your Credit ScoreThe illustration above should give you an idea of the importance of credit scoresWhen it comes to mortgages even a small difference in rate can equate to thousands of dollarsSomeone could have a rate 0.75% higher (or more) based on credit score aloneSo be sure all 3 of your credit scores are as high as possible before you apply!The graphic above was based on real advertised rates from Zillow’s marketplace for a $400,000 loan amount at 80% loan-to-value (LTV) for a 30-year fixed on an owner-occupied, single-family residence. While interest rates are quite a bit higher today, the same sliding scale rule applies.Those with higher credit scores will get the lowest mortgage rates available, while those with lower credit scores will have to settle for higher rates.Notice that the interest rate is a full 0.75% higher for a borrower with a 620 FICO score versus a borrower with a 740+ FICO score. That can equate to a lot of money over time. And mortgages can last a long time, sometimes 30 years!One thing that determines what mortgage rate you’ll ultimately receive is credit scoring, though it’s just one of many factors, known as mortgage pricing adjustments, used to determine the price of your loan.Along with credit scoring is documentation type, property type, occupancy type, loan amount, loan-to-value, and several others.Each pricing adjustment is essentially applied based on risk. So a borrower with a high-risk loan must pay a higher mortgage rate than a borrower who presents low risk to the lender.This is how risk-based pricing works.Borrowers with Lower Credit Scores Present More Risk to the Lender (And Must Pay More!)Simply put, the less risk you present to your mortgage lender, the lower your mortgage rate will be. And vice versa.That’s because they can fetch a higher price for your lower-risk home loan when they sell it on the secondary market.Lenders consider a number of things to measure risk, as mentioned above.Using credit score alone, it’s impossible to tell a prospective borrower what they may qualify for without knowing all the other important pieces of the puzzle.But I will say that your credit score is definitely one of the most important (if not the most important) factor that goes into determining your mortgage interest rate.And as I always say, it’s one of the few things you can mostly control. Pay your bills on time, keep your outstanding balances low, and apply for new credit sparingly.If you follow those simple tips, your credit scores should solid. It’s not rocket science.How Much Does Credit Score Affect the Mortgage Interest Rate?There are pricing adjustments specifically for credit scoresThey can raise your mortgage rate significantly if you have poor creditThe adjustments grow larger as credit scores move lowerAnd are especially impactful if you also come in with a small down paymentGenerally speaking, a credit score of 780 or above should land you in the lowest-risk bracket (it used to be 740 and before that 720). So it has gotten harder.If all other areas of your unique borrowing profile are also in good standing, you will qualify for a mortgage at the lowest possible interest rate.Of course, you’ll need to comparison shop to find that low rate too. It won’t necessarily come looking for you. But you should at least be eligible for the best a bank or lender has to offer.This lower monthly mortgage payment will allow you to save on interest over the entire mortgage term.As mentioned, credit score can be hugely important in determining pricing because lenders charge massive adjustments if your score is low.Just take a look at the chart above from Fannie Mae. If your credit score is 780 or higher, you’ll only be charged 0.375% (this isn’t a rate adjustment but rather a pricing hit) at 80% LTV (20% down payment).Conversely, if your credit score is between 640 and 659, you’ll be charged 2.25% in pricing adjustments.For the borrower with a 650 credit score, this might equate to an interest rate that is 0.75% higher on a 30-year fixed mortgage versus the 780-score borrower.That difference in rate could stick with you for years if you hold onto your mortgage.This means higher payments month after month for decades, all because you didn’t practice good credit scoring habits.Not only can a good credit score save you money monthly and over time, it will also make qualifying for a mortgage a lot easier.For these reasons, your credit score should be your top concern when applying for a mortgage!What Credit Score Do You Need for Best Mortgage Rate?Most mortgage rate ads you’ll come across make lots of assumptions (if you read the fine print)You’re often required to have a credit score of 740 or higher for the best rateIf your credit scores aren’t that good, expect a higher rate when obtaining a quoteFannie Mae and Freddie Mac now require a 780 FICO score for the lowest mortgage ratesIf you’ve ever seen a mortgage advertisement on TV or the Internet, the lender assumes you’ve got an excellent credit score.This could mean a credit score of 720, 740, or possibly even higher. And they use that assumption to produce a favorable mortgage rate in their ad.For example, Wells Fargo’s mortgage rate page has a disclaimer that reads, “This rate assumes a credit score of 740.”But without that great credit score, your mortgage rate could be significantly higher when all is said and done.And now that Fannie Mae and Freddie Mac have added new credit scoring tiers, these credit score assumptions may rise to 780 for the lowest advertised rates.Long story short, aim for 780+ credit scores from now on if you want to qualify for the best rates.Borrowers With Low Credit Scores May Have Trouble Getting ApprovedAt the other end of the spectrum, borrowers with credit scores of say 660, 640, and 620 will have greater difficultly securing a mortgage.Assuming they are able to get approved for a home loan, they will receive higher mortgage rates.Unfortunately, I can’t say you’ll get X or Y mortgage rate if you have Z credit score, there are just too many factors in play all at once. And credit score is just one of them, albeit a very important one.But I can say that your credit score is hugely influential in determining both the mortgage rate you’ll receive and whether you’ll successfully obtain home loan financing to begin with.So it’s recommended that you check your credit score(s) 3+ months before applying for a mortgage to see where you stand. And continue to monitor them up until you apply.This shouldn’t be much of a chore or even an expense now that so many companies provide free credit scores, including major banks and credit card issuers.For example, the many banks and credit card companies I do business with offer free scores. And it’s actually interesting to see the divergence in scores across different companies.[How to get a mortgage with a low credit score.]Check Your Credit 90+ Days Before Shopping for a Mortgage!Don’t chance it – check your credit scores 3+ months in advanceThis allows you to see where you stand credit-wise and gives you time to fix thingsIt may take months to turn things around if you need to improve your scoresThings like disputes may take 90 days or longer to complete and reflect in your scoresAim for a 780 FICO score to qualify for the best mortgage ratesIf you don’t know your credit scores several months in advance of applying for a mortgage, you may not have adequate time to make any necessary changes.Trust me, surprises come up all the time when it comes to credit.An erroneous (or forgotten) late payment could deflate your credit scores substantially, even if it’s reporting in error.And that lower score could increase your mortgage rate a percentage point or more. Yes, credit scores can make that much impact!Disputing errors and/or addressing other credit missteps can take many months to complete, so don’t hesitate to check your credit if you think you’ll be applying for a mortgage at any point in the near future.It’s good to know where you stand at all times, but especially before applying for a home loan. Don’t just assume you’ve got excellent credit. Verify it!And while you’re at, don’t make a lot of purchases before applying for a mortgage. That too can sink your scores.The good news is poor credit scores can be improved. You’re aren’t stuck with them. If your credit scores need some TLC, take the time to improve them instead of settling for a higher rate today.If your scores are already excellent, don’t forget to shop around! Simply comparing a few different lenders can be just as important as maintaining good credit.Read more: What credit score do I need to get a mortgage?