Rocket, Mr. Cooper merger: HMDA data reveals market impact

unitedbrokersinc_m7cmpd2025-05-19T11:22:31+00:00Rocket Mortgage is buying Mr. Cooper in what could be a transformative deal for the industry, so we looked at what it might mean for mortgage production based on select Home Mortgage Disclosure Act datasets.An analysis of available 2024 HMDA data through iEmergent shows that while Mr. Cooper's servicing strength could eventually help Rocket compete with its closest origination rival, the combination alone won't immediately change its ranking.What follows below are some numbers behind that conclusion and others reached based on modified loan-application register data. All combined numbers are pro forma as the acquisition has not closed, but it is expected to receive the regulatory approvals needed to do so in 2025.

Investors await another Monday jolt after Moody's downgrades US

unitedbrokersinc_m7cmpd2025-05-18T19:22:37+00:00Investors face yet another bumpy start to the trading week, although it's mounting concern over US debt rather than tariffs likely generating the volatility this time.Financial markets reopen in Asia on Monday after Moody's Ratings announced Friday evening it was stripping the US government of its top credit rating, dropping the country to Aa1 from Aaa. The company, which trailed rivals, blamed successive presidents and congressional lawmakers for a ballooning budget deficit it said showed little sign of narrowing.READ MORE: How Trump's wild tariff ride has changed mortgagesThe downgrade risks reinforcing Wall Street's growing worries over the US sovereign bond market as Capitol Hill debates even more unfunded tax cuts and the economy looks set to slow as President Donald Trump upends long-established commercial partnerships and re-negotiate trade deals. In a potential sign of things to come on Monday, 10-year Treasury yields rose as high as 4.49% in thin volumes on Friday and an exchange-traded fund tracking the S&P 500 fell 0.6% post-market."A Treasury downgrade is unsurprising amid unrelenting unfunded fiscal largesse that's only set to accelerate," said Max Gokhman, deputy chief investment officer at Franklin Templeton Investment Solutions. "Debt servicing costs will continue creeping higher as large investors, both sovereign and institutional, start gradually swapping Treasuries for other safe haven assets," he added. "This, unfortunately, can create a dangerous bear steepener spiral for US yields, further downward pressure on the greenback, and reduce the attractiveness of US equities."Michael Schumacher and Angelo Manolatos, strategists at Wells Fargo & Co., told clients in a report that they expect "10 year and 30 year Treasury yields to rise another 5-10 basis points in response to the Moody's downgrade."LEARN MORE: Mortgage rate trackerA 10 basis point increase in the 30-year yield would be enough to lift it above 5% to the highest since November 2023 and closer to that year's peak, when rates reached levels unseen since mid-2007.While rising yields typically boost a currency, the debt worries may add to skepticism over the dollar. A Bloomberg index of the greenback is already close to its April lows and sentiment among options traders is the most negative in five years.'Loss of Confidence'European Central Bank President Christine Lagarde told La Tribune Dimanche in an interview published on Saturday that the dollar's recent decline against the euro is counterintuitive but reflects "the uncertainty and loss of confidence in US policies among certain segments of the financial markets."Rising Treasury yields would also complicate the government's ability to cut back by running up its interest payments, while also threatening to weaken the economy by forcing up rates on loans such as mortgages and credit cards.US Treasury Secretary Scott Bessent downplayed concerns over the US's government debt and the inflationary impact of tariffs, saying the Trump administration is determined to lower federal spending and grow the economy.Asked about the Moody's Ratings downgrade of the country's credit rating Friday during an interview on NBC's Meet the Press with Kristen Welker, Bessent said, "Moody's is a lagging indicator — that's what everyone thinks of credit agencies."In a move that may help temper some of the negative market sentiment, President Trump said over the weekend he'll have a phone call with Russian President Vladimir Putin on Monday morning to discuss how to stop the war in Ukraine.Moody's move was anticipated by many given it came when the federal budget deficit is running near $2 trillion a year, or more than 6% of gross domestic product. The US government is also on track to surpass record debt levels set after World War II, reaching 107% of GDP by 2029, the Congressional Budget Office warned in January.Moody's said it expects "federal deficits to widen, reaching nearly 9% of GDP by 2035, up from 6.4% in 2024, driven mainly by increased interest payments on debt, rising entitlement spending, and relatively low revenue generation."Despite such sums, lawmakers will likely continue work on a massive tax-and-spending bill that's expected to add trillions to the federal debt over the coming years. The Joint Committee on Taxation had pegged the total cost of the bill at $3.8 trillion over the next decade, though other independent analysts have said it could cost much more if temporary provisions in the bill are extended.Analysts at Barclays Plc said in a report that they did not expect the Moody's downgrade to change votes in Congress, trigger forced selling of Treasuries or have much impact on money markets. Treasuries have often rallied after similar actions in the past. "Credit downgrades of the US government have lost political significance after S&P downgraded the US in 2011, and there were limited, if any, repercussions," said Michael McLean, Anshul Pradhan and Samuel Earl of Barclays. Around the same time Moody's was announcing its decision, the US Treasury was reporting China had reduced its holdings of Treasuries in March. While that may further encourage speculation the world's second largest economy is lowering its exposure to US debt and the dollar, Brad Setser, a former Treasury official, said on X that the data suggested "a move to reduce duration than any real move out of the dollar."Despite the recent trade tensions and worries over fiscal profligacy, the Treasury statistics suggested foreign demand for US government securities remained strong in March, indicating no signs of a revolt against American debt.Still, traders will be hard at work early again on Monday, just a week since they had to react quickly to weekend news of an improvement in trade relations between the US and China.

US states likely to defy US downgrade to keep top credit ratings

unitedbrokersinc_m7cmpd2025-05-18T18:22:34+00:00US states from Florida to North Carolina and Texas would likely hold onto top-notch credit scores from Moody's Ratings, mostly because they're in better fiscal shape than the federal government itself. More than a dozen states have pristine triple-A ratings from Moody's, according to Bloomberg-compiled data, ranking them higher than the US government, which was stripped of its last top credit rating on Friday. That's in part thanks to requirements for all but one, including the District of Columbia, to balance their operating budget in some form, according to a 2021 report by the National Association of State Budget Officers.READ MORE: Inflation news helps to push mortgage rates higherAnalysts at JPMorgan Chase & Co. also suggested in a note on Friday that states should be relatively immune. They cited a Moody's report from 2023, when the ratings firm changed its outlook on the US government to negative, that few public finance issuers were directly affected by that revision.For the country, it's a different story. Policymakers have consistently "failed to agree on measures to reverse the trend of large annual fiscal deficits and growing interest costs," Moody's said Friday when it downgraded the federal government to Aa1.The move reflects deepening concern that ballooning debt and deficits will damage America's standing as the preeminent destination for global capital and increase the government's borrowing costs. That worry was swiftly reflected in market moves Friday as 10-year Treasury yields shot higher, and as an exchange-traded fund tracking the S&P 500 also fell. READ MORE: Tariff shock: Where smart money is going in mortgage, housingOther parts of the financial markets, including $9 trillion of mortgage bonds effectively guaranteed by the US government, could see increased volatility Monday since they're more exposed to interest-rate moves. And while few US companies hold AAA credit scores — just Johnson & Johnson and Microsoft Corp. have those from S&P Global Ratings, for example — borrowing costs for corporates may rise as the premiums they pay to borrow are based off government debt yields as a starting point. If history is any guide though, US states should be fairly resilient. US states rated AAA by Fitch Ratings kept their top credit ratings even after it downgraded the US to AA+ in 2023. At the time, Florida Governor Ron DeSantis said his state was a "blueprint" for the federal government to follow. Still, the impact will likely be felt in some areas of the muni market — just as it was with Fitch's downgrade. After its move, Fitch cut billions of dollars worth of municipal debt that was linked to the country's rating, such as pre-refunded municipal bonds with repayments that are wholly dependent on US government and agency obligations held in escrow. Credits like DC and some housing transactions do have connections with the federal government, according to the JPMorgan analysts, who once again cited the Moody's report from 2023. After its revision in 2023, Moody's also changed the outlook on its Aaa rating of the Smithsonian Institution to negative from stable. The move reflected "the material funding and governance linkages between the Smithsonian and the United States government."More VolatilityThe muni market, in addition to corporates across America, could be impacted in other ways by the move higher in US Treasury yields. State and local debt tends to take its cues from that market.Municipal housing bonds that are mainly secured by mortgage-backed securities issued by Ginnie Mae, Fannie Mae or Freddie Mac saw their ratings cut at the time of Fitch's downgrade. Prices of MBS fall when interest rates fluctuate, and any further moves would add to recent gyrations triggered by tariffs that proved painful for the bonds."Volatility remains elevated, particularly with long rates reaching relatively high levels recently," said Neil Aggarwal, a portfolio manager at Reams Asset Management. "So fixed-income investors I think do have some concerns regarding growth and liquidity already." Volatility increased after Fitch's downgrade in 2023, hurting returns for some investors relative to Treasuries. But on a bigger scale, Aggarwal said the overall impact for MBS would likely be contained. Major holders of the bonds don't tend to be overly sensitive to changes in government ratings, barring a bigger or unexpected downgrade. "Given it was a half-step downgrade and other rating agencies had already gone first, the direct impact is likely to be less than rate volatility impact," said Ken Shinoda, a portfolio manager at DoubleLine Capital. Following its downgrade of the US, Fitch also cut the ratings of Fannie Mae and Freddie Mac, which remained in government conservatorship after being taken over during the 2008 global financial crisis. That in turn caused credit ratings for over 400 securities tied to the two entities to be lowered.

Mortgage Rates Aren’t That High

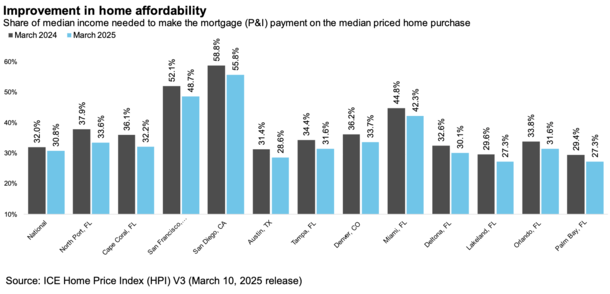

unitedbrokersinc_m7cmpd2025-05-18T17:22:23+00:00With mortgage rates staying stubbornly elevated, new narratives are being written in an attempt to change that view.A popular one of late has been arguing that mortgage rates aren’t that high today. Or not as high as people think.The rationale is that when you zoom out, mortgage rates are actually pretty middle of the road historically, which bucks the misconception that they’re high.After all, they were in the high double-digits in the 1980s, and still start with a 6 today. Seems okay, right?So is it true that mortgage rates aren’t so bad?Context Is Key for Mortgage RatesI could sit here and tell you the same thing. That mortgage rates aren’t that high. But what purpose would that serve if the proposed monthly payment still doesn’t pencil?And what solace would that provide if you knew you missed the boat on snagging a 2-3% fixed rate just a few years earlier?It probably wouldn’t give you any comfort unless you’re an extreme optimist. Instead, you’re probably just doing the math like everyone else and not liking what you see.If you’re a prospective home buyer today, mortgage rates are top of mind. And you probably don’t care what the long-term average is for the 30-year fixed.Spoiler alert: It’s a higher 7.75%, or about 75 basis points (bps) above current levels.Does this mean the 30-year fixed is a screaming bargain today? I wouldn’t say so, but others might try to make that argument.The biggest pain point of the past few years has been the magnitude of change in mortgage rates (going from sub-3% to 7%+ in just over a year).Sure, mortgage rates sit below their long-term average. And without a doubt, they’re more than half that of the 1980s mortgage rates, when the 30-year fixed nearly cracked 19%.But knowing that still might not change the fact that buying a home today has fallen out of reach for many.Home Buyer Affordability Remains a Challenge but Is Slowly ImprovingPerhaps instead of looking at mortgage rates in a vacuum, we should consider overall housing affordability.After all, mortgage rates could be higher today and buying conditions more affordable, assuming home prices were lower and/or wages were higher.Taking a holistic view allows us to reduce focus on mortgage rates and look at the big picture.It also forces us to ask why housing is so expensive today, an answer that commonly goes back to a lack of available supply.There’s still a deficit of homes for sale in most markets nationwide, though it is beginning to ease some.A recent report from ICE found that the share of median income required to make a principal and interest payment fell from 32% in March 2024 to 30.8% in March 2025.It’s not a huge difference, but at least it’s moving in the right direction. And ironically, as pertains to this post, it’s likely better mostly due to lower mortgage rates.So as much as folks want to say mortgage rates don’t matter, they do. They’re a bit lower than they were a year ago, despite remaining elevated.In fact, a 1% drop in mortgage rates is equal to a 10%+ drop in homes prices. Meaning it’s probably more effective to get rates lower than it is a price correction/crash.Especially when there is a shortage of homes on the market. Supply is really what drives prices, not mortgage rates.Another Soft Spring for Home Buying Due to High Mortgage Rates?A different report from ICE from May found that home purchase applications haven’t risen as much as one would expect for this time of the year.We’re basically at peak home buying season and despite many YoY gains in weekly mortgage applications, the numbers just aren’t there (also recall 2024 home sales were the worst since 1995).Through April 25th, applications rose in each of the prior 13 weeks, but were only up 3% YoY in the week of April 25th.ICE noted that it’s “a much lower rate of growth than the typical +9% to +24% expected” during this time of the year.So even if mortgage rates “aren’t that high,” combined with where home prices and wages are, they appear to be cost-prohibitive.The proof is that home purchase apps “spiked in the immediate aftermath of reciprocal tariff announcements in early April” when mortgage rates temporarily dipped.So it’s clear rates still matter, a lot. And if/when they go down, home buyers tend to pounce.At the same time, one could argue that the artificially low mortgage rates seen over much of the past decade masked other issues like eroding affordability due to rapidly ascending home prices and a lack of available supply.We essentially got away with it while mortgage rates ran at more than 50% off their historical, long-term average.But now that rates are back to “normal,” the math simply ain’t mathing.Read on: The Trick Home Builders Use to Sell More Homes Before creating this site, I worked as an account executive for a wholesale mortgage lender in Los Angeles. My hands-on experience in the early 2000s inspired me to begin writing about mortgages 19 years ago to help prospective (and existing) home buyers better navigate the home loan process. Follow me on X for hot takes.Latest posts by Colin Robertson (see all)

Appeals court hears CFPB argument for 90% reduction in force

unitedbrokersinc_m7cmpd2025-05-18T18:22:38+00:00John Heltman A panel of appellate judges will decide whether the Trump administration can fire 90% of the Consumer Financial Protection Bureau's staff through a reduction-in-force without impacting the agency's legally-mandated work.On Friday afternoon, a three-judge panel of the U.S. Court of Appeals for the District of Columbia heard oral arguments on whether a district court erred in issuing an injunction that stopped the CFPB leadership from cutting roughly 1,500 employees through a government RIF. The Trump administration argued that cutting staff was not a final agency action, or even a policy, and therefore is not reviewable by the courts under the Administrative Procedure Act. The APA, enacted in 1946, provides a framework for how agencies create and enforce rules, and what can be reviewed by courts.At the hearing, Judge Gregory Katsas highlighted the lack of a clear statement by CFPB officials to shut down the agency, which could be a legal hurdle for the agency's union, which has argued that CFPB officials have been working behind the scenes to dismantle the agency. "This has a little bit of a nailing-Jello-to-the-wall quality to it," said Katsas, a Trump appointee. "The agency action feels a little hard to pin down. There's no agency record. There's no rule or order. What's the end game other than some form of very ongoing and intrusive judicial supervision?"The National Treasury Employees Union sued acting CFPB Director Russell Vought in February to halt mass firings. Vought appealed a preliminary injunction that restricted his ability to reorganize and reduce the CFPB's staff. The Department of Justice, defending Vought, has argued that a district court injunction was an unwarranted intrusion on the executive branch's authority to manage the CFPB, and that the union's claims lacked legal and factual basis.Last month the same appeals court's panel sided, in part, with the Trump administration by allowing some firings to resume. But the court's three-judge panel narrowed the district court's injunction and instead required CFPB officials to make a "particularized assessment" to determine which employees are necessary for the agency to perform its legally-mandated duties. Eric McArthur, a Department of Justice lawyer defending the CFPB, said that if CFPB officials had made a decision to shut down the agency without legislation, then it would be unlawful.But he claimed that the CFPB's leaders determined, after an assessment, that only 200 employees are necessary for the agency to perform its statutory functions, and that they are allowed to fire the remaining employees without judicial oversight. "The new leadership of the bureau has a radically different vision for this agency and the way it has been operated in the past, and wants to strip it down, as it were, to the statutory studs," McArthur said. "That is a lawful policy. To do only the bare statutory minimum is lawful. Whether that latter policy decision is good policy or bad policy is not for the courts to review. That is ultimately for the American people to decide whether that's a good policy through their elected representatives, and ultimately, at the ballot box."Judge Cornelia Pillard disputed McArthur's claim that CFPB officials had no intention of shutting down the agency. She disputed whether it was possible to "radically scale down" the agency without CFPB officials having a plan to do so. "There's a lot of factual evidence raising solid inferences as to what the district court found and your response to that, I take it, is that's all a misunderstanding," said Pillard, who is an appointee of President Obama. "Radically scaling down without a plan also seems to me to be extraordinary. I don't think that's the way it's been done in the past."To which McArthur said: "It is certainly unusual … and I wouldn't say there was a lack of a plan. I discern a very clear governing policy here, which is: 'We're going to minimize, to the extent possible, the elimination of non-statutorily required functions.'"But at another point in the hearing, McArthur disputed that there was a plan and he sought to characterize emails sent to staff from Vought and the CFPB's Chief Legal Officer Mark Paoletta ordering employees to stop working as a "a pause of non-urgent work that doesn't say we're not going to perform our statutory duty.""We don't think there was ever any decision — authoritative or otherwise — to shut down the agency," McArthur said, referring to a stop-work order in February. "This was at a particular moment where the building was shut down for the week because it was unsafe to come in because of the protest activity around the building, and it was a provisional and temporary measure." Jennifer Bennett, a principal at the law firm Gupta Wessler, which is representing the union plaintiffs in the case, claimed that a record of emails and witness statements submitted at the district court's evidentiary hearing showed that CFPB officials took several actions that, when taken as a whole, amounted to a dismantling of the agency. "There would actually be quite a danger of holding this shutdown is not a final agency action," Bennett said. "Getting rid of an agency is a separation of powers violation. The facts and what the district court found is they were getting rid of the agency completely. And so that I think is a clear constitutional violation."Many of the questions asked by the judges dealt with whether the firings amounted to a violation of the Constitution or a statutory claim. The CFPB was created by the Dodd-Frank Act of 2010, and specifically the Consumer Financial Protection Act vested in the CFPB the power to enforce and administer 18 consumer finance laws. Those laws had been spread among many different regulatory agencies. The CFPB's union claims that the proposed reduction in force would significantly harm the CFPB's ability to function and protect consumers. The bureau's actions, the union claims, violate the collective bargaining rights of employees who are NTEU members. Bennet claimed that the CFPB's leadership has sought to usurp legislative authority. The stop-work order was used as a justification to eliminate staff."The stop work order is a permanent decision — and, I'll note, it's a justification not just for firing people, but for RIFs, which isn't just actually firing people; a RIF is technically eliminating that position from the agency entirely," she said. "They use the stop work order as a justification to fire people from the agency."At one point, Judge Neomi Rao cut in to question whether a "district court judge is going to decide the extent of RIFs that the executive branch thinks is appropriate? So there would just be constant judicial supervision: You can do 40% RIFs, but you can't do 50%? What would that possibly look like?"Bennet said an injunction that said "don't shut down the agency" would work. "I want to be really clear that we are not saying that this preliminary injunction would be the permanent injunction," she said. "But what this preliminary injunction does is … ensures that we are not having to worry about the agency being shut down in the interim as the case goes on."Both Katsas and Rao, at different points, suggested that the plaintiffs had an Article 2 claim, in which the president was not living up to his duties to faithfully execute laws, particularly in the context of public-facing functions such as a consumer complaint database. "I do think that the clearest constitutional violation here is the one that the district court found, which is that they were shutting down the agency without any authorization," Bennett said.Katsus said the court is being put in the position of deciding how many employees can be fired while still having the CFPB perform its functions, such as answering the phone."What might an injunction look like that would not involve this problem of, at what point are you firing too many people?" Katasas asked. "Or at what point are you canceling too many contracts, losing too many offices?"

CFPB proposes end to pandemic servicing requirement

unitedbrokersinc_m7cmpd2025-05-16T22:22:40+00:00The Consumer Financial Protection Bureau published a proposed rule in the Federal Register on Friday that could scale back some procedures added for mortgaged homeowners with hardships due to COVID-19.The temporary requirements added during the pandemic have largely sunset, and one aspect that has not is on track to be addressed by a planned revision to broader regulation, according to the proposal Russell Vought, acting director of the Consumer Financial Protection Bureau, authorized."In light of the end of the COVID-19 pandemic, these regulations needlessly complicate Regulation X without commensurate benefits," Russell Vought, acting director at the Consumer Financial Protection Bureau, said in the proposed rule.The proposed change, in line with the Trump administration deregulatory agenda, is an example of how some rules the CFPB is planning to roll back are being processed through Federal Register publication and comment periods. The 30-day comment period for this change ends June 16.One sticking point in rolling back the rule may be the flexibility some in the industry have been using in the section that hasn't officially expired, according to law firm Bradley Arant Boult Cummings."In our opinion, the CFPB is understating the impact of rescinding the anti-evasion exception for some loan modifications," Jonathan Kolodziej and Jason Bushby, attorneys at the law firm, wrote in commentary posted on its website.The attorneys showed concern that servicers have been using that aspect of the 2021 final rule to "continue offering certain loan modification options in a streamlined fashion" and rescinding it could require procedural change.The proposed 2024 revision of the larger Reg X that governs servicing — which would have removed the temporary pandemic contingencies — addressed that concern, according to the bureau. The bureau promised it will pick up where it left off and review previous feedback "received in response to the 2024 proposed rule, including comments related to applying the loss mitigation lessons learned from the COVID-19 pandemic."Two other parts of the 2021 rule that have already sunsetted were some temporary borrower contact requirements and extra steps before starting foreclosure.The early intervention requirements ended Oct. 1, 2022 and the additional pre-foreclosure procedures only applied to loans to foreclosure starts before Jan. 1 of that same year.

Rocktop buys Incenter Capital, expecting robust MSR market

unitedbrokersinc_m7cmpd2025-05-16T21:22:35+00:00Rocktop Technologies' purchase of Incenter Capital Advisors is both complementary to its current capabilities as well as a way for the company to differentiate itself.Terms of the deal, which was completed on May 15, were not disclosed. For now, Incenter Capital Advisors will retain its current branding."We are very tech heavy, tech enabled, we have a very strong expertise set that sits around the capital market space in particular," said Brett Benson, Rocktop's co-president and chief investment officer, in an interview. "Just our combined domain expertise here is where we get very excited about the opportunity set."Incenter Capital Advisors brokers and consults on the trading and pricing of mortgage servicing rights along with post-transactional support in the transference of these assets.Why Rocktop wanted to buy Incenter Capital AdvisorsAmong those synergistic pieces is Rocktop's MSR valuations, due diligence functions and transaction management functions that are complementary with the business it acquired, Benson said.Rocktop has had personal relationships with Incenter Capital Advisors executives for a number of years, including its managing director, Tom Piercy."The opportunity came about partially because of our perspective on where the market is going," Benson said. "It has been a very light trading environment for the past couple of years; our expectation is that we will have a more robust — I won't use the word healthy, I will say more robust — market going forward."Focusing on AI and blockchainIn turn, Rocktop has been focused on the technology wthat enhances the trading operations functions, including artificial intelligence and blockchain."We have been working very heavily on using those AI functions for data mapping and servicing transfers and the capital markets, trade ops functions. For those reasons, and just the personal relationships we've had with the Incenter Capital Advisors group, particularly Tom Piercy, the discussions kind of took a life of their own," Benson noted.At some point during those talks it became clear that it made more sense for Rocktop to acquire Incenter Capital Advisors, rather than just do a partnership.His views for a more robust MSR market is based on increases in both origination activities and distress for borrowers. In turn those naturally lead to more capital market activities.The outlook for MSR trades in 2025It is the balancing of mortgage rates, something that hasn't existed for some period of time, that will lead to more origination activity. In turn, it will add more supply to the MSR market and that should lead to more trading, Benson said.Another factor is delinquency rates, which are picking up. That too leads to more MSR trades as servicers look to move distressed portfolios."By aligning Rocktop's strengths in data and document management, intelligent workflow automation, and AI-driven analytics with Incenter Capital Advisors' client-facing market execution, deep valuation expertise and data sets, we will create a powerful feedback loop between valuation intelligence, real-time market signals, and process efficiency," said Piercy in a press release. "This will allow institutional mortgage investors to act more strategically — and more confidently — across the entire lifecycle of MSR and whole loan investing for best execution," he added.Piercy is remaining with Incenter Capital Advisors.While Incenter Capital Advisors was sold, other business lines remain with Incenter Lender Services, including property tax, insurance, loan diligence, student lending, appraisal, title, and marketing services and solutions, as well as CampusDoor, a private student lending technology platform.

Fraudsters get prison for $1.3M Virginia home scheme

unitedbrokersinc_m7cmpd2025-05-16T20:22:34+00:00Two men will spend multiple years in federal prison for a scheme to buy a $1.3 million Virginia home. A federal judge this week sentenced Herman Estes Jr., of Fieldale, Virginia to 84 months in prison for the wire and tax fraud to purchase the Roanoke County home in March 2023. A co-conspirator, Daniel Heggins of Charlotte, North Carolina, was also sentenced to 24 months in prison. Feds say Estes tendered a fraudulent cashier's check for $1,307,199 supposedly drawn off a Federal Reserve Bank to buy the property. The money was debited to a settlement company's trust account overseen by Heggins before the check was flagged as fraudulent. In 2021, Estes filed a false amended income tax return claiming he was entitled to a $18.3 million refund; he amended a subsequent return in 2023 for an additional $2.9 million refund. The Bureau of Alcohol, Tobacco and Firearms and the Internal Revenue Service investigated the case.The median sold home price in Roanoke County today is $360,500, according to Realtor.com. The home in the case was located on Old Mill Plantation Road, a pricey enclave in the county. According to a superseding indictment, Estes contacted a real estate agent online about the property, and provided a false letter showing he was approved for a private real estate loan for $1.3 million. The filing also said Estes uploaded extensive false trust documents via a cloud-based eClosing platform. Both men were also sentenced to three years of supervised release. The punishment comes amid an emphasized push by the Trump administration's housing regulators to eliminate fraud, waste and abuse in the market. Regarding home loans, Federal Housing Finance Agency Director Bill Pulte has established a fraud tip line, and publicly mulled Fannie Mae and Freddie Mac collaborating on combatting fraud and recalling loans.

Conservatives block tax bill, including bank-favored riders

unitedbrokersinc_m7cmpd2025-05-18T18:22:43+00:00Rep. Chip Roy, R-Texas, during a joint session of Congress in the House Chamber of the U.S. Capitol in Washington, D.C., on March 4, 2025. Bloomberg WASHINGTON — The House Budget Committee failed to advance House Republicans' tax and spending bill, a stunning failure for the bill that would have given banks many items on their legislative wish list. The House committee voted 21-16 to reject the bill, with Republicans Chip Roy of Texas, Ralph Norman of South Carolina, Josh Brecheen of Oklahoma and Andrew Clyde of Georgia joining Democrats in voting against President Donald Trump's "big, beautiful bill." "We don't need 'GRANDSTANDERS' in the Republican Party," Trump said in a social media post just hours before the vote on Friday. "STOP TALKING, AND GET IT DONE! It is time to fix the MESS that Biden and the Democrats gave us. Thank you for your attention to this matter!"The Republican holdouts are demanding more cuts to Medicaid and other programs. The Republican caucus is also balancing the interests of lawmakers from Democratic-led states who demand a larger state and local tax, or SALT, deduction, and more moderate members who don't want extreme cuts to Medicaid. "We are writing checks we cannot cash, and our children are going to pay the price," Roy told the committee. "So, I am a 'no' on this bill unless serious reforms are made." The panel will hold another vote on Monday, according to Rep. Lloyd Smucker, R-Pa., who changed his vote to "no" in order to bring up the bill again in the committee. This development throws into jeopardy many of the big wins that banks received in the original version of the tax bill, including making permanent the Section 199(a) pass-through deduction of 23%, which would apply to many community banks. The Section 199(a) provisions currently allow owners of pass-through entities to deduct up to 20% of their taxable income from those entities. Bank groups say extending the provision to 23% and making it permanent would keep community banks' tax rate in line with the corporate tax rate. Other measures favoring banks, particularly community ones, are also likely safe. The Ways and Means tax bill that passed through committee earlier this week included the ACRE Act, exempting taxation interest on loans secured by farmland and most residential mortgages in small towns, which is politically popular. Less sure is the future of so-called MAGA accounts. House Republicans included a measure called Money Accounts for Growth and Advancement, or MAGA accounts, for children born roughly within Trump's term. The government would seed these accounts with $1,000, and although balances would grow tax free, there would be taxes and penalties for withdrawing the money, especially if the child does so before age 30.Brokers and banks who hold these accounts might benefit from the added business.The conservative Republican revolt could also mean that lawmakers need to revisit other measures to please hardliners who want the bill to be budget-neutral, such as higher taxes on some trades, stock buybacks or corporate earnings. It could also present an opportunity for banks. Notably, the bill out of Ways and Means did not include any change to credit unions' tax exemption, a longtime ask of bankers on Capitol Hill. It's more likely that cuts will come on the spending side, but it will be difficult to balance the budget, or get close to it, without making cuts to programs that Republicans in vulnerable districts have warned would be politically toxic.