Meet The New Agency SEO Template From The Avada Team

Sed ut perspiciatis unde omnis iste natus error sit voluptatem accusantium doloremque laudantium.

See Our Top Notch Services

Sed ut perspiciatis unde omnis iste natus error sit voluptatem accusantium doloremque laudantium.

Our Work

Sed ut perspiciatis unde omnis iste natus error sit voluptatem accusantium doloremque laudantium.

Our Plans

Sed ut perspiciatis unde omnis iste natus error sit voluptatem accusantium doloremque laudantium.

Standard

- 5 Projects

- 5 GB Storage

- Unlimited Users

Premium

- 10 Projects

- 15 GB Storage

- Unlimited Users

Professional

- 15 Projects

- 30 GB Storage

- Unlimited Users

Extreme

- Unlimited Projects

- Unlimited Storage

- Unlimited Users

Our News

Sed ut perspiciatis unde omnis iste natus error sit voluptatem accusantium doloremque laudantium.

CFPB court battle with union continues with no end in sight

Bloomberg News Key Insight: The Consumer Financial Protection Bureau is going to run out of money early next year, putting the agency in violation of a preliminary injunction.What's at Stake: Acting Director Russell Vought says that because he cannot request funding for the agency, he may have to furlough employees or be unable to pay them. Forward Look: Legal experts say if an appeals court agrees to rehear the case, it will be months before a decision is reached. The Consumer Financial Protection Bureau and the National Treasury Employees Union agree that a preliminary injunction barring acting CFPB Director Russell Vought from firing employees remains in effect.But the two sides differ on how the district court should respond if the CFPB refuses to request money from the Federal Reserve System to pay its employees, putting it in violation of the injunction. On Friday, the CFPB and its union filed legal briefs in response to a request from U.S. District Court Judge Amy Berman Jackson, who has been overseeing the NTEU's lawsuit against Vought to halt a plan to fire up to 90% of the bureau's employees.In the latest twist, Vought told both courts last month that the CFPB will run out of money next year — and will likely be in violation of the court's preliminary injunction because he will be unable to pay employees. Vought alleges he cannot request funding from the Federal Reserve System because the central bank is unprofitable, though — in yet another twist — the Fed expects to turn a profit in early 2026. Brett A. Shumate, an assistant attorney general in the Department of Justice's civil division, said in a three-page brief that the district court should take a limited approach. He claimed that a decision in August by a panel of the U.S. Court of Appeals for the District of Columbia Circuit in favor of the Trump administration is the current law, even though it has been stayed on appeal."The Court should interpret the injunction narrowly to achieve the limited effect of temporarily remedying the early 2025 actions the Court found occurred and were unlawful, rather than as addressing separate questions regarding whether Congress has appropriated sufficient funds for the Bureau to discharge all its obligations under statute or court order throughout 2026," Shumate wrote. Meanwhile, Jennifer D. Bennett, representing the NTEU, said the preliminary injunction "remains in effect," and that the court "has authority to clarify the scope of its order and, if it is violated, to enforce it," according to the union's five-page brief filed Friday.Both sides are waiting for the D.C. Circuit to agree to rehear the case. Vought and President Trump have both publicly stated that they want to eliminate the CFPB. Vought has argued that as director, he has broad control over the agency's staff and direction. To that end, the DOJ urged the district court to take a narrow approach."District courts are not 'roving commissions' assigned to pass on how well federal agencies are satisfying their statutory obligations," and "may intervene only when a specific unlawful action harms the plaintiff, and only to the extent necessary to set aside that action," Shumate wrote.The CFPB's roughly 1,400 employees have been fighting for their right to continue working at the agency. The Trump administration locked employees out of their Washington, D.C., headquarters in February and has been working to get the bureau's remaining civil servants to resign, according to current and former employees. For the past nine months, employees have been told to be "work ready," though most are not working. Last week, employees received emails notifying them that if they haven't used their cell phones, to turn them in to the agency. Legal experts say it could be months before any court action. JoAnn Needleman, leader of the financial services regulatory and compliance group at the law firm Clark Hill, said that if the D.C. Circuit grants the en banc petition to rehear the case before the full court, then it would set a briefing schedule to hear the case in April or May, and the court likely would rule in September. The preliminary injunction was initially aimed to prevent a mass layoff and it is unclear how the courts will deal with the new funding issue being raised by the CFPB. Vought and some Republicans have advocated a novel legal theory that under the Dodd-Frank Act, the CFPB cannot request funding if the Fed doesn't turn a profit.

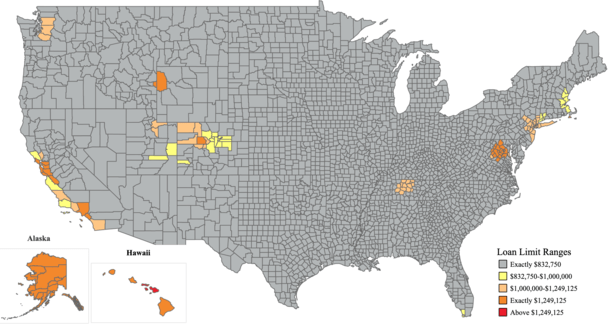

2026 Conforming Loan Limit Climbs to $832,750

The 2026 conforming loan limits were released during the holiday week and (surprise, surprise) they’re higher!In case you weren’t aware, these loan limits are driven by the annual change in home prices, and yes, property values went up.While there have been pockets of weakness lately, namely in places like Florida and Texas, home prices still increased nationally.As such, the 2026 conforming loan limit will be $26,250 higher versus 2025, rising from $806,500 to $832,750.And in high-cost regions, the ceiling loan limit for one-unit properties will be a whopping $1,249,125.2026 Conforming Loan Limits Climb Again1-unit property: $832,7502-unit property: $1,066,2503-unit property: $1,288,8004-unit property: $1,601,750The FHFA announced last week that the conforming loan limit for mortgages backed by Fannie Mae and Freddie Mac rose to $832,750 for 2026.This marks an increase of $26,250 from the 2025 loan limits, driven by a 3.26% rise in home prices between the third quarters of 2024 and 2025.It’s not quite as large as the 5.2% increase seen a year ago, but it’s higher nonetheless.In high-cost regions of the country like Los Angeles, the new ceiling for one-unit properties will be $1,249,125, which is 150 percent of the baseline limit.While many expected home prices to be flat this year, or even fall, they still managed to gain a little more despite poor affordability.The FHFA bases the change on its own nominal, seasonally adjusted, expanded-data FHFA home price index (HPI).Importantly, the conforming loan limit cannot fall though. So even if home prices did happen to go down between the third quarter of last year and this year, the conforming limit wouldn’t go down.Instead, it would simply stay put. Something to think about moving forward if the doomsayers are finally right and home prices come down nationally.In the meantime, home buyers and existing homeowners looking to refinance a mortgage can take advantage of slightly higher loan limits.What’s the Benefit of Staying At/Below the Conforming Loan Limit?The main advantage of staying at/below the conforming loan limit is that mortgage rates tend to be lower.Conforming loans are the most common type of home loan, offered by just about every bank and lender because they’re easy to unload to investors on the secondary market.Conversely, jumbo loans while widely available, are more niche and don’t have a big backer like Fannie and Freddie.As a result, interest rates on jumbo loans are often higher, though this isn’t always the case and exceptions do apply.In addition, it’s often easier to get approved for a conforming loan because the underwriting standards are a little looser.For example, you can come in with just a 3% down payment and you often don’t need much in the way of asset reserves.The maximum DTI limits and credit score requirements also tend to be a lot more forgiving.Meanwhile, a jumbo loan lender might require a 10% minimum down payment and six months of reserves.So something to consider if you were at/close to the conforming limit and are now under it thanks to the increase.2026 High-Cost Area Loan Limits Rise to $1,249,1251-unit property: $1,249,1252-unit property: $1,599,3753-unit property: $1,933,2004-unit property: $2,402,625As always, the loan limits are higher in many cities nationwide where property values are greater thanks to the high-cost area limits.There are more than 3,000 counties or county-equivalent jurisdictions in the United States, and each year about 100 to 200 of them qualify for high-cost limits that exceed the baseline limit, as seen in the map above.This includes places like Denver, Jackson Hole, Los Angeles, and New York City, and also Alaska, Guam, Hawaii, and the U.S. Virgin Islands.In those regions, the loan limits go as high as $1,249,125 for a one-unit property, and to nearly $2.5 million for a fourplex.There are also high-cost regions in the state of Hawaii that go even higher. So there is certainly a lot of opportunity to stay at/below the conforming loan limits.The new conforming loan limits are effective January 1st, 2026, though some lenders are already accepting the higher limits today. Before creating this site, I worked as an account executive for a wholesale mortgage lender in Los Angeles. My hands-on experience in the early 2000s inspired me to begin writing about mortgages 19 years ago to help prospective (and existing) home buyers better navigate the home loan process. Follow me on X for hot takes.Latest posts by Colin Robertson (see all)

Planet's Home Lending outpaces mortgage industry in 3Q

Planet Financial Group grew its production volume by 64% and its mortgage servicing portfolio by 28% year-over-year in the third quarter, as its portfolio retention unit reported record lock volumes in September, a strong month for refinances in the industry.The privately held company did not disclose any profit or loss data. As a group, independent mortgage bankers earned $1,201 per loan originated in the quarter, while servicing operating income was $92 per loan, according to the Mortgage Bankers Association.Including all business lines, 85% of the participating IMBs in the report were profitable on a pretax basis in the third quarter.Planet's mortgage production statisticsPlanet's annual increase in volume by far tops the 7% industry-wide gain to $488 billion from $456 billion, according to Fannie Mae's November housing forecast.The company originated $8.4 billion in the third quarter, up from $6.5 billion in the second quarter and $5.1 billion one year prior.Its portfolio retention group funded approximately $464 million during the period."We ended the quarter with a surge in demand as rates fell and the retention group locked $759 million in September," John Bosley, president of mortgage lending, at Planet Home Lending said in a press release.The third quarter production also included $377 million from its distributed retail channel, the segment's best quarterly performance for the company since the pandemic, Planet said."A strong servicing book, combined with our distributed retail and retention efficiency, gives Planet a real advantage when rates move," said Bosley. "We're seeing that play out in record locks, high recapture and a robust Q4 pipeline."The bulk of Planet's volume came through the correspondent aggregator channel, where it produced $7.5 billion; the company said it had a "notable increase in engagement" from depositories like credit unions and community banks, along with non-delegated mortgage sellers.It has added or expanded several niche product offerings, including down payment assistance options; a first lien bridge loan to support a "Buy Now Sell Later" consumer strategy; financing accessory dwelling units; and one-time close new construction offerings with bundled builder collaborations."Our niche products are doing exactly what they're designed to do: unlock opportunities in today's environment," Bosley said. "Our branches are helping more buyers move forward while also driving growth for builders and real estate agents."Planet's MSR portfolio growth in 3Q25As of Sept. 30, Planet had a $140.9 billion MSR portfolio. This includes $125.1 billion of owned MSRS, along with $14.1 billion of subservicing.It also reported a record $300 million in loan modification volume."Our servicing team continues to scale efficiently while maintaining quality," said Sandra Jarish, president, servicing. "We're managing a larger, more complex portfolio, while keeping delinquencies at or below industry benchmarks and helping homeowners stay on track through thoughtful, high-touch solutions."Planet also offers a co-issuer program as an alternative to selling a mortgage to an aggregator. It allows originators who do not service to sell their production directly to the government-sponsored enterprises and separately sell the MSRs.During the quarter it acquired $2.1 billion of MSRs through bulk purchases as well as the co-issuer program.Its correspondent unit launched a Ginnie Mae PIIT (short for Pools Issued for Immediate Transfer) program. This gives the company access to a broader base of government-guaranteed mortgage originators who prefer this form of secondary market execution, the company said."Planet's Origination and Servicing businesses are tightly connected, giving us the ability to move quickly when conditions change to capture volume, protect performance and deliver value to borrowers and clients throughout the loan lifecycle," said Michael Dubeck, CEO and president of Planet Financial Group.

What Our Clients Say

Ability proceeds from a fusion of skills, knowledge, understanding and imagination, consolidated by experience.

Beauty is when you can appreciate yourself. When you love yourself, that’s when you’re most beautiful.