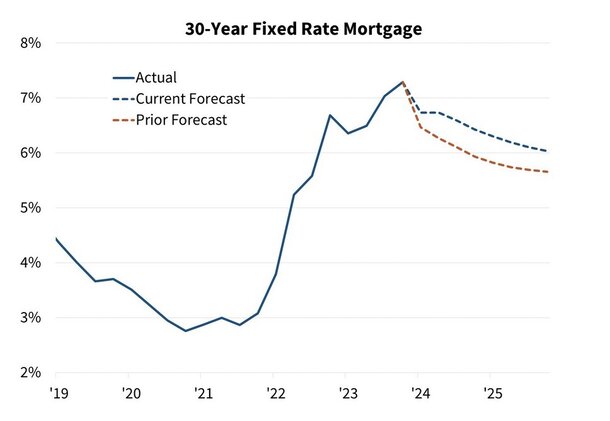

Construction at the Willows at Valley Run, an affordable housing development in Coatesville, Pa. The Biden administration's budget proposal lays out several initiatives to boost housing supply, and while many of those proposals enjoy bipartisan support, the odds of congressional action before November's elections is unlikely.Bloomberg News WASHINGTON — Two provisions of President Joe Biden's sweeping proposal to address home affordability could help ease the nation's housing supply woes and benefit banks along the way.Much of the White House's $258 billion affordable housing plan is unlikely to gain momentum on Capitol Hill before Congress shifts fully into campaign mode ahead of this fall's elections. But a pair of tax credits — one tried and true, the other brand new — appear to have broad appeal. The first is the Low-Income Housing Tax Credit, or LIHTC, a nearly 40-year-old program that has become a favorite among apartment developers across the country. The credit is granted in exchange for reserving a portion of their units as affordable rentals for at least 30 years.The second initiative is called the Neighborhood Homes Tax Credit, which would provide a similar tax break for those who build or renovate low-cost single family "starter" homes in areas of need."We have a huge hole in our housing supply that we dug for over 15 years, and we're not going to build that overnight. We're going to get out of it the same way we got into it, which is a shovel at a time," said David Dworkin, head of the housing affordability advocacy group National Housing Conference. "So, the housing supply elements of the president's plan, which have broad bipartisan support, are essential to moving forward."Support for the supply side proposals is broader than just among Democrats and their allies. Real estate industry groups are also heartened by elements of Biden's budget, too."Just a mere mention in his [State of the Union] address about building and preserving an additional 2 million homes, that was awesome," said Lake Coulson, chief lobbyist for the National Association of Home Builders. "Absolutely."LIHTCCreated by the Tax Reform Act of 1986, the LIHTC — colloquially pronounced "lie-tech" — has become an essential financing tool for developers. It has helped finance more than 3.5 million apartments, according to the Department of Housing and Urban Development. The program helps add between 50,000 and 60,000 units to the housing supply annually, according to analysis from the Urban Land Institute.The Biden plan calls for committing $37 billion to the program. It would also slash the minimum amount of tax-exempt bond financing eligible projects must secure from 50% of the total cost to 25%, allowing developers to secure more private funding for their projects. The White House estimates 1.2 million units would be built or preserved as a result of this proposal.Steve Adamo, president of residential and consumer lending at Toms River, N.J.-based OceanFirst Bank, said the LIHTC program plays a critical role in many of the construction projects to which his bank lends."It assists, pretty aggressively, the developers in our commercial lending space," Adamo said. "It's really important that the Low-Income Housing Tax Credit is available and viable for those developers. It's important for the lending industry as a whole."Congressional outlookThe LIHTC reforms endorsed by the White House already feature in pending legislation: the Tax Relief for American Families and Workers Act of 2024. Proposed by Sen. Ron Wyden, D-Ore., and Rep. Jason Smith, R-Mo., the bill also includes an expansion of the Child Tax Credit, research and development spending, and various business-friend reforms.The package enjoys bipartisan support, bolstering the LIHTC expansion as the housing policy most likely to come to fruition. But even that might not be enough to overcome the legislative hurdles that lie ahead, Isaac Boltansky, director of policy research at the investment bank BTIG, said.Debates over the funding of the government, addressing issues at the Mexican border and funding of foreign conflicts in Ukraine and Gaza are all higher profile issues that will take precedence in the months ahead, Boltansky, leaving little bandwidth for housing-related negotiations. "I don't see any reason to be optimistic moving forward that we'll see comprehensive action on housing, given the current legislative calendar," he said. "These guys are struggling to keep the lights on."Still, Boltansky said, a spending bill will eventually be passed and some funds will be committed to housing initiatives. While LIHTC stands a chance of being included in an omnibus package, he said the odds drop off substantially for other elements of the White House proposal.The other "interesting" proposal, Boltansky said, is the Neighborhood Home Tax Credit, which is also part of existing legislation being backed by both Democrats and Republicans — the Neighborhood Homes Improvement Act, which was introduced by Reps. Mike Kelly, R-Pa., and Brian Higgins, D-N.Y., last June. The Biden plan calls for $19 billion to be allocated to the credit over the next 10 years. Mark Zandi, chief economist for the ratings agency Moody's, said the credit would make it financially viable to make existing homes that have fallen into disrepair habitable again. While the program does not have the baked-in support network of the LIHTC, Zandi said he sees it as politically viable, even in a divided Congress."It's a tax credit, so Republicans will be more amenable to it than straight up spending, and I Democrats obviously are on board because it helps to create more supply, particularly in urban areas," he said. "Although, it is broad-based. There are a lot of rural areas with old dilapidated housing that would benefit, as well."Other initiativesThe White House proposal includes a number of grants that would also fund expansion of the housing supply, including $20 billion to local jurisdictions to fund "innovative" development projects — such as commercial to residential conversions. It set aside $1.25 billion for HUD to finance affordable housing projects and called for more funding of public housing projects. These initiatives have been received less warmly by Republicans. Less popular still are various proposals for expanding homeownership, such as providing down payment assistance and providing a $10,000 tax credit to homeowners who sell their starter homes — defined as properties valued below the area median home price — in an attempt to unlock more supply. Edward DeMarco, president of the Housing Policy Council, a trade group representing the mortgage origination and servicing industry, said such efforts would only induce more demand."Introducing additional consumer tax credits to buy a house at a time in which we clearly have demand outstripping supply in most, if not all markets, is simply a path to inflating house prices. That benefit is going to go to the home seller, not to the home buyer," DeMarco, a former acting director of the Federal Housing Finance Agency, said. "The effort to encourage home supply is really where all the action should be."Dworkin, who served as a senior advisor to the Treasury Department on housing and community development during the Obama administration, challenged this characterization. He said the proposal would not create more demand for homes, because the demand is already there."We're not increasing the demand. We're increasing the ability of people to meet the demand," he said. "The idea that housing prices are going to go up even more because a few more people are going to be able to make a down payment, just isn't credible."Still, Dworkin said, the administration will have to pick its battles. Because of this, he encouraged the White House to commit few resources to certain proposals. Specifically, he flagged a proposal that would provide a tax credit for first-time buyers to, effectively, buy a lower interest rate on their mortgages, noting that rates are set to come down in the near-term anyway."I'm reticent to spend that kind of money on a proposal that doesn't have strong congressional support, and that is solving what is likely to be a short-term problem," he said. "The question is where we choose to spend the limited dollars we have, and our biggest priority is around production and ways to help people make a down payment."Thinking localStakeholders on all sides of the housing sector agree that the biggest hindrance to the creation of new supply is at the local level, in the forms of restrictive zoning and arduous entitlement processes. Influencing these policies are largely beyond the reach of the federal government. Still, Adamo said the federal government can facilitate some needed zoning changes by making investments in critical infrastructure."They could assist in public-private partnerships to create more density. Whether it's electrical grids or wastewater management, there's lots of infrastructure at the very local level that needs to be addressed," he said. "There are some good initiatives in the housing credits and tax abatements for first time buyers and sellers, but to get more housing, we need to solve the issues that are taking place more locally."Still, some would rather see the Biden administration do less, not more."The most important thing that the federal government could do is to get out of the way and that is just philosophically at odds with this administration," former FHFA Director Mark Calabria said.Regulatory red tapeBiden's focus on environmental regulation as well as his energy and trade policies are the most frequently cited issues, but current bank regulatory proposals have also been flagged as potentially detrimental to the cause of expanding housing supply.DeMarco said the so-called Basel III endgame proposal from the Federal Reserve, Federal Deposit Insurance Corp. and Office of the Comptroller of the Currency includes provisions that would make it harder for banks to engage in various parts of the housing finance system."There were clearly, in the proposed rule, disincentives for bank participation in funding anything having to do with housing," he said. "A reevaluation of that proposal in terms of what it means for banks to be doing both construction lending as well as mortgage lending could be a net positive to bank participation and bank financing in this space."Fed Chair Jerome Powell said the regulators are considering changes to the sweeping risk capital reform package, noting that a full reproposal of the rule could be in the offing. 'Build, build, build'Like all presidential budgets, Biden's $3 trillion spending plan is largely aspirational and serves as a directional indicator for the administration's priorities. Still, housing remains a top concern for many voters, so there are political points to be won and lost. As lawmakers in Washington grapple with the issues, Zandi said the policies focus most squarely on supply on the ones that the administration should emphasize."The president said 'build, build, build,' and I'm fully on board with that," Zandi said. "If you've got limited political capital and you're going to spend it on something, it has to be supply."